AIG Reports Third Quarter 2014 Net Income Of $2.2 Billion And Diluted Earnings Per Share Of $1.52

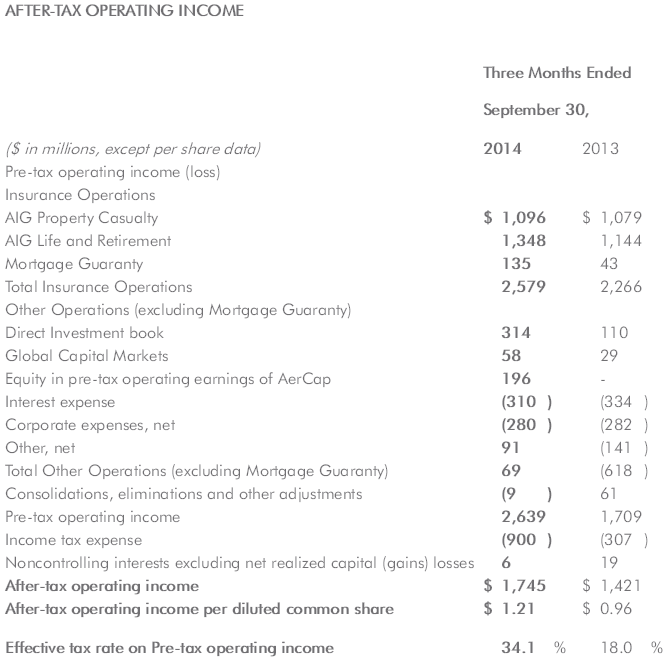

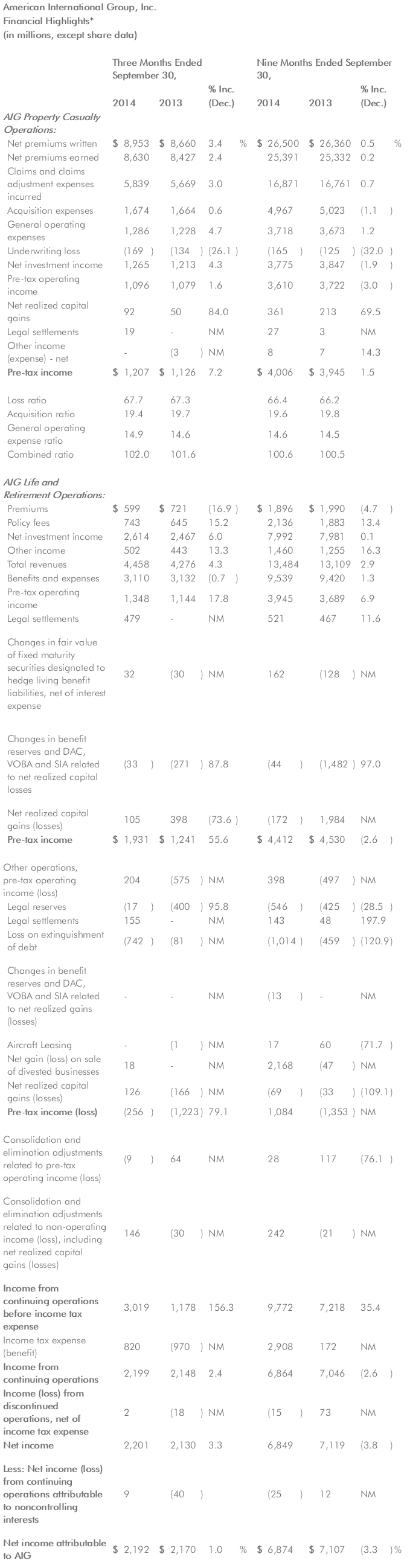

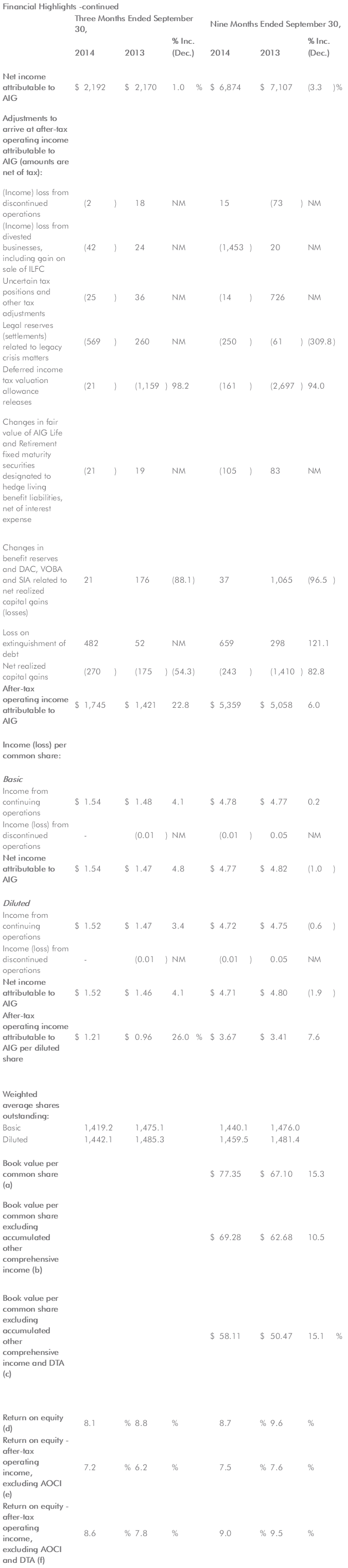

NEW YORK--(BUSINESS WIRE)--Nov. 3, 2014-- American International Group, Inc.(NYSE:AIG) today reported net income of $2.2 billion for the quarter ended September 30, 2014, up slightly from the prior-year quarter. After-tax operating income was $1.7 billion for the third quarter of 2014, up from $1.4 billion in the prior-year quarter.

Diluted earnings per share were $1.52 for the third quarter of 2014, compared to $1.46 for the third quarter of 2013. After-tax operating income per diluted share increased to $1.21 for the third quarter of 2014, from $0.96 in the prior-year quarter.

“I am excited to lead AIG forward and further build on our capabilities to serve all our stakeholders,” said AIG President and Chief Executive Officer Peter Hancock. “Our new management structure brings together a team that has the skill set, experience, and commitment to execute on our strategies and serve our customers around the world. Together, we remain disciplined in our approach to balancing growth, profitability, and risk and focused on maintaining the strength of our industry-leading balance sheet.

“The solid third quarter results were driven by consistent performance across our businesses,” Mr. Hancock said. “While no one quarter is a trend, our risk-adjusted return focus could be seen in various metrics including improved accident year loss ratios, modest net spread compression, and continued capital management. In the quarter and through early October, we repurchased $1.5 billion of AIG Common Stock and completed over $4.0 billion in liability management, excluding DIB activities. As a result of our strong capital position and a positive outlook for our businesses, the Board has authorized additional share repurchases of $1.5 billion.”

Capital and Liquidity

- AIG shareholders’ equity totaled $108.6 billion at September 30, 2014

- Book value per share of $77.35 grew 15 percent from September 30, 2013; book value per share excluding accumulated other comprehensive income (AOCI) and deferred tax assets (DTA) grew 15 percent to $58.11 over the same period

- Repurchased 24.8 million shares of AIG Common Stock in the third quarter of 2014, including 1.7 million shares received in July 2014 upon the settlement of an accelerated share repurchase agreement executed in the second quarter of 2014 and including the initial delivery of approximately 8.8 million shares pursuant to a $692 millionaccelerated share repurchase agreement executed in September 2014, which settled inOctober 2014 with the delivery to AIG of approximately 3.9 million additional shares

- Tax sharing payments to AIG Parent from insurance businesses amounted to $314 million in the third quarter of 2014 and $1.1 billion year-to-date

- During the third quarter of 2014, AIG issued $1.0 billion of 2.300% Notes due 2019 and $1.5 billion of 4.500% Notes due 2044. In October 2014, AIG issued an additional$750 million of 4.500% Notes due 2044

- During the third quarter of 2014, AIG repurchased, in tender offers, certain high coupon hybrid and senior notes issued or guaranteed by AIG Parent, for an aggregate purchase price of $2.5 billion; in October 2014, AIG repurchased $1.6 billion aggregate principal amount of 8.175% hybrid notes

- During the third quarter of 2014, AIG reduced Direct Investment book (DIB) debt by approximately $2.0 billion through a redemption of $790 million aggregate principal amount of its 4.875% Notes due 2016 and a redemption of $1.25 billion aggregate principal amount of its 3.800% Notes due 2017, in each case, using cash allocated to the DIB. In October 2014, AIG further reduced DIB debt through a redemption of approximately $2.0 billion aggregate principal amount of its 8.250% Notes due 2018 and the repurchase of approximately $405 million aggregate principal amount of its 5.450% Medium-Term Notes, in each case, using cash allocated to the DIB

- AIG Parent liquidity sources were $17.1 billion at September 30, 2014, including $12.6 billion of cash, short-term investments, and unencumbered fixed maturity securities, down from $18.5 billion at June 30, 2014

All operating segment comparisons that follow are to the third quarter of 2013 unless otherwise noted.

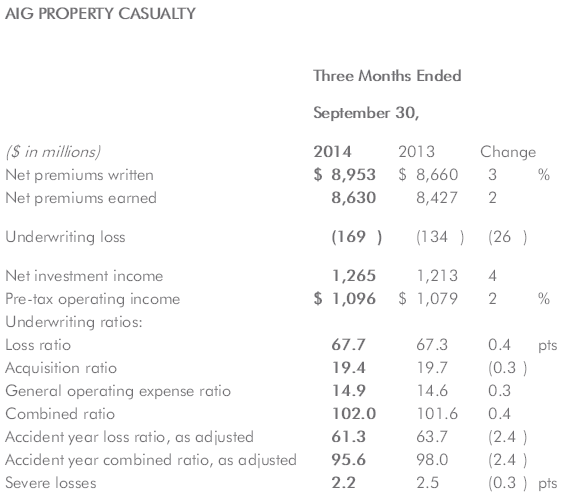

AIG Property Casualty’s pre-tax operating income increased by two percent to $1.1 billion. Higher net investment income, improved loss experience in Consumer Insurance, a lowerCommercial Insurance current accident year loss ratio, as adjusted, and reduced severe losses were partially offset by higher net adverse prior year loss reserve development and higher catastrophe losses. As part of AIG’s continued focus on capital management, AIG Property Casualty distributed $800 million in dividends in the form of cash and fixed maturity securities to AIG Parent during the third quarter of 2014.

The third quarter 2014 combined ratio was 102.0, a 0.4 point increase from the prior-year quarter. Catastrophe losses were $284 million, compared to $222 million in the third quarter of 2013. Net adverse prior year loss reserve development was $227 million, primarily in the primary Casualty business, compared to net adverse prior year loss reserve development of$70 million for the third quarter of 2013. These increases were partially offset by a $23 milliondecrease in Commercial Insurance severe losses to $188 million. The third quarter 2014 acquisition ratio decreased 0.3 points to 19.4 due to a reduction in expense related to personnel engaged in sales support activities. The general operating expense ratio increased 0.3 points to 14.9, primarily due to an increase in technology-related expenses, partially offset by reductions in employee-related and other operating expenses.

The third quarter 2014 accident year loss ratio, as adjusted, was 61.3, a decrease of 2.4 points from the prior-year quarter attributable to improved accident year loss experience inConsumer Insurance and Financial Lines in Commercial Insurance, and lower severe losses. The increase in net investment income was driven by higher returns on alternative investments, which was partially offset by the effects of lower reinvestment yields compared to interest rates on matured or sold investments, and lower income on investments accounted for under the fair value option.

Excluding the effects of foreign exchange and additional premiums on loss-sensitive business, third quarter 2014 net premiums written increased three percent from the same period in the prior year, with Commercial Insurance and Consumer Insurance third quarter 2014 net premiums written growing three percent and two percent, respectively. Commercial Insurancecontinues to benefit from new business growth in Property and Financial Lines. Consumer Insurance continues to benefit from growth in AIG Fuji Life and in personal property in Japanand the U.S., partially offset by declines in the U.S. warranty business and in certain classes of Accident & Health business, due to maintaining underwriting discipline.

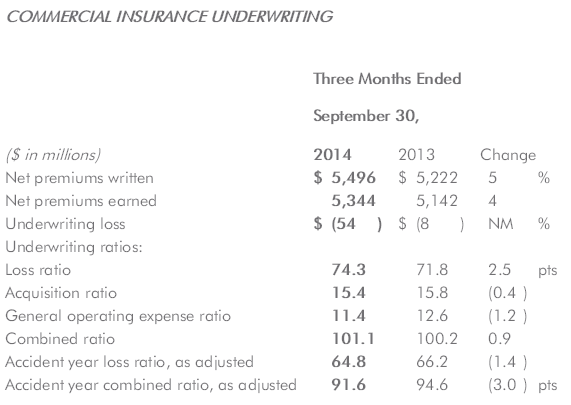

The Commercial Insurance combined ratio increased 0.9 points to 101.1, as improvements in the accident year loss ratio, as adjusted, were more than offset by higher net adverse prior year loss reserve development and higher catastrophe losses. The third quarter 2014 accident year loss ratio, as adjusted, decreased 1.4 points to 64.8. The acquisition ratio decreased 0.4 points to 15.4, primarily due to a reduction in expenses related to personnel engaged in sales support activities, lower premium taxes, and guaranty fund and other assessments. The general operating expense ratio decreased 1.2 points to 11.4 primarily due to lower employee-related and other operating expenses, partially offset by the increased technology-related expenses mentioned above.

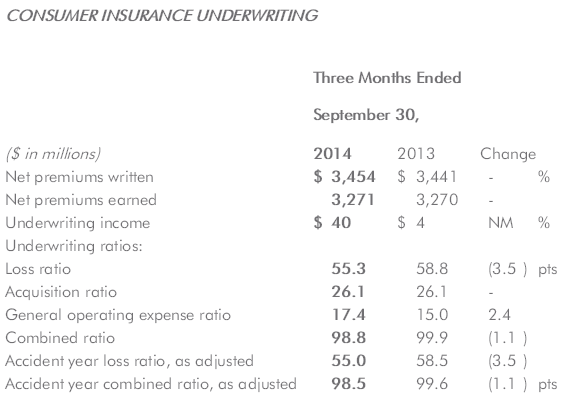

The Consumer Insurance combined ratio decreased 1.1 points to 98.8 due to a lower loss ratio. Both the loss ratio and the accident year loss ratio, as adjusted, decreased 3.5 points to 55.3 and 55.0, respectively, reflecting rate increases and improved claim experience in theJapan automobile business, and rate actions and coverage changes in the U.S. warranty business. The general operating expense ratio increased 2.4 points primarily due to higher expenses related to the ongoing integration of AIG Property Casualty’s Japan entities and investment in targeted growth areas, partially offset by a decrease in employee-related and other operating expenses.

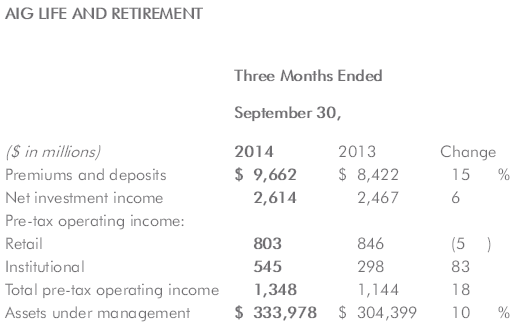

AIG Life and Retirement reported pre-tax operating income of $1.3 billion in the third quarter of 2014, an increase of 18 percent over the prior-year period, reflecting higher fee income from growth in assets under management and higher net investment income, primarily due to strong returns on alternative investments. Active crediting rate management and increased assets offset the impact of lower investment yields available in the current interest rate environment. Pre-tax operating income included a net positive adjustment to DAC and reserve items of $120 million related to an annual review of actuarial assumptions, compared to a$118 million net positive adjustment in the same quarter in the prior year. AIG Life and Retirement generated $9.7 billion of premiums and deposits in the third quarter of 2014, reflecting continued sales growth in variable annuities and index annuities in the Retirement Income Solutions product line and a large deposit for a stable value wrap funding agreement, partially offset by lower sales of Fixed Annuities due to the sustained low interest rate environment and lower sales of Retail Mutual Funds.

Net investment income for the third quarter increased to $2.6 billion, reflecting strong performance from alternative investments and higher call and tender income. Reinvestment of portfolio cash flows in the sustained low interest rate environment was the primary driver of the decline in base investment yield to 5.11 percent from 5.26 percent in the third quarter of 2013.

Assets under management increased 10 percent from a year ago to $334 billion, reflecting appreciation in equity markets, which contributed to an increase in assets under management in the variable annuity and mutual fund businesses, and strong net flows from the individual variable annuity business. Further development of AIG’s stable value wrap business contributed $10.9 billion to the increase in assets under management from the prior-year period.

The Retail operating segment reported quarterly pre-tax operating income of $803 million. These results included higher fee and spread income from growth in assets under management, primarily in Retirement Income Solutions, and higher alternative investment income. The decrease in Retail pre-tax operating income compared to the prior-year period was primarily due to an annual review and update of actuarial assumptions, which resulted in a net positive adjustment of $71 million in the third quarter of 2014 compared to a $198 million net positive adjustment in the third quarter of 2013.

The Institutional operating segment reported quarterly pre-tax operating income of $545 million. Results were driven by higher fee income, higher alternative investment income, and a net positive adjustment of $49 million related to an annual review and update of actuarial assumptions, compared to an $80 million net unfavorable adjustment for assumption updates in the prior-year period.

In the third quarter of 2014, AIG Life and Retirement subsidiaries declared dividends and made loan repayments to AIG Parent totaling $2.4 billion, of which $1.7 billion was paid in cash to AIG Parent in the third quarter, and the remaining $635 million was distributed to AIG Parent in the form of cash and fixed maturity securities in October 2014. These dividend payments included approximately $465 million of legal settlement proceeds.

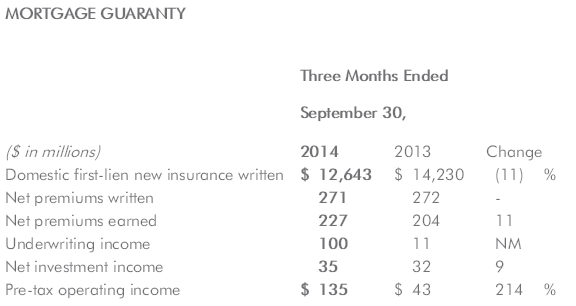

United Guaranty Corporation (UGC) reported pre-tax operating income of $135 million for the third quarter of 2014, compared to pre-tax operating income of $43 million in the prior year quarter resulting from decreased first-lien claims and claims adjustment expenses incurred and an increase in first-lien net premiums earned. Current quarter lower incurred losses were due to $6 million of favorable first-lien prior year loss reserve development compared to $34 million of unfavorable first-lien prior year loss reserve development for the same period in 2013, lower new delinquencies, and an increased rate of cures. Increased first-lien net premiums earned were due primarily to higher persistency.

Net premiums written remained consistent with the prior-year quarter at $271 million. Domestic first-lien new insurance written decreased 11 percent to $12.6 billion in principal of loans insured, driven primarily by declining mortgage originations from refinancing activity. Quality metrics remained high, with an average FICO score of 750, and an average loan-to-value of 92 percent on new business.

OTHER OPERATIONS

AIG’s Other Operations (excluding Mortgage Guaranty) reported third quarter 2014 pre-tax operating income of $69 million compared to a pre-tax operating loss of $618 million in the prior-year third quarter. This improvement primarily reflects the results from the DIB driven by higher asset appreciation and earnings from AIG’s equity investment in AerCap Holdings N.V.

Conference Call

AIG will host a conference call tomorrow, Tuesday, November 4, 2014, at 8:00 a.m. ET to review these results. The call is open to the public and can be accessed via a live listen-only webcast at www.aig.com. A replay will be available after the call at the same location.

Additional supplementary financial data is available in the Investor Information section atwww.aig.com.

The conference call (including the conference call presentation material), the earnings release and the financial supplement may include projections, goals, assumptions and statements that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These projections, goals, assumptions and statements are not historical facts but instead represent only AIG’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside AIG’s control. These projections, goals, assumptions and statements include statements preceded by, followed by or including words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “view,” “target” or “estimate.” These projections, goals, assumptions and statements may address, among other things: AIG’s exposures to subprime mortgages, monoline insurers, the residential and commercial real estate markets, state and municipal bond issuers, and sovereign bond issuers; AIG’s exposure to European governments and European financial institutions; AIG’s strategy for risk management; AIG’s generation of deployable capital; AIG’s return on equity and earnings per share; AIG’s strategies to grow net investment income, efficiently manage capital and reduce expenses; AIG’s strategies for customer retention, growth, product development, market position, financial results and reserves; and the revenues and combined ratios of AIG’s subsidiaries. It is possible that AIG’s actual results and financial condition will differ, possibly materially, from the results and financial condition indicated in these projections, goals, assumptions and statements. Factors that could cause AIG’s actual results to differ, possibly materially, from those in the specific projections, goals, assumptions and statements include: changes in market conditions; the occurrence of catastrophic events, both natural and man-made; significant legal proceedings; the timing and applicable requirements of any new regulatory framework to which AIG is subject as a nonbank systemically important financial institution and as a global systemically important insurer; concentrations in AIG’s investment portfolios; actions by credit rating agencies; judgments concerning casualty insurance underwriting and insurance liabilities; judgments concerning the recognition of deferred tax assets; and such other factors discussed in Part I, Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) in AIG’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2014, Part I, Item 2. MD&A in AIG’s Quarterly Reports on Form 10-Q for the quarterly periods ended June 30, 2014 andMarch 31, 2014, and Part I, Item 1A. Risk Factors and Part II, Item 7. MD&A in AIG’s Annual Report on Form 10-K for the year ended December 31, 2013. AIG is not under any obligation (and expressly disclaims any obligation) to update or alter any projections, goals, assumptions, or other statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise.

Comment on Regulation G

Throughout this press release, including the financial highlights, AIG presents its financial condition and results of operations in the way it believes will be most meaningful, representative and transparent. Some of the measurements AIG uses are “non-GAAP financial measures” under Securities and Exchange Commission rules and regulations. GAAP is the acronym for “accounting principles generally accepted in the United States.” The non-GAAP financial measures AIG presents may not be comparable to similarly named measures reported by other companies. The reconciliations of such measures to the most comparable GAAP measures in accordance with Regulation G are included within the relevant tables or in the Third Quarter 2014 Financial Supplement available in the Investor Information section of AIG’s website, www.aig.com.

Book Value Per Common Share Excluding Accumulated Other Comprehensive Income (Loss) (AOCI) and Book Value Per Common Share Excluding AOCI and DTA are used to show the amount of AIG’s net worth on a per-share basis. AIG believes Book Value Per Common Share Excluding AOCI and Book Value Per Common Share Excluding AOCI and DTA are useful to investors because they eliminate the effect of non-cash items that can fluctuate significantly from period to period, including changes in fair value of AIG’s available for sale securities portfolio, foreign currency translation adjustments and, in the case of Book Value Per Common Share Excluding AOCI and DTA, U.S. tax attribute deferred tax assets. Book Value Per Common Share Excluding AOCI is derived by dividing Total AIG shareholders’ equity, excluding AOCI, by Total common shares outstanding. Book Value Per Common Share Excluding AOCI and DTA is derived by dividing Total AIG shareholders’ equity, excluding AOCI and DTA, by Total common shares outstanding.

AIG uses the following operating performance measures because it believes they enhance understanding of the underlying profitability of continuing operations and trends of AIG and its business segments. AIG believes they also allow for more meaningful comparisons with AIG’s insurance competitors.

After-tax operating income (loss) attributable to AIG is derived by excluding the following items from net income (loss) attributable to AIG: income (loss) from discontinued operations, income (loss) from divested businesses, (including gain on the sale of ILFC and certain post-acquisition transaction expenses incurred by AerCap in connection with its acquisition of ILFC and the difference between expensing AerCap’s maintenance rights assets over the remaining lease term as compared to the remaining economic life of the related aircraft and related tax effects), legacy tax adjustments primarily related to certain changes in uncertain tax positions and other tax adjustments, legal reserves (settlements) related to “legacy crisis matters,” deferred income tax valuation allowance (releases) charges, changes in fair value of AIG Life and Retirement fixed maturity securities designated to hedge living benefit liabilities (net of interest expense), changes in benefit reserves and deferred policy acquisition costs (DAC), value of business acquired (VOBA), and sales inducement assets (SIA) related to net realized capital gains (losses), AIG Property Casualty other (income) expense-net, (gain) loss on extinguishment of debt, net realized capital (gains) losses and non-qualifying derivative hedging activities, excluding net realized capital (gains) losses. “Legacy crisis matters” include favorable and unfavorable settlements related to events leading up to and resulting from AIG’sSeptember 2008 liquidity crisis and legal fees incurred by AIG as the plaintiff in connection with such legal matters. See page 13 for the reconciliation of Net income attributable to AIG to After-tax operating income attributable to AIG.

AIG Property Casualty pre-tax operating income (loss) includes both underwriting income (loss) and net investment income, but excludes net realized capital (gains) losses, other (income) expense-net, and legal settlements related to legacy crisis matters described above. Underwriting income (loss) is derived by reducing net premiums earned by claims and claims adjustment expenses incurred, acquisition expenses and general operating expenses.

AIG Property Casualty, along with most property and casualty insurance companies, uses the loss ratio, the expense ratio and the combined ratio as measures of underwriting performance. These ratios are relative measurements that describe, for every $100 of net premiums earned, the amount of claims and claims adjustment expense, and the amount of other underwriting expenses that would be incurred. A combined ratio of less than 100 indicates underwriting income and a combined ratio of over 100 indicates an underwriting loss. The underwriting environment varies across countries and products, as does the degree of litigation activity, all of which affect such ratios. In addition, investment returns, local taxes, cost of capital, regulation, product type and competition can have an effect on pricing and consequently on profitability as reflected in underwriting income and associated ratios.

Both the AIG Property Casualty Accident year loss ratio, as adjusted, and the AIG Property Casualty combined ratio, as adjusted, exclude catastrophe losses and related reinstatement premiums, prior-year development, net of premium adjustments, and the impact of reserve discounting. Catastrophe losses are generally weather or seismic events having a net impact on AIG Property Casualty in excess of $10 million each.

AIG Life and Retirement pre-tax operating income (loss) is derived by excluding the following items from pre-tax income (loss): legal settlements related to legacy crisis matters described above, changes in fair values of fixed maturity securities designated to hedge living benefit liabilities (net of interest expense), net realized capital (gains) losses, and changes in benefit reserves and DAC, VOBA and SIA related to net realized capital gains (losses).

AIG Life and Retirement premiums and deposits includes direct and assumed amounts received on traditional life insurance policies, group benefit policies and deposits on life-contingent payout annuities, as well as deposits received on universal life, investment-type annuity contracts and mutual funds.

Other Operations pre-tax operating income (loss) is derived by excluding the following items from pre-tax income (loss): certain legal reserves (settlements) related to legacy crisis matters described above, (gain) loss on extinguishment of debt, net realized capital (gains) losses, changes in benefit reserves and DAC, VOBA and SIA related to net realized capital gains (losses), income (loss) from divested businesses, including Aircraft Leasing, and net (gain) loss on sale of divested businesses (including gain on the sale of ILFC and certain post-acquisition transaction expenses incurred by AerCap in connection with its acquisition of ILFC and the difference between expensing AerCap’s maintenance rights assets over the remaining lease term as compared to the remaining economic life of the related aircraft and our share of AerCap’s income taxes).

Results from discontinued operations are excluded from all of these measures.

American International Group, Inc. (AIG) is a leading international insurance organization serving customers in more than 130 countries and jurisdictions. AIG companies serve commercial, institutional, and individual customers through one of the most extensive worldwide property-casualty networks of any insurer. In addition, AIG companies are leading providers of life insurance and retirement services in the United States. AIG common stock is listed on the New York Stock Exchange and the Tokyo Stock Exchange.

Addition information about AIG can be found at www.aig.com | Youtube: www.youtube.com/aig | Twitter: @AIGInsurance | LinkedIn: http://www.linkedin.com/company/aig

AIG is the marketing name for the worldwide property-casualty, life and retirement, and general insurance operations of American International Group, Inc. For additional information, please visit our website at www.aig.com. All products and services are written or provided by subsidiaries or affiliates of American International Group, Inc. Products or services may not be available in all countries, and coverage is subject to actual policy language. Non-insurance products and services may be provided by independent third parties. Certain property-casualty coverages may be provided by a surplus lines insurer. Surplus lines insurers do not generally participate in state guaranty funds, and insureds are therefore not protected by such funds.

See accompanying notes on the following page.

Financial highlights - notes *

Including reconciliation in accordance with Regulation G.

(a) Represents total AIG shareholders' equity divided by common shares outstanding.

(b) Represents total AIG shareholders' equity, excluding AOCI divided by common shares outstanding.

(c) Represents total AIG shareholders' equity, excluding AOCI and DTA divided by common shares outstanding.

(d) Computed as Annualized net income (loss) attributable to AIG divided by average AIG shareholders' equity. Equity includes DTA.

(e) Computed as Annualized after-tax operating income attributable to AIG divided by average AIG shareholders' equity, excluding AOCI. Equity includes DTA.

(f) Computed as Annualized after-tax operating income attributable to AIG divided by average AIG shareholders' equity, excluding AOCI and DTA.

Source: American International Group, Inc.

American International Group, Inc.

Investors:

Liz Werner, 212-770-7074

elizabeth.werner@aig.com

Fernando Melon, 212-770-4630

fernando.melon@aig.com

or

Media

Matt Gallagher, 212-458-3247

matthew.gallagher2@aig.com

Jon Diat, 212-770-3505

jon.diat@aig.com

Disclosure: None.