Emerging Market ETFs Are Taking Back The World

More often than not, if you tell me that an asset is roughly 20% above its long-term trendline, I will tell you that the investment is overbought. I might even explain that a pullback to the 200-day moving average is a necessary prerequisite before buying the asset or, at the very least, an 8%-10% sell-off prior to purchase.

Technical analysis concerns notwithstanding, iShares MSCI Brazil (EWZ) has broken out of a multi-year bearish downtrend. This exchange-traded tracker forfeited more than 50% in value between October of 2011 and Q1 of 2014. Then market participants began to notice the price-to-earnings (P/E) discounts relative to developed world alternatives. They also lowered their expectations for economic growth. Eventually, braver souls dangled a few toes into the Amazon River.

Emerging market ETFs like iShares Brazil (EWZ) haven’t received this kind of love in seven years. What’s more, you can own EWZ for roughly 33% less than what an advocate might have paid for it near the tail end of 2011. I am not suggesting that you chase the rally; you will need to forge your own conclusions. Nevertheless, Brazil (EWZ) offers reasonable reward for the risk.

Is the upswing for iShares Brazil (EWZ) the only one that is worthy of investigation? Hardly. You might be intrigued by the prospect of owning a basket of Chinese companies for less than what one paid for SPDR S&P China (GXC) nearly four years ago. Or perhaps you would prefer a piece of India via WisdomTree India (EPI) at a 15% discount off of 2011 prices.

Note the similarity between India’s breakout and Brazil’s breakout. Both fell 50%-plus from respective 2011 highs. And while India (EPI) bottomed out in the 2nd half of 2013 whereas Brazil (EWZ) bottomed out in the first few months of 2014, each is roughly 20% above its respective long-term trendline. Overbought? Sure. Yet the extent of the demand is greater than at other moments in the past four years. Whether you wait for a cooling off period or nibble this afternoon, the move may help you shift away from relying too heavily on U.S. stock ETFs.

Keep in mind, the economic data on emergers is quite favorable. In China alone, wages have been growing at a double-digit annual percentage (13.8%) for a decade, increasing the purchasing power of middle-class consumers there. Wage growth in the U.S.? Stagnant. In fact, some estimate that the number of middle-class consumers in emerging markets will surpass the number in the U.S. and Europe combined by 2020.

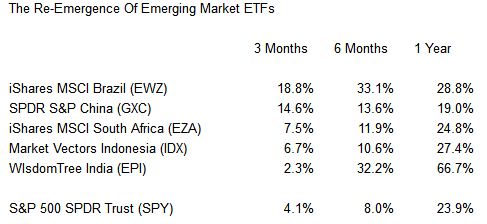

Still not convinced? Then consider the total return percentages in the table below:

U.S. equities have been the clear leader since the euro-zone crisis in 2011. Yet a seismic shift that favors emerging markets may be in the works. And unlike the QE-inspired success for U.S stock ETFs, the exuberance for emerging market ETFs is far more rational.

ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser ...

more