Expect Rate Sensitive ETFs To Extend Their Lead Due To Housing Uncertainty

I have not been able to sell my house. I have lowered the original asking price ($1,139,000) by more than 5%. I have jacked up the commission for buyer agents. None of it matters – million dollar homes throughout Orange County, California are not receiving a whole lot of offers.

Granted, real estate is local. What’s more, I may be fortunate enough to rent out the residence. (My family already has a new home to move into in November.) Yet many stock investors have already forgotten the adverse impact that weakness in real estate can have on the broader economy as well as market-based securities.

Does my anecdotal evidence about million dollar listings in Orange County, California even matter? I think that it may. For one thing, the unemployment rate in the “OC” is a full percentage point lower than the national average. A higher percentage of employed residents typically suggests a greater amount of disposable household income. Yet prospective home-buyers are not flocking to bid; sales volume is down nearly 10% in California year-to-date. Secondly, borrowing standards remain tight, particularly in places where a 4-bedroom, 3-bath home falls into the jumbo mortgage camp. The Mortgage Banking Association expects 2014 total lending to fall 13.4%. Additionally, stagnant wage growth as well as fear of excessive debt may also be conspiring to dampen interest in home purchasing.

Homebuilders have tried to stay upbeat about their rate-sensitive industry. 30-year mortgage rates have, in many cases, dropped three-quarters of a percentage point in 2014. And while conforming loans may benefit the most, even jumbos are more affordable. The problem? Borrowers cannot get access to the credit.

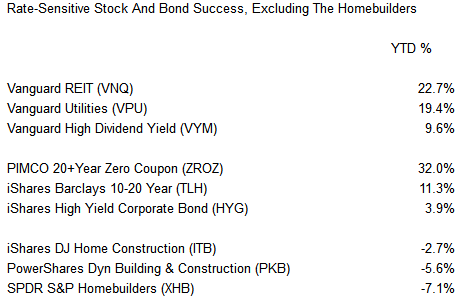

Perhaps ironically, rate-sensitive stock segments (e.g., utilities, REITs, high yielding dividend stocks, etc.) as well as rate-sensitive bond assets (e..g, high-yield bonds, long-term Treasuries, etc.) have performed tremendously year-to-date – with one exception. Homebuilder shares are no longer rising and falling in sync with interest rate trends.

There are other ways to look at the long-term woes for housing. In May of 2013, the Federal Reserve first hinted that it would taper its policy of buying bonds to push rates lower. That policy shift sent the 10-year yield from approximately 1.5% all the way up to 3.0%, and caused rate-sensitive assets of all stripes to underachieve in the 2nd half of 2013. Homebuilders were no exception, as the SPDR S&P Homebuilder (XHB):S&P 500 price ratio confirmed the relative weakness.

Then a funny thing happened in 2014. Against all economist projections – when only a handful of financial professionals had suggested interest rates would fall, not rise – interest rates slipped significantly. The 75 basis point drop in the 10-year has been a boon to dividend yielders, utilities, REITs, bonds and a variety of rate sensitive assets. All except one — home construction corporations. As the acceleration of the relative weakness in the XHB:S&P 500 price ratio demonstrates, housing uncertainty trumps rate favorability.

As long as the U.S. experiences the duel threat of deceleration in gross world product (GWP) and housing uncertainty, I am committed to the barbell approach that I have talked about throughout the entire year. On the right side of the barbell, I may continue to acquire lower risk equity assets during setbacks – ETFs such as iShares S&P 100 (OEF) and iShares USA Minimum Volatility (USMV). On the left side of the barbell, I may continue to accumulate longer-term bond assets on sell-offs like Vanguard Long-Term Bond (BLV) and Vanguard Extended Duration (EDV). I am less interested in assets in the middle of the risk curve – assets such as convertibles, preferreds and REITs. That is not an indictment of those asset classes in the middle; rather, it is endorsement of the barbell – a time-honored, late-stage bull market allocation.

ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser ...

more