Historical Returns Of Traditional Asset Classes

The other day an acquaintance said that her nearly grown son wants to invest for the future but he doesn’t have the time nor the market savvy to invest in anything outside of an index tracking stock or mutual fund. She thought that investing in the S&P 500 or perhaps gold would be the most beneficial, but I countered with the small cap Russell 2000 (IWM is the index’s most popular tracking stock).

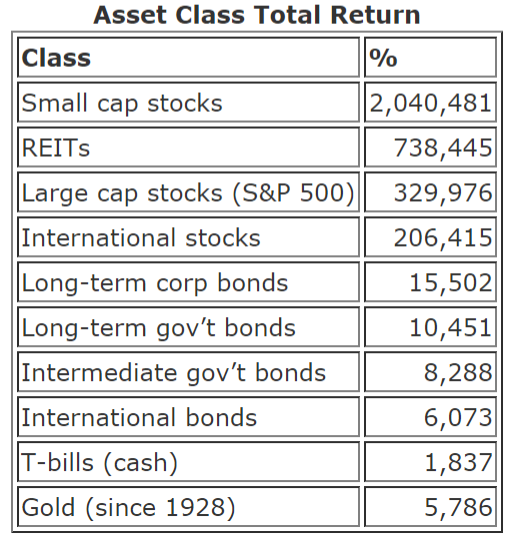

Sure, it’s more volatile in the short-term but in the long term it’s been tough to beat. As a favor, I said I’d run the historical numbers for the traditional asset classes (1928 to present). She was blown away by the results:

ObservationsThe above numbers reflect total returns since January, 1928 through September, 2014. (Total returns include price appreciation plus dividends.)

1. Small-caps clobber all other asset classes. Going forward, I believe that biotechs and new tech (alternative energies, internet, space exploration, nanotech, quantum entanglement technologies, etc.) will be among the big leaders.

2. Long-term corporate bonds are better than long term government bonds due to the risk premium (higher rate of interest earned) because of the possibility of default. (Government bonds are considered to be essentially risk-less.)

3. Real-estate investment trusts (REITs) have always been solid and should be a major component of any portfolio.

4. The returns of large-cap US stocks (aka the S&P 500) still dominate the returns of International stocks. (But frontier markets shouldn’t be overlooked as future sources of increasing growth.)

5. Gold: The yellow metal was actually illegal to own in bullion form from 1933 to 1974. During those years the price was fixed by the government but afterward the law was changed and the price was allowed to float. Gold has been a terrific investment over some periods since the mid-’70s but it’s been a bad one in recent years. Since its mid-2011 peak, the metal has shed about 36%. The good thing about gold is that it is portable; the bad thing is that it does not pay a dividend. The other bad thing is that gold doesn’t have much use outside of being decorative while platinum and palladium have use in industry.

6. Cash (T-bills): Over the long term, cash has not been king. Stashing your cash under the mattress is the worst place to put your money. But in times of unrest, it’s better than being in losing investments.

Conclusion

When considering asset allocation, you must also take into account your investment horizon. Are you in your early 20′s and investing for the next 50-70+ or are you much closer to retirement and need to shelter your nest egg? This is where Modern Portfolio Theory comes into play and why investing only in the currently highest returning asset classes is not always the best move because volatility risk must be taken into account.

Modern Portfolio Theory strives to minimize risk over the the long term but it can become a major hindrance to portfolio returns during sharp market corrections. To learn one way to utilize the benefits of the asset allocation strategy provided by Modern Portfolio Theory while also protecting your nest egg during sharp market corrections (especially if you’re looking at less than 20 years to retirement) please visit the Portfolio Preserver website.

Disclosure: None.

I respectfully differ with your suggestion that time periods in Modern Portfolio Theory should be separated by decades. One of the criticisms of Modern Portfolio Theory is that it sometimes produces ill advised allocation results too heavily skewed toward one or two asset classes in violation of the very tenet of broad diversification designed to avoid portfolio volatility resulting from being too heavily allocated in too few investment types. One of the reasons this occurs is that a base of data is used which is too short and absent of the litany of market conditions that occur over long periods of time. The time period selected in the article’s analysis, nearly 87 years, includes the breadth of types of markets that occur over time, bull markets, bear markets, flat markets, recession, depression, war, peace, etc. It is only by consideration of all these in a single analysis that Modern Portfolio Theory can properly advise the investor so that they can achieve their long-term goals while experiencing these different markets.

Modern Portfolio Theory does not care why changes occur from decade to decade and I would argue that it is not necessary for the passive investor to care either. The results of the strategy incorporate all the investor needs to know to maintain as straight a line as is possible toward their ultimate financial goal.

The mutual funds and index tracking stocks the article suggests as preferable for a young investor with a long time horizon are indeed the small cap stocks in the more volatile stock market with their higher yields obtained over time. Agreed that a more diversified allocation should be transitioned into over time as the investor inches closer to retirement.

Thanks for taking the time to post your thoughts!

I think in order to draw a conclusion, alternate time periods should be used. Although 1928-2014 is a start, that leaves the door open for a lot of omitted variables to influence the data. Better to sort it by decade to get an idea of how the returns have changed over time. This also allows you to try and gain an understanding about why the change occurred. Since your friend's son is only nearly grown (implying still well away from retirement), I think it is in his best interest to shy away from mutual funds and index tracking stocks for now, and chase the higher yielding and more volatile stock market. And then he can gradually transition into more stable investments as he inches closer to retirement.