Dear Numpty

Dear fellow Numpty:

What is astonishing about the way banks cheated their clients by colluding to fix exchange rates to extract higher sums is not only that they did this to what they called “Numpty's”, but when they did this.

The FX faux fix went on until early this year, according to the $4.5 bn settlement made with regulators in Europe yesterday. And the settlement will exceed $4.5 bn. There are still other fixes for which further fines are payable covering US exchange rate manipulation and at least one banking major, Barclays, refused to join the settlement.

Anyone who ever bought a foreign share using a US discount brokerage foreign exchange facility; anyone who ever paid for foreign travel or hotels using a credit card in a different currency; anyone who ever imported or exported anything was cheated by the banks.

We learned about early on. About a decade ago, I sold a French stock called Stellergènes from my account with Fidelity when its compliance officer called me to say I could not accept a takeover bid from a Swiss buyer. Actually he was wrong but I listen to lawyers and doctors.

The trade was mistakenly booked in US dollars although French stocks are priced in euros. I was left short by ~25% at the then-exchange rate. Some readers proceded to legally get the Swiss takeover payments, so the whole compliance routine was unnecessary. I had found the stock by my own research work, without help from readers or Fidelity (Fido).

After long hemming and hawing, Fido converted my proceeds into dollars at a weird exchange corresponding to nothing public. They refused to adjust the rate to what was shown for the trading day.

A certified grouse, I then sought arbitration with Fido to try to get this adjusted. Instead of displaying zeal for customer satisfaction, Fido then simply banned me from having a Fido account. That is how E-trade won my fidelity, such as it is. The Swiss buyer relisted the share in 2009 and it even trades now on the Euronext part of the NYSE and as an ADR again.

Now I am thinking maybe the Fido global trading desk was treated as a Numpty and not just me. The fine is trivial considering the pattern of deceit.

A new Van Eck China Bond ETF is offering yield-hungry investors a chance to buy RMB bonds under the planned Hong Kong-Shanghai link. The CBON yield is expected to be ~4%. The amount of taxation is unclear as Shanghai interest is taxed while Hong Kong's is not.

China was looking poorly yesterday apart from the worry about one of our shares discussed for subscribers below. Chinese industrial output failed to meet expectations, rising only 7.7% in Oct vs estimates of 8%, continuing the Q3 pattern of slow growth. This may require govt stimulus, which however, risks boosting retail sales, which are growing exponentially based on the 11/11 frenzy at Alibaba. More on this below.

Our newly returned India reporter offers better ideas. India is gaining from yield hunger. Its debt markets have drawn in $23 bn ytd, while equities inflows were only $15 bn, according to Barron's Blog. So we are aiming Abhimanyu Sisodia's attention to stocks. He wrote earlier on 2 key deals reached with India by the supposedly lame duck Obama administration:

India won okay from the USA allowing to publicly stockpile food, which paves the way for a global World Trade Organization accord that could add $1 bn and 21 mn jobs to the global economy (according to Reuters). India now has US support before the WTO General Council, The deal will allow large state food purchases to continue, despite other countries saying the food buying and stockpiling amounts a subsidy leading to surpluses and dumping on world markets. Just some food for thought. [Ed: Pun intended.]

Obama seems quite charmed by Modi, no surprise, as India is wisely considering opening its defense industry to foreign direct investment. Non-Indian companies will be allowed to assemble weapons.

10¢ Misses By Many Dimes

*The advantage of getting company results after we have filed for the day is that I can take my time summing them up after listening to the conference call. So here is CEO Pony Ma telling us about the Tencent Q3 results yesterday. Naturally he stressed the positive, which led to comments below his quoted remarks. [All numbers are in renminbi and all comparisons with prior year Q3.] Over to Ma:

"We achieved a quarter of solid growth in our platforms, revenue, and earnings. Our online advertising business grew significantly y/o/y due to our performance-based advertising on our social platforms (Mobile Qzone and Weixin Official Accounts).

“In our advanced businesses, we retained our traffic leadership in online games and PC games. We significantly increased the market share of our AdFlow business Ying Yong Bao and growth in the mobile ecosystem we are building. Looking forward we will depend our partnerships with vertical leaders and continue to invest in our people, products, and platforms.

“Now let me highlight the financial results for you. Total revenue was RMB19.8 bn, up 28%. [see below.]

“Excluding e-Commerce transactions, total revenue grew at 47%. Value added services revenue was RMB16 bn, up 38% of which social network revenue was RMB4.6 bn, up 47% and online games revenue was RMB11.3 bn, up 34%. This primarily reflected revnue growth in PC client games, driven by major and recently luanched titles and increased contributions from international markets.

“Online advertising revenue was RMB2.4 bn, up 26%.

eCommerce transactions revenue was about RMB500 mn, down 81% [ed: RMB 459 mn which] reflected a traffic shift to JD.com following our strategic transaction in March 2014 and the repositioning our Yixun business from principal to marketplace.

“Non-GAAP operating profit was RMB8.3 bn, up 55%. Non-GAAP net profit attributable to shareholders was RMB6.4 bn, up 47%.

“Moving onto our key online platforms, we achieved strong year-on-year growth in mobile usage and activities [MAU] on our social platforms. Total MAU for QQ was 820 mn, within which Smart devices MAU grew 36% to 542 mn. QQ PCU increased 22% to 217 mn. Weixin and WeChat achieved a combined MAU of 468 mn, up 39%r. Total MAU for Qzone was 629 mn, of which Smart devices MAU rose 26% to 506 mn.”

A less rosy view. TCTZF missed both growth and profit consensus estimates with the lowest rise in revenues in any quarter since 2007 of merely 28% and higher staff costs. Until last quarter, growth was 55%. Part of the reason was the sale of its E-commerce business to JD.com.

While it earned RMB 5.66 bn, the analysts expected earnings of an average of 6.1 bn (Bloomberg tally). In late trading on Wednesday the share lost 2.5% but made it up yesterday.

WeChat-Weixin monthly users grew only 6.8%, the slowest gain ever. Mobile QQ also sagged.

Meanwhile SG&A costs rose a huge 45% for 3.79 bn allegedly for R&D spending. Wondering about what R&D meant to Tencent I asked: it turns out R&D is need to comply with difficultApple's mobile operating system guidelines.

This tells you more on the JD.com deal. TCTZF aims to generate revenue by an open platform tactic which allows stores, software developers, and marketeers to freely sell goods on its eCommerce sites. TCTZF publishes the application interface and they can go online with no gatekeeper. An example of an open platform is linked-in. It may pay off eventually but hasn't yet.

Yesterday, TCTZF signed a deal with Warner Music to distribute music for the No. 3 recording co.

*Chinese logistics is how to gain from the singles day selling boom. We have a horse in this race, and it is neither Ma-headed company, not Alibaba either. It is Global Logistics Properties whose Chinese warehouses serve the consumer market. About 80% of the deliveries it organizes are for domestic conumption. GBTZF of Singapore was tipped here by Harry Geisel.

*I sold my Anton Oilfield Services at $44.75 mainly by forcing E-trade to accept should have executed my order when I input it on Oct. 28 and wrote it up here. ATONY

*It has fallen since then along with its 20% parent, which I vastly prefer,Schlumberger Ltd. SLB and ATONY are both suffering from the lower price of crude oil, but the latter more so. But as ATONY plummets I am tempted to get back in. Christian de Haemer is plugging “the cheapest oil company on earth.” It may be ATONY rather than some Iraqi wildcatter.

Journais ou Verdade?

*Correios de Portugal SA, or CTT, the country's post office, is “weighing its options” over Portugal Telecom and may make a bid for its assets. CTT and PT have business partnerships. CTT made its statement earlier after being quizzed by Brazilian journais. The US stock market seems to think this will not get delivered.

Meanwhile Oi SA fell short on both revenues and profits in Q3 with net coming in at reais 8.84 bn vs 2013 Q3 level of 9.26 bn. Revenues fell over 5% to Rs 7.74 bn in Brazil and by 4.5% in the colonial homeland of Portugal, to the equivalent of Rs 1.83 bn. PT is down marginally by (0.015%) but it and Oi have stopped plummetting.

*Alkemes's partner Janssen Pharma, a sub of Johnson & Johnson, won US FDA NDA approval yesterday for the 1x/month atypical Invega Sustena (paliperidone palmitate) injection for treating schizophrenia and schizoaffective disorder either alone or with adjunctive therapy. ALKS wins a royalty for its patented production technique using non-particles for the jab. Now you know why ALKS insiders have been buying so heavily.

Benefits of Bullish Bucks

*As the country delays new taxes in the run-up to a snap election, Japanese shares continue to rise in local currency with our latest Chris Loew pick, Shinmaywa, JP:7224, now over Y1000.

*Our protection against yen depreciation is an ETF, which many trackers of my performance my be missing. YPF, Proshares Ultrashort Yen, is at an all-time high of $84 this week, and our gain is coming close to 90%. I do not buy hedged ETFs, but I do hedge using ETFs.

Our hedge on the sinking loony, Horizons US Dollar Currency A, CA:DLR, is up 11.5%.

Our general protection against the dollar's rise is up over 41%, Power shares US$ Index Bullish, UUP.

(My personal fave, robot-maker Fanuc is now over Y20,550. I opted to wait till JP:6954 was cheaper before recommending the share to my readers, and still wait. I have owned it for nearly 30 years.)

Upgrades: We Told You First

*CAE was upgraded by Canaccord Genuity from hold to buy after it reported yesterday. It might be a good FDI investor in India. It is down despite this.

*Novartis was upped to buy from hold by Kepler Capital Markets which prefers it toRoche.

*CRH was upped to a hold from an underweight by Societe Generale analysts.

*Hikma Pharma is now covered by Oriel Securities in London which rates it hold with a GBP 1825 target price, equal to about $60 per ADR where it now is.

*Veresen (FCGYF) was raised to outperform from sector perform by CIBC.

*Gemalto will present next week at the Deutsche Bank ADR conference. It was recommended by Harry. The digital Franco-Dutch security firm this week acquired Marquis IS Systemswhich provides ID and drivers' licenses via US state motor vehicles depts. GTOMY also won a contract to provide its Optelio “sticker” for secure contactless mobile payment Westpac Bank customers in New Zealand. This is likely to spill over to Australia if it works well and shows how GTOMY is jumping the queue on contactless payments ahead of Apple.

*Marine Harvest Group (also tipped by Harry) was written up in Dick Davis Dividend Digest this month by editor Nancy Zambell. MHG factory farms salmon offshore Norway, Canada, Scotland, and Chile.

*Delek Group is affected by the exit of Israel Chemicals from their homeland as their joint salt water desalination unit has been put on the market. It operates globally, including a plant near San Diego. But without an Israeli ID it might be able to sell to the world's most water-short countries of the Arab world. It already pipes salt-free water to Jordan. The price is said by Ha'aretz to be as much as $1bn, half to DGRLY which also needs money.

*Spanish sustainable energy building Abengoa is hurting from its 9-mo report which cut full year forecasts, and from fear of ever cheaper oil hurting investment in alternatives like hydro, solar and wind. ABGB is aiming to become middle man for utility investors by arranging financing and turning facilities over to utes or irs Abengoa yield sub, which has been separately listed. ABGB has been listed on Q for a year and was tipped by Frida Ghitis when it was a third higher.

That's not the worst of it. We sold Canadian Solar (CSIQ) around its present price to buy ABGB.

Yesterday ABGB announced it will build the largest biomass plant on earth in Belgium using wood chips and agro-residue to produce 215 mW of power/d as well as district heating (cogeneration) for Ghent.

Fund notes:

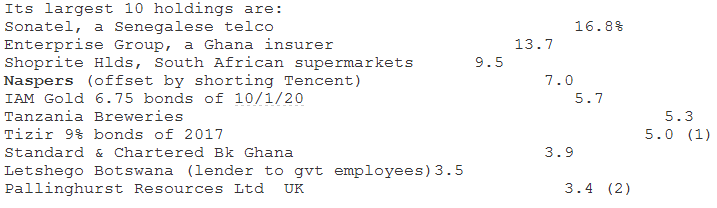

*Africa Opportunity Fund published its Sept. close data on Nov. 12 but despite promises failed to e-mail me a copy. I had to snatch it from the website after promising not to.

The fund closed Sept. with its NAV at $1.062/sh and its price at $1.0515, a 4.43% discount. Its newly issued "c" shares which are still mostly in cash are trading at a premium.

The fund is off 12.8% YTD.

1. Tizir is a jv of France's Eramet Nickel and Australia's Mineral Development with a Senegalese mine.

2. Pallinghurst mines for manganese and platinum in Mozambique, Zambia, and S. Africa.

Although it was not stated in this report in the past AOF shorted the

South African Shoprite and went long the cheaper Zimbabwe listed

variant.

*The NYSE yesterday issued a trading halt for its MKT market after an outage at its workstation delayed or prevented order processing and execution. Among the shares affect is Aberdeen Asia Pacific Income Fund, FAX. All trades during the outage will be reversed.

Disclosure: None