USD/CAD Price Turns Positive Near 1.2680 As Oil Retreats, Firm USD

On Thursday, the USD/CAD price continued to move higher after the Bank of Canada broke out of the 1.2600 area and gained some momentum.

Keeping its forecast for the first rate hike in mid-2022, the Bank of Canada left its rate at 0.25%. Although it appears that Omicron is the only new coronavirus variant creating uncertainty, the Bank of Canada warned that it may not be the only one. The Bank of Canada’s warning was a factor that pressured the Canadian dollar.

In the meantime, crude oil prices have struggled to gain acceptance above $73 a barrel, declining moderately from a two-week high hit earlier this Thursday. Further weakening of the commodity-pegged Canadian dollar prompted a good rally for the USD/CAD pair amid a moderate spike in dollar demand. The safe-haven dollar benefited from continued growth in US Treasury yields, restrained Fed expectations, and cautious market sentiment.

The Fed is expected to tighten monetary policy soon to contain persistently high inflation. As a result, investors are prepared for an inflation spike in May 2022. The benchmark 10-year bond return was heavily influenced by this factor. US Treasuries have surpassed 1.50% once again. Additionally, the dollar has experienced tailwinds due to escalating geopolitical tensions, a factor that has outweighed recent optimism in markets.

Participants in the market eagerly await the US economic report, which will publish the weekly jobless claims. The US dollar will continue to be driven by US bond yields and broader market risk sentiment. Moreover, the USD/CAD pair should benefit from oil price dynamics. However, the focus will be on the US CPI data released on Friday, which will help determine the economy’s direction going forward.

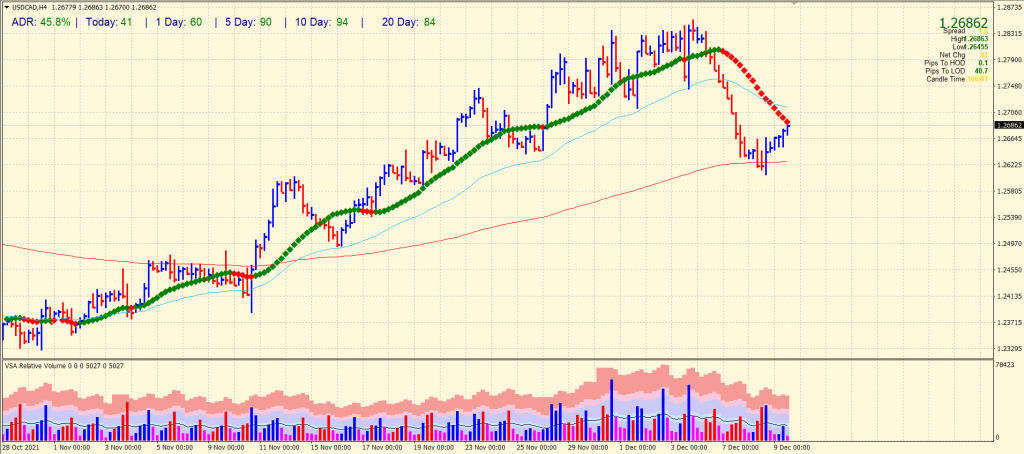

USD/CAD Price Technical Analysis: Gains Look Shallow

(Click on image to enlarge)

The USD/CAD price found respite just below the 200-period SMA on the 4-hour chart. The pair jumped to the 1.2680 area where the 20-period SMA paused the rallies. Further upside may find some resistance around the 1.2700 to 1.2710 area where 50-period SMA resides. The recent upside wave remains shallow and may only be a minor correction. On the downside, we may see a test of 1.2600 area ahead of 1.2550.

Disclaimer: Riki nema disclaimer.