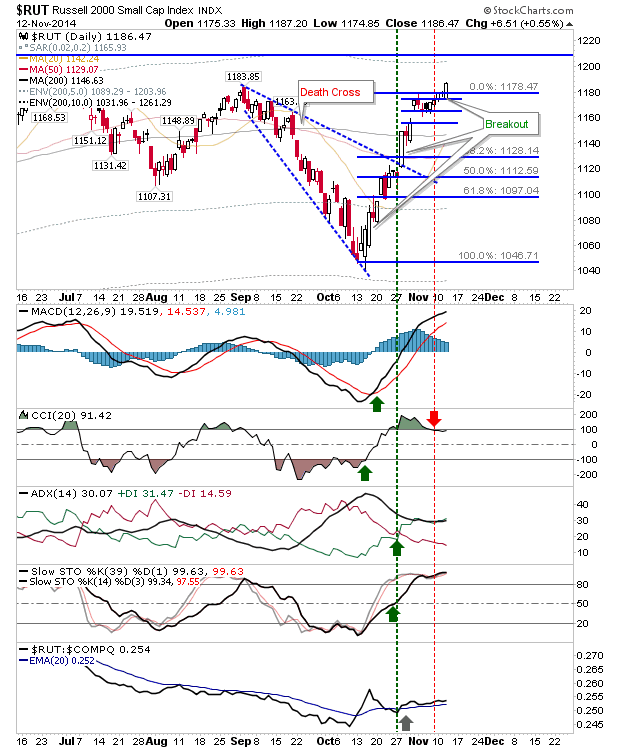

Russell 2000 Adds To Breakout

Wednesday proved to be a relatively quiet day. Large Caps managed to keep themselves out of the limelight with a mid-morning recovery after an opening sell off. Best of the action belonged to the Russell 2000. It was able to put some distance on a tight handle consolidation, which sets it up for a move to challenge resistance at 1,208.

The Semiconductor Index had a very quiet day, but it's trading close to measuring(?) gap support and may offer a long side opportunity.

This time, it might be Technology indices which can help the Semiconductors. The Nasdaq 100 added a small amount to what has been a tentative breakout. Breakout support for the Nasdaq 100 lives at 4,117, but if it can maintain this level it will help the SOX push a break of 652.

The S&P didn't offer much. I'm still liking a move back to Fib retracements, but with everyone waiting for sellers to move in, and not selling themselves, then the only way this market can go is up. Something will be needed to shake traders out of this narrow range apathy.

Opportunities for Thursday should focus on the breakout in the Russell 2000 and a possible support 'buy' in the Semiconductors. Should selling re-emerge, then there is a risk of a 'bull trap' in the Russell 2000, which in itself would trigger additional (rapid) selling/shorting activity.

Disclosure: None.