(Fiscally) Bleeding Kansas

The deterioration in Kansas state finances not only continues unabated — it is seemingly accelerating.

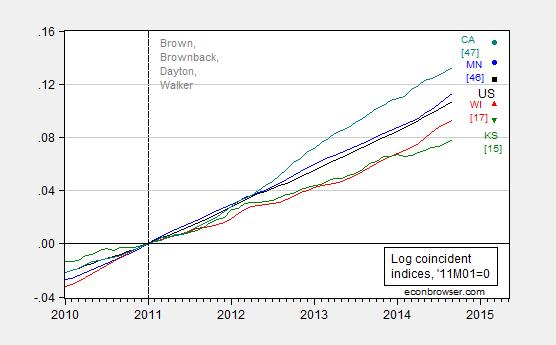

Figure 1 presents the evolution of estimates of Kansas state general fund receipts.

Figure 1: Kansas state general fund receipts, as estimated by Kansas Legislative Research Department and Kansas Division of the Budget June 16, 2014 (blue), adjusted for legislative changes during veto session Nov. 10, 2014 (red), and updated estimates as of Nov. 10, 2014 (black). Shaded area are forecasts as of November 2014. Source: Kansas Legislative Research Department and Kansas Division of the Budget (June 16, 2014) and Kansas Legislative Research Department and Kansas Division of the Budget (November 20, 2014).

As the Kansas budget blog observes, FY 2015 approved spending plus additional costs required to pay for Medicaid and school finance totals $6.427 billion. That means that even after completely draining the reserves in the state bank account, $279 million must still be cut from already approved spending just to keep the state solvent.

From the Wichita Eagle:

The state of Kansas will not have enough money to pay its bills through June unless it cuts $279 million in spending, according to updated revenue estimates.

Just a week after being re-elected, Gov. Sam Brownback is staring down a budget crisis, and nonpartisan analysts point to his signature policy as the cause.

Budget director Shawn Sullivan had the unenviable chore of presenting the state’s dire fiscal outlook at a news conference Monday evening at the Capitol. The state must cut $279 million for the current fiscal year, which ends in June, and another $436 million in the next fiscal year.

…

The shortfall is primarily being driven by the state’s income tax cuts, which Brownback signed into law in 2012, confirmed Raney Gilliland, director of the state’s nonpartisan Legislative Research Department. The state has lowered its expectation for individual income tax revenue by $239 million since April.

Sullivan said he had not discussed raising taxes or delaying scheduled tax cuts as possible solutions to righting the state’s financial ship.

Gilliland said the state’s current budget woes differed from the crisis it underwent during the recent recession, when the federal government came to the aid of Kansas and other states that saw revenue plummet.

“It’s not a national phenomenon, so I’m not expecting under these circumstances for the federal government to come to our rescue,” Gilliland said.

Gilliland said it was “yet to be determined” whether the income tax cuts were stimulating more economic activity than the state would see otherwise. The state is projected to see slower growth next year than the nation as a whole.

On the campaign trail, the governor repeatedly promised that economic growth would cover the state’s projected shortfall.

…

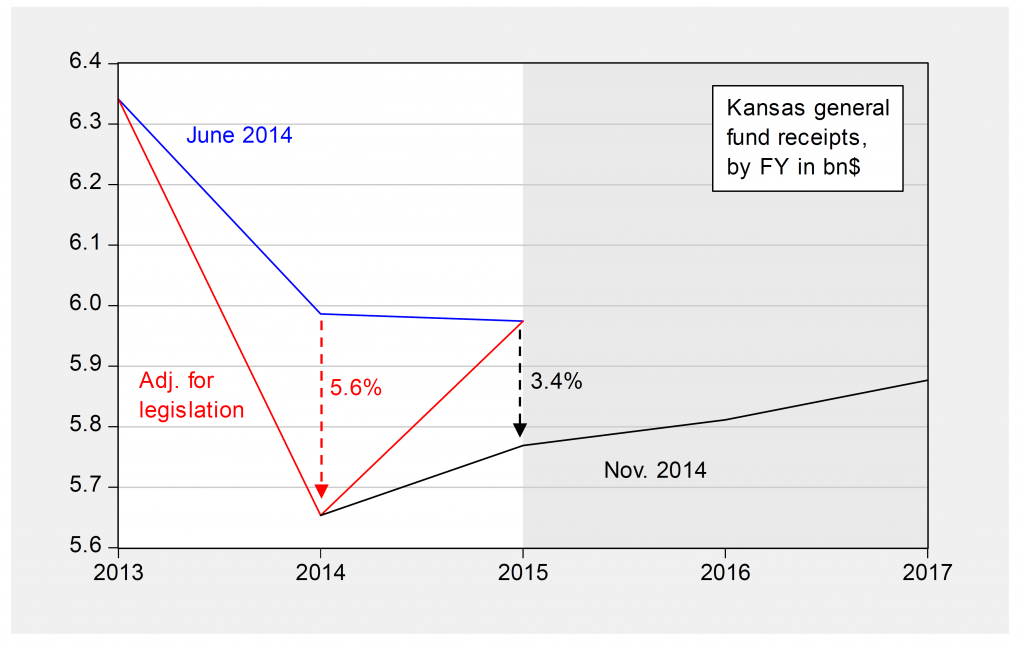

Below is a depiction of the Kansas economic outlook, based on the Philadelphia Fed’s leading indices.

Figure 2: Log coincident indices for Minnesota (blue), Wisconsin (red), Kansas (green), California (teal), and US (black), and forecasted levels for March 2015, all seasonally adjusted, normalized to 2011M01=0. Numbers in [square brackets] are ALEC-Laffer rankings from Rich States, Poor States 2014. Source: Philadelphia Fed leading indices,coincident indices, ALEC RSPS2014, and author’s calculations.

The outlook for the Kansas economy does indeed look rather lackluster for the next half year.

Disclosure: None.