Morning Call For November 24, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.24%) this morning are up +0.18% and European stocks are up +0.99% at a 1-3/4 month high after German business confidence unexpectedly rose for the first time in 7 months. European bank stocks and government bonds also rose on speculation the ECB will expand stimulus after ECB President Draghi last Friday said the ECB needs to accelerate inflation and may broaden its asset-purchase program. 10-year government bond yields from France, Italy and Spain all fell to record lows on speculation the ECB will soon begin to buy sovereign debt. Asian stocks closed mostly higher: Japan closed for holiday, Hong Kong +1.95%, China +2.55%, Taiwan +0.34%, Australia +1.08%, Singapore -0.14%, South Korea +0.98%, India +0.58%. China's Shanghai stock Index soared to a 3-year high as the Asian markets reacted for the first time to the surprise interest rate cut by the PBOC that was done after the Asian markets closed last Friday. Commodity prices are mostly lower. Dec crude oil (CLF15 -0.55%) is down-0.41%. Dec gasoline (RBF15 -0.68%) is down -0.58%. Dec gold (GCZ14 -0.35%) is down -0.23%. Dec copper (HGZ14 -0.08%) is up +0.02%. Agriculture prices are mostly lower. The dollar index (DXY00 -0.09%) is down -0.09%. EUR/USD (^EURUSD) recovered from a 2-week low and is up +0.17% after the German IFO business confidence unexpectedly improved. USD/JPY (^USDJPY) is up +0.38%. Dec T-note prices (ZNZ14 -0.09%) are down -4 ticks.

The German Nov IFO business climate unexpectedly rose +1.5 to 104.7, better than expectations of -0.2 to 103.0. The Nov IFO current assessment rose +1.6 to 110.0, better than expectations of -0.4 to 108.0. The Nov IFO expectations rose +1.6 to 99.7, stronger than expectations of +0.2 to 98.5.

ECB Governing Council member Ewald Nowotny said that the ECB should wait for the effects of measures already taken before adding more stimulus measures as monetary policy works with a long delay.

U.S. STOCK PREVIEW

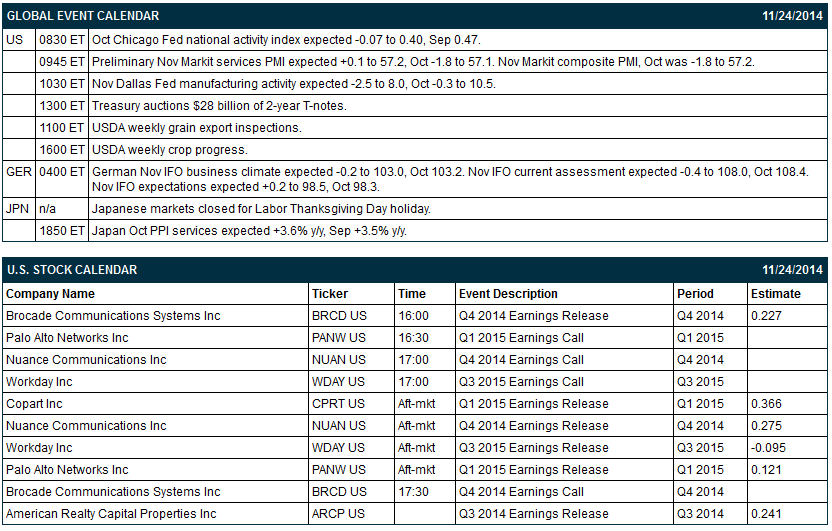

There are no major U.S. economic reports today. The Treasury today will sell $28 billion of 2-year T-notes. There are 6 of the Russell 1000 companies that report earnings today: Brocade Communications (consensus $0.23), Copart (0.37), Nuance Communications (0.28), Workday (-0.10), Palo Alto Networks (0.12), American Realty Capital Properties (0.24). Equity conferences this week includes: Brean Capital Life Science Conference on Mon, Smart Grid World Conference 2014 on Mon, UBS India Conference on Mon.

OVERNIGHT U.S. STOCK MOVERS

Deutsche Bank keeps its 'Buy' rating on Hewlett-Packard (HPQ +0.89%) and raises its prices target on the stock to $45 from $40.

Standard Pacific (SPF -0.52%) was downgraded to 'Neutral' from 'Buy' at BofA/Merrill Lynch.

Copa Holdings (CPA +0.01%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

Tesla (TSLA -2.38%) rose over 1% in pre-market trading after Reuters reported that Tesla is in negotiations with BMW about partnering on batteries and lightweight components.

Verizon (VZ +0.04%) was downgraded to 'Neutral' from 'Buy' at Citigroup.

Ulta Salon (ULTA +0.27%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

Chicago Bridge & Iron (CBI +1.91%) and Jacobs Engineering (JEC +0.68%) were both downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

Trina Solar (TSL +4.10%) reported Q3 EPS of 14 cents, less than consensus of 15 cents.

AMC Entertainment (AMC -2.38%) was initiated with a 'Buy' at Goldman Sachs with a price target of $30.

Lockheed Martin (LMT +1.28%) is being awarded a $4.12 billion government contract modification for the production of 43 Low Rate Initial Production Lot VIII F-35 Lightning II aircraft.

Glenhill Advisors reported a 12.5% passive stake in The Joint (JYNT -1.66%) .

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.24%) this morning are up +3.75 points (+0.18%). The S&P 500 index on Friday soared to a new record high and closed higher: S&P 500 +0.52%, Dow Jones +0.51%, Nasdaq +0.22%. Bullish factors included (1) the action by the PBOC to cut interest rates for the first time in over 2 years, which boosted optimism in the global economic outlook, and (2) carry-over support from a rally in European equities on speculation the ECB will expand its stimulus measures after ECB President Draghi said he will do what is necessary to raise inflation in the Eurozone as fast as possible.

Dec 10-year T-notes (ZNZ14 -0.09%) this morning are down -4 ticks. Dec 10-year T-note futures prices on Friday closed higher: TYZ4 +4.00, FVZ4 +2.75. Bullish factors included (1) carry-over support from a rally in German bunds to a 5-week high after comments from ECB President Draghi bolstered speculation the ECB may expand stimulus, and (2) comments from Fed Governor Tarullo who said that trading physical commodities poses “unique risks” to banks and that regulators should examine additional capital requirements for lenders that trade commodities, which may boost banks’ demand for Treasuries to satisfy their capital requirements.

The dollar index (DXY00 -0.09%) this morning is down -0.076 (-0.09%). EUR/USD (^EURUSD) is up +0.0021 (+0.17%). USD/JPY (^USDJPY) is up +0.45 (+0.38%). The dollar index on Friday rallied to a 4-1/3 year high and closed higher. Closes: Dollar index +0.719 (+0.82%), EUR/USD -0.01501(-1.20%), USD/JPY -0.376 (-0.32%). Bullish factors included (1) weakness in EUR/USD which fell to a 2-week low after ECB President Draghi reiterated his commitment to raising inflation as fast as possible, which suggests the ECB may yet implement full-blown quantitative easing, and (2) improved interest rate differentials for the dollar against other major global currencies as the Fed cuts back on stimulus while the PBOC, BOJ and ECB cut interest rates and expand their stimulus measures.

Jan WTI crude oil (CLF15 -0.55%) this morning is down -31 cents (-0.41%) and Jan gasoline (RBF15 -0.68%) is down -0.119 (-0.58%). Jan crude and Dec gasoline on Friday rallied to 1-week highs and closed higher. Closes: CLF5 +0.66 (+0.87%), RBF5 +0.0289 (+1.43%). Bullish factors included (1) China’s interest rate cut, which may boost economic growth and energy demand in China, the world’s second-biggest consumer of crude oil, and (2) the rally in the S&P 500 to a record high, which bolsters optimism for the U.S. economic outlook and fuel demand.

Disclosure: None