Hold Gartner For Now, Buy Or Sell It Later

Gartner, Inc. (NYSE: IT) is a major information technology research and advisory firm headquartered in Stamford, CT. The company provides decision makers in numerous industries with necessary technology related insights and analysis on a day-to-day basis. Gartner currently has clients in more than 14,000 organizations across 85 countries. Gartner’s services are delivered through the company’s Research, Consulting and Events divisions.

The stock price is currently reflecting its real value as well as the fact that the company still has room for growth. With a $6.56 billion market cap, Gartner is the largest IT research shop and a growing player in the information technology services industry. This market is gigantic: global spending on information technology was more than $3.6 trillion in 2012 and this spending is increasing consistently year over year. The IT services market makes up the largest portion in this big IT pie and the market is supposed to reach $1147 billion in 2017 with an estimated 5% increase rate per year according to a recent research from a major market insight company.

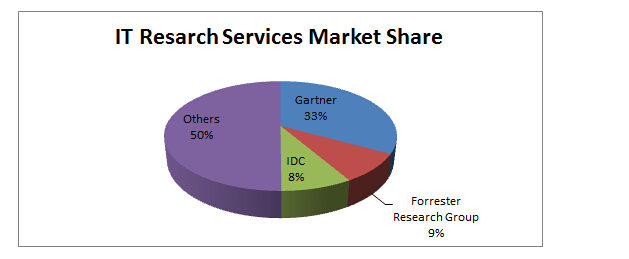

Chart 1

Gartner’s major competitors are Forrester Research, Inc. (NASDAQ: FARR), Yankee Group, IDC and AMR. The company also competes indirectly with consulting firms and information providers such as media publishers. Gartner is the most well-known brand among its major direct competitors. One of the company’s pivotal long-term strategies is to expand the magnitude of business with its valuable clients and grow new customers and markets with its high quality industry related research and strategic advice.

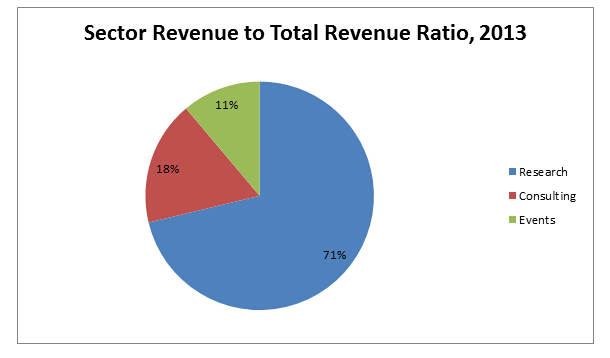

Chart 2

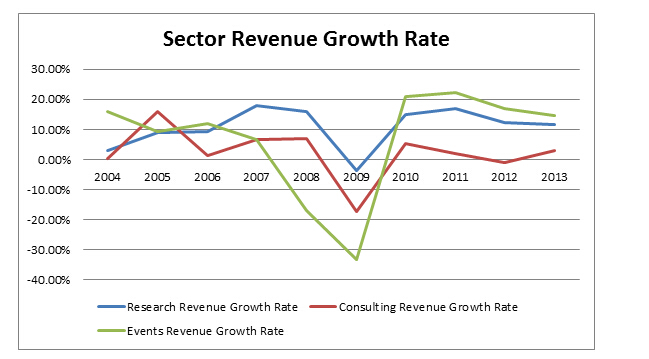

Chart 3

Gartner’s Research, Consulting and Events revenue counted towards the company’s total revenue as 71.24%, 17.61% and 11.15%, respectively, in fiscal year 2013. The company’s Research segment experienced 11.77% growth in 2013 compared to fiscal year 2012, while its Events revenue advanced 14.49% in 2013. Gartner’s Consulting revenue expanded 3.07% last year. For the next five years, the company’s Research division should keep supplying revenue to Gartner, and its Events division has the possibility to increase rapidly. Its Consulting arm might slow down in terms of its growth rate. A breakthrough point could be expected for three major segments. We would need to see how the company’s strategy changes for the next five years before making any statement.

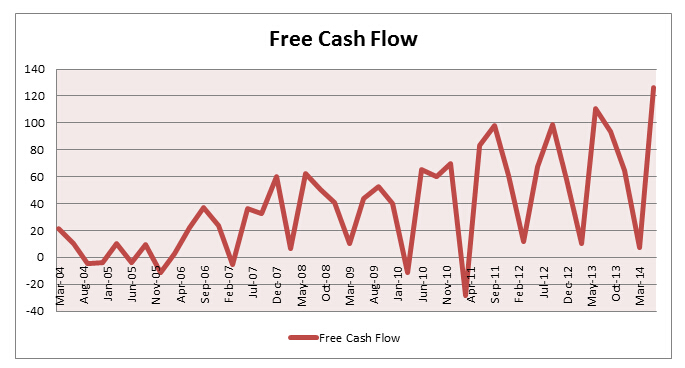

Chart 4

Gartner’s cash flow is strong and stable as we can see in Chart 4. In fact, it is not difficult for us to recognize the pattern of the free cash flow in the past 10 years for this company -- what goes up eventually goes down, then bounces back to a new high. In general, Gartner’s cash flow is increasing and is adjusting at a relatively steady pace. The adjusting period for Gartner is usually six months to one year. The company’s FCF reached a new peak as of June 2014. As for Gartner’s FCF in Q3 and Q4 2014, we do not know but we may expect the cash flow to hit a trough point at the end of 2014 or earlier 2015.

Chart 5

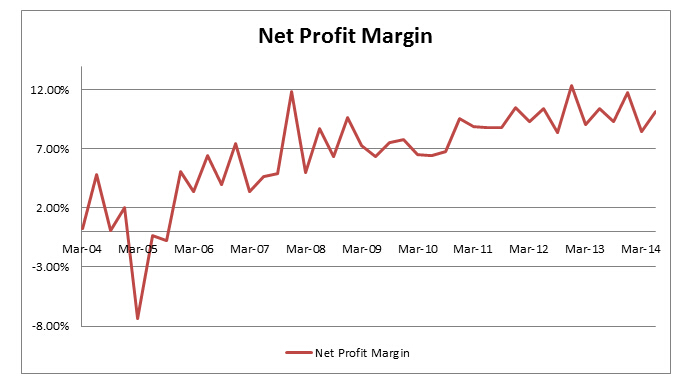

Gartner is currently holding a reasonable positive profit margin and its profit margin has an uptrend overall. The company’s net profit margin had a 3741% increase in Q1 2014 compared to Q1 2004. Gartner’s Net Profit Margin was 10.20% as of Q2 2014, similar to industry average 10.80%.

Valuation

Chart 6

Positives: Strong cash flow and earnings growth history, reasonable profit margin, excellent industry reputation, mature business strategy and model, large market coverage of its business services, top-notch IT Research contents and high quality research analysts and consultants.

Negatives: The company’s consulting business is growing slowly and is facing tremendous competition from giants in the consulting industry. Innovations are expected on its products and services. The “Gartner” brand needs further promotion.

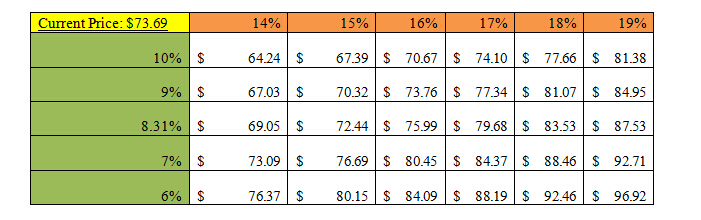

Recommendation: Assuming Gartner, Inc. is able to grow steadily at 14% per year, with a 6% discount rate, the stock price should be $76.37 according to my calculation, which is slightly higher than its current price $73.69. Considering the company’s growing Research sector and the positive prospect of its Events division, the company has the potential to reach a higher growth rate within the next five years. We still need to see the company’s financial performance for Q3 and Q4 2014 and we might expect a minor adjustment in price for this stock in less than a year. I would recommend to hold this stock at its current price $73.69.

Disclosure: None.