Morning Call For Oct. 2, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.14%) this morning are down -0.01% and European stocks are down -0.39% ahead of the outcome of today's ECB meeting and the press conference by ECB President Draghi soon after. European stocks may be disappointed if Draghi fails to offer insight into the size and scope of its expected purchases of asset-backed securities (ABS). Greek sovereign debt rallied sharply Wednesday after the Financial Times reported that the ECB will propose that existing requirements on the quality of assets accepted are relaxed to allow purchases of some Greek and Cypriot ABS. Russia's Micex Stock Index tumbled to a 1-1/2 month low after the IMF cut its Russian 2015 GDP forecast in half to +0.5% from +1.0% amid the fallout from the conflict in Ukraine and a weaker ruble. Asian stocks closed lower: Japan -2.61%, Hong Kong, China and India closed for holiday, Taiwan -0.17%, Australia -0.68%, Singapore -1.08%, South Korea -1.09%. Japan's Nikkei Stock Index fell sharply to a 3-1/2 week low on carry-over weakness from Wednesday's slide in U.S. stocks along with a decline in Japanese exporters after the yen rose to a 1-week high against the dollar. Commodity prices are mostly lower. Nov crude oil (CLX14 -1.80%) is down -2.22% at a 17-month low after Saudi Arabia reduced the price of its Arab Light crude by $1 a barrel, suggesting that Saudi Arabia does not plan on cutting production and instead wants to protect its share of OPEC output. Nov gasoline (RBX14 -1.87%) is down -2.05% at a 3-3/4 year low. Dec gold (GCZ14 -0.17%) is down -0.10%. Dec copper (HGZ14 -0.71%) is down -0.56%. Agriculture and livestock prices are mixed with Dec live cattle up +0.45% at a contract high. The dollar index (DXY00 -0.26%) is down -0.27%. EUR/USD (^EURUSD) is up +0.12%. USD/JPY (^USDJPY) is down -0.28% at a 1-week low. Dec T-note prices (ZNZ14 -0.01%) are up +0.5 of a tick at a 1-month high.

Eurozone Aug PPI fell -0.1% m/m, right on expectations, and on a year-over-year basis fell -1.4% y/y, a larger drop than expectations of -1.2% y/y.

The UK Sep Markit/CIPS construction PMI unexpectedly rose +0.2 to 64.2, better than expectations of -0.5 to 63.5 and the fastest pace of expansion in 8 months.

U.S. STOCK PREVIEW

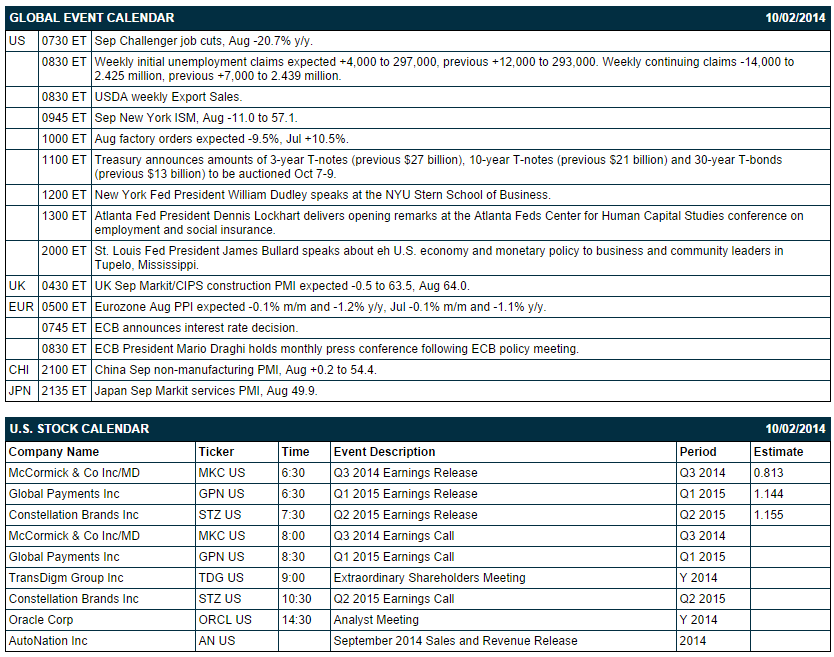

Today’s weekly initial unemployment claims report is expected to show a small increase of +4,000 to 297,000, adding to last week’s increase of +12,000 to 293,000. Meanwhile, today’s continuing claims report is expected to show a decline of -14,000 to 2.425 million, more than reversing last week’s rise of +7,000 to 2.439 million. Today’s Aug factory orders report is expected to show a decline of -9.5%, giving back most of the +10.5% increase seen in July. There are three of the Russell 1000 companies that reports earnings today: McCormick (consensus $0.81), Global Payments (1.14), Constellation Brands (1.16). Equity conferences today include: Paris Motor Show 2014-Press Days on Thu.

OVERNIGHT U.S. STOCK MOVERS

McCormick & Co. (MKC -1.93%) reported Q3 EPS of 95 cents, better than consensus of 81 cents.

Constellation Brands (STZ -2.18%) reported Q2 EPS of $1.11, weaker than consensus of $1.16.

Global Payments (GPN -1.56%) reported Q1 cash EPS of $1.22, higher than consensus of $1.14.

Darden (DRI -0.99%) says it sees Q2 EPS in the upper end of 26 cents-28 cents, better than consensus of 26 cents.

Autodesk (ADSK +1.02%) was upgraded to 'Neutral' from 'Sell' at Citigroup.

Citigroup keeps its 'Buy' rating on Apple (AAPL -1.56%) and raised its price target on the stock to $120 from $110 citing higher than expected iPhone 6 pricing.

Intuit (INTU -2.20%) was downgraded to 'Underweight' from 'Equal-Weight' at Evercore.

Barrick Gold (ABX +0.61%) was upgraded to 'Hold' from 'Sell' at Canaccord.

Bank of America (BAC -1.35%) was upgraded to 'Buy' from 'Neutral' at UBS.

Deutsche Bank reiterated its 'Buy' ratinng on CME Group (CME -0.70%) and raised its price target on the shares to $95 from $85.

Northrop Grumman (NOC -2.84%) has been awarded a $306.13 million government contract for logistics support of the Global Hawk fielded weapon system.

ICS Opportunities reported a 5.2% passive stake in Penn Virginia (PVA -4.64%) .

Marathon Petroleum (MPC -2.63%) was initiated with a 'Top Pick' at RBC Capital with a price target of $115.

Valero (VLO -1.45%) was initiated with an 'Outperform' at RBC Capital with a price target of $66.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.14%) this morning are down -0.25 of a point (-0.01%). The S&P 500 index on Wednesday fell to a 1-1/2 month low and closed sharply lower: S&P 500 -1.32%, Dow Jones -1.40%, Nasdaq -1.60%. Bearish factors included (1) European economic concerns after the German Sep Markit/BME manufacturing PMI was revised lower to 49.9 from 50.3, the first time the index has fallen below 50.0 in 15 months, and (2) the -3.4 point drop in the Sep ISM manufacturing PMI to 56.6, weaker than expectations of -0.5 to 58.5. On the positive side, the Sep ADP employment report increased by +213,000, stronger than expectations of +205,000.

Dec 10-year T-notes (ZNZ14 -0.01%) this morning are up +0.5 of a tick at a 1-month high. Dec 10-year T-note futures prices on Wednesday jumped to a 3-week high and closed higher. Bullish factors included (1) carry-over support from a rally in German bunds to a 3-week high on concern the European economy is slowing after the Eurozone Sep Markit manufacturing PMI was revised down to a 15 month low, (2) the larger-than-expected decline in the Sep ISM manufacturing PMI, and (3) increased safe-haven demand for Treasuries as stocks stumbled. Closes: TYZ4 +28.00, FVZ4 +15.75.

The dollar index (DXY00 -0.26%) this morning is down -0.234 (-0.27%). EUR/USD (^EURUSD) is up +0.0015 (+0.12%) and USD/JPY (^USDJPY) is down-0.31 (-0.28%) at a 1-week low. The dollar index on Wednesday closed higher. Bullish factors included (1) weakness in EUR/USD after the Eurozone Sep Markit manufacturing PMI was revised lower to the slowest pace of expansion in 15 months, and (2) increased safe-haven demand for the dollar after the S&P 500 fell to a 1-1/2 month low. Closes: Dollar index +0.036 (+0.04%), EUR/USD -0.00078 (-0.06%), USD/JPY -0.751 (-0.68%).

Nov WTI crude oil (CLX14 -1.80%) this morning is down sharply by -$2.01 a barrel (-2.22%) at a 17-month low and Nov gasoline (RBX14 -1.87%) is down-0.0503 (-2.05%) at a 3-3/4 year low. Nov crude and Nov gasoline prices on Wednesday settled mixed: CLX4 -0.43 (-0.47%), RBXX4 +0.0124 (+0.51%). Crude prices erased an early rally and closed lower after Saudi Arabia cut its November official selling prices to all areas, suggesting they won’t be cutting back on production. Bullish factors included (1) the unexpected -1.363 million bbl decline in weekly EIA crude inventories to an 8-month low of 356.6 million bbl versus expectations for a +1.5 million bbl build, and (2) the -1.84 million bbl drop in EIA gasoline inventories to a 22-month low of 208.5 million bbl versus expectations for a -600,000 bbl decline.

Disclosure: None