Reduce Your Allocation To Small Cap U.S. Stock ETFs

The Wall Street media may celebrate the 33% intra-day jump in Alibaba shares. They may tout the record highs in the Dow and the S&P 500. However, they are missing the boat on both the economy as well as key stock market divergences.

Let us start with the economic environment. The all-important Conference Board’s Leading Indicators Index (LEI) rose a meager 0.2%. That is indicative of an economy that has little chance of repeating its 4% 2nd quarter expansion. Even if one believed that the U.S. has been granted immunity from the recessionary pressures in Europe, annualized sub-par growth in the area of 2% has become the new normal; since the Great Recession’s end in June of 2009, momentary acceleration has always been followed up by extraordinary disappointment. Why else would the Federal Reserve endorse nearly six years of on-again, off-again quantitative easing (QE) alongside zero percent overnight lending rates?

From a longer-term view, inflation-adjusted household income today is approximately 8% lower than when the Great Recession began in 2007. The central bank (i.e. “The Fed”) has been hoping for wage inflation for years. Unfortunately for the institution’s committee members, it hasn’t materialized and it is unlikely to do so. Corporations effectively used the Fed’s interest rate generosity to borrow cheaply, buy back their own stock, increase productivity as well as merge with other companies. Pay more to existing employees? Ramp up hiring of well-compensated individuals? Much like the dream of economic “lift-off,” policy makers have engaged in little more than wishful thinking.

Those who agree with my delineation of economic weakness tend to bring up the argument that the U.S. is the cleanest dirty shirt in the world’s hamper. Perhaps. Yet the idea that one should pay exorbitant prices for U.S. stock ownership – as determined by nearly any metric on the board (e.g., price-to-earnings, price-to-dividend, price-to-sales, price-to-book, Tobin’s Q, etc.) – is suspect. Low interest rates cannot justify it. “Where else can you put your money” is not a valid justification either.

The primary reason for continuing to own U.S. equities is that the fear-greed cycle still favors “going long.” Until the S&P 500 SPDR Trust (SPY) breaks below and stays below its 200-day moving average, you are likely to benefit from the durable uptrend in large-caps.

The case that can be made for larger corporations, however, cannot necessarily be made by smaller companies and the ETFs that purport to represent them. One of the most common methods for assessing the health of the broader U.S. picture is via the cumulative NYSE Advance/Decline (A/D) line. The popular indicator charts the the net number of NYSE stocks (advancers minus decliners) in a given day and adds it to a running total, offering technical analysts a way to visualize whether the overall market is healthy or not.

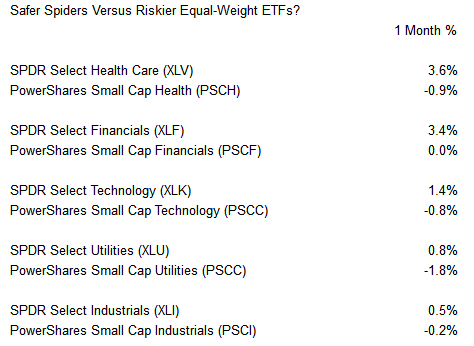

In the above chart, we see that the overall market is faltering, even as the Dow and the S&P 500 receive glorious accolades. Historically, the pattern has a habit of foreshadowing trouble. How is this playing itself out on the ETF landscape? An easy way to find out is to compare the PowerShares Small Cap Sector ETFs against the market-cap weighted SPDR Sector ETFs. The former perform better when risk-takers are rewarded the most, while the latter perform better when safety-seekers are moving away from smaller corporations.

The bottom line? ETF enthusiasts may see their portfolios tread water if they choose a diversified path. Foreign equities, emergers and small caps have been struggling as of late. The primary winners – the Dow, the S&P 500 and Alibaba – are what they show us on CNBC.

ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser ...

more