Nu Skin's Capital Structure Makeover

Yesterday Nu Skin announced that they had a new loan to replace the old loan. This was essential because the old loan was about to breach its covenants and an event of default would not be a good thing for Nu Skin shareholders or their management.

So prima-facie the new loan was good news.

The stock however dropped almost 10 percent (and was briefly down more).

The loan terms are onerous and complicated and there are some bizarre disclosures in the attachments to the loan document.

The first bizarre thing about the loan is the disclosure as to how much is drawn immediately. Here it is:

The Credit Agreement provides for a $127,500,000 term loan facility, a ¥6,593,406,594 term loan facility and a $187,500,000 revolving credit facility, each with a term of five years. The term loan facilities were drawn in full on October 10, 2014, and $112,500,000 of the revolving credit facility was also drawn on October 10, 2014.

They immediately drew $127.5 million dollars of term loan, ¥6.59 billion and a further $112.5 million on the revolver. That is $309.4 million USD.

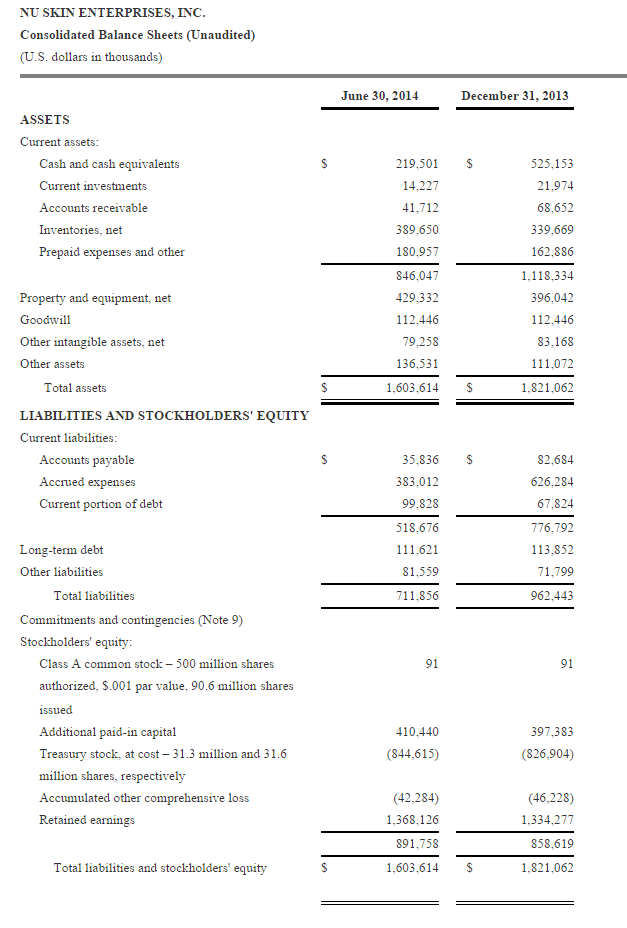

This is way more debt than they had at the end of the previous quarter. Here is the balance sheet from the last 10-Q.

In the last quarter they had $219.5 million in cash and another $14.2 million in current investments. Against this they had $99.8 million in current debt and another $111.6 million in long term debt.

Total debt was $211.4 and net debt was zero.

Despite this they drew $302 million at moderately high interest rates.

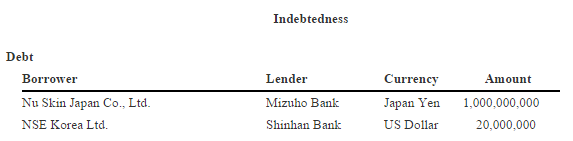

But it is worse than that... the old debt numbers included some debt in Japan and Korea. Some of that is being left in place as per the loan covenant. In quantity:

That is another $30.5 million of debt.

So now - suddenly - the company has $339.9 million in debt - way more than the $211.4 they used to have. The rise is inexplicable because their last accounts showed net cash.

The company has rapidly - and at what was to them a penal interest rate - borrowed a huge amount of money they didn't seem to need a quarter ago and when they had net cash.

And it can't be for an acquisition because the loan covenants prohibit that.

If you have any good idea what the sink-hole that absorbed this much cash is let me know. However if this cash were needed during the last quarter the whole thing is diabolical. Bluntly if it were needed the company is presumably and somehow massively loss making. I simply do not know how. I am a bear on this stock but that is worse than I would have dared to guess.

Two hypotheses:

(a) the company is secretly massively cash consumptive and we do not know (in which case short) or

(b) the company is drawing a huge amount of debt for which it has no obvious use and which it is prohibited to use for an acquisition [that might include buy-backs as discussed below].

But remember this: Nu Skin drew the revolvers. And it drew them hard. Drawing the revolvers has precedent. It is seldom something that makes credit providers happy. There may be a good explanation (truly). The market has not been provided with it.

Dividend restrictions

The story from yesterday was that the debt covenants involved dividend restrictions. This came from slightly ambiguous wording in the press release.

The press release states:

The Credit Agreement requires the Company to maintain a consolidated leverage ratio not exceeding 2.25 to 1.00 and a consolidated interest coverage ratio of no less than 3.00 to 1.00. The Credit Agreement also includes other covenants, including covenants that, subject to certain exceptions, restrict the ability of the Company and its subsidiaries (i) to create, incur, assume or permit to exist any liens, (ii) to incur additional indebtedness, (iii) to make investments and acquisitions, (iv) to enter into mergers, consolidations or similar transactions, (v) to make certain dispositions of assets, (vi) to make dividends, distributions and prepayments of certain indebtedness, (vii) to change the nature of the Company's business, (viii) to enter into certain transactions with affiliates, (ix) to enter into certain burdensome agreements, (x) to make certain amendments to certain agreements and organizational documents and (xi) to make certain accounting changes.

The highlighted section makes it clear that the company may not pay dividends subject to certain exceptions, which means provided they meet these exceptions they may pay dividends.

Indeed the loan documents allow the following use of proceeds:

Section 6.11. Use of Proceeds. Use the proceeds of the Credit Extensions (i) for working capital, capital expenditures, and other lawful corporate purposes, including (without limitation) investments, acquisitions, stock repurchases and dividends not prohibited by the Loan Documents and (ii) to consummate the Refinancing

So they may buy back stock and pay dividends provided they meet a fairly burdensome list of possible events of default.

An event of default is disastrous under the new documents because it involves immediate acceleration. You do not want immediate acceleration ever.

That said - and it is a clear positive for Nu Skin - the default based on trailing operating cash flow has been removed. As indicated in past blog posts Nu Skin is peculiar - it generates substantial earnings and huge negative operating cash flows. Nu Skin breaches its cash flow based covenants - and these have been removed.

The only explanation (that is not truly nasty) that I have for drawing the revolvers is a deep desire to use the cash (whilst it is available) to buy back stock. However given the nasty taste that drawing revolvers gives to credit providers this is an aggressive thing to do. [But it is possible. I am not dismissing it.]

Receiveables from offshore entities

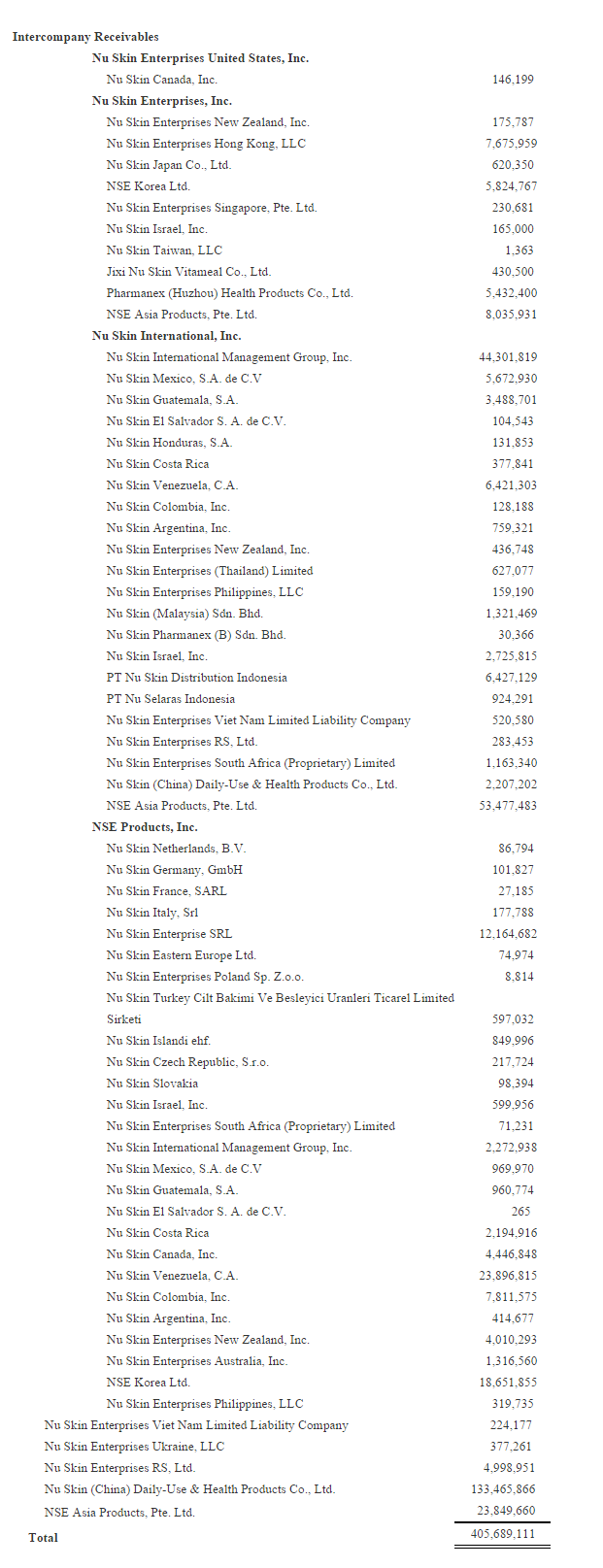

The disclosure that caused most amazement amongst Nu Skin watchers was a disclosure at the back of the credit agreement about how much money their offshore subsidiaries own them. This is a list:

The total is almost $406 million. This is large - about half the stockholders equity and the bulk of tangible stockholders equity.

If the foreign subsidiaries have the cash (and it is presumed they do) then they should - subject to payment restrictions - just pay it.

There is $24 million owed to head office by Venezuela. Good luck collecting that. But outside that the amounts should be collectable if the foreign subsidiaries are good for it. There is $133 million owed by China. This might be difficult to collect based on the amount of activity we have seen in China. However if they own the very large office complex we saw (see the post) they could collect some of it by selling up.

But the more pertinent question is why haven't all those subsidiaries been able to pay the money they owe to head office? Inquiring minds are asking. Especially as the company drew the revolvers.

--

Venezuela

The Venezuela amounts are irrelevant in Nu Skin (and Herbalife for that matter) but there is a contradiction between what the table above shows and the management says. According to recent presentation at the Wedbush conference they only had $10-15 million of sales in Venezuela.

It is hard to see how they are owed $24 million by a subsidiary that only has half that in sales. I can't square it. A clearer explanation of Venezuela exposure would be nice.

John

The content contained in this blog represents the opinions of Mr. Hempton. Mr. Hempton may hold either long or short positions in securities of various companies discussed in the blog based upon Mr. ...

more