Friday Failure – JP Morgan Misses Big!

Wheeeeee – down we go again!

I hate to say I told you so but — no, actually I'm loving this one… In fact, JPM specifically was our earnings short of the week – from our Live Chat Room on Monday morning, I said to our Members:

Earnings/QC – I think I like a bearish play on JPM best. STZ also tempting for a short but, with JPM, we already liked them short on the Dow list. With JPM at $59.60, I like selling the May $57.50 calls for $2.90 and buying the Jan $57.50/62.50 bull call spread at $2.40 to cover for a net .50 credit. If all goes well, JPM goes down and the short May calls expire worthless and whatever is left on the spread is bonus money (plus the credit).

This isn't that complicated folks, we just read the news and make a play. The rest is just picking the right option strategy and allocating appropriate amounts of cash – this is what we teach people how to do every day at PSW (you can join us HERE). That trade will be up more than 100% for the week this morning as JPM plunges to about $55. Yet another example of all the fun things we can do with our CASH!!!

And you KNOW we shorted Oil Futures (/CL) at $103.50 – I told you that in yesterday morning's post. We already hit $103 overnight (up $500 per contract) and we re-loaded this morning at $103.40 and now we're heading back to $103 yet again. Hopefully this is the big one and we get a ride back to $102 – which would be up $1,500 per contract.

I mentioned we were back to bearish in the morning post yesterday and, at 11:14, we added an aggressive SDS (ultra-short S&P) May $27/30 bull call spread at $1.15, buying 20 of those for $2,300, offset with the sale of a single ISRG 2016 $350 put at $31 ($3,100) for a net $800 credit. In yesterday's sell-off alone, the bull call spread finished at $1.65 ($3,300) while the ISRG puts held $31 for net $200 – a $1,000 gain on the day – THAT'S A NICE HEDGE!

That's just a hedge we added to our already bearish positions. It's a process called "layering" that we teach our Members to take advantage of larger legs down or up in the market than we originally planned for. As you can see, it's never too late for us to catch a trend with the tools we have at our disposal.

Last Friday, right in the morning post, I listed our shorting line for the Futures at:

- Dow (/YM) 16,500, now 16,000 – up $3,000 per contract

- S&P (/ES) 1,885, now $1,815 – up $3,500 per contract

- Nasdaq (/NQ) 3,660, now 3,450 – up $4,200 per contract

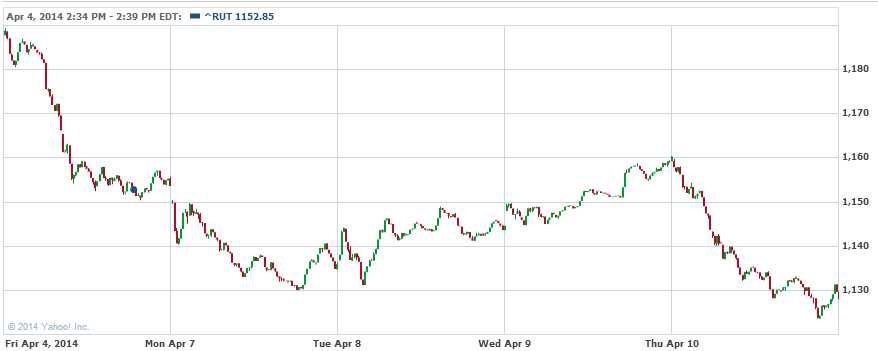

- Russell (/TF) 1,190, now 1,115 – up $7,500 per contract

As I mentioned at the time, the Russell was our favorite short and we had laid out several aggressive TZA (ultra-short Russell) trade ideas in previous posts and, of course, it was also our favorite trade idea of our "5 Trade Ideas that Make 500% if the Market Falls" (it did and they did!) – yet another post full of trade ideas that was delivered to our subscribers to prepare them for the market falling!

In Monday Morning's post, we discussed our XRT May $84 puts, which were .85 when our Members got them and $1.42 when I pointed them out for non-subscribers and yesterday they finished at $2.75, up 223% for our Members and up 93% for those of you who read us for free – still pretty good, right? I also said, right in Monday's post:

1,160 is the weak bounce line on the Russell and 1,170 is a strong bounce – that's what we'll be watching for today and we need AT LEAST the weak bounce today and the strong bounce tomorrow before we stop looking for the next 50-point drop – to 1,100.

Remember, the dip buyers have been conditioned for two straight years to buy every dip in the market and, so far, it's been a rewarding strategy. It's going to take a lot more than a small little 5% correction on the Russell and Nasdaq to break that pattern and the Dow, S&P and NYSE haven't even begun to fall. We just caught a nice wave on Friday – but the waters are still very choppy.

Not a bad call 3 days in advance, right? This morning the Russell is under 1,120, well on it's way to our 1,100 target. That's how, using our 5% Rule™, we were able to flip bullish Monday afternoon and play for the bounce and then (as I noted in yesterday's post, flip right back to bearish at our bull target), in Tuesday morning's post, I mentioned we added JNJ May $95 puts for 0.80 and they fell to 0.60 as the market climbed but, yesterday, we got our drop and hit $1.20 – up 50% in 3 days on that one. These are just the free samples, folks!

We always give our free samples into earnings but that's over now as we get into the more serious trades coming up over the next month. JPM above is one example of how we can make money with our earnings spreads and, since we're mainly in cash and waiting for some bottom-fishing – this party goes back to being private next week.

We will also be closing Premium Chat Memberships shortly, as we're getting full there but you can still sign up for the wait list between now and when we open up again and our new "Trend Watcher" Membership is also available if you want to check us out during earnings season.

Have a great weekend,

- Phil