Stairs Up And Elevator Down?

This reflex, counter-trend Cycle move has now added 180 points in 10 sessions, more than eclipsing the 17 session fall that preceded it. They often say that equities take the “stairs up and an elevator down”, which is why I find it very difficult to respect a move of this magnitude. To me, the only condition in which I can accept this type of all-inspiring move is if the market was headed for a final blow-off top.

However, the Cycle count does not show new highs, at least not coming for another couple of months (only from the next IC). Massive “surprise” moves, such as a blow-off, have been known to occur from very unorthodox setups such as these. The point is that this 5 year bull market continues to demand my respect, even though the expectation for new all-time highs here is no longer warranted. In the end, price trumps any technical analysis and discipline.

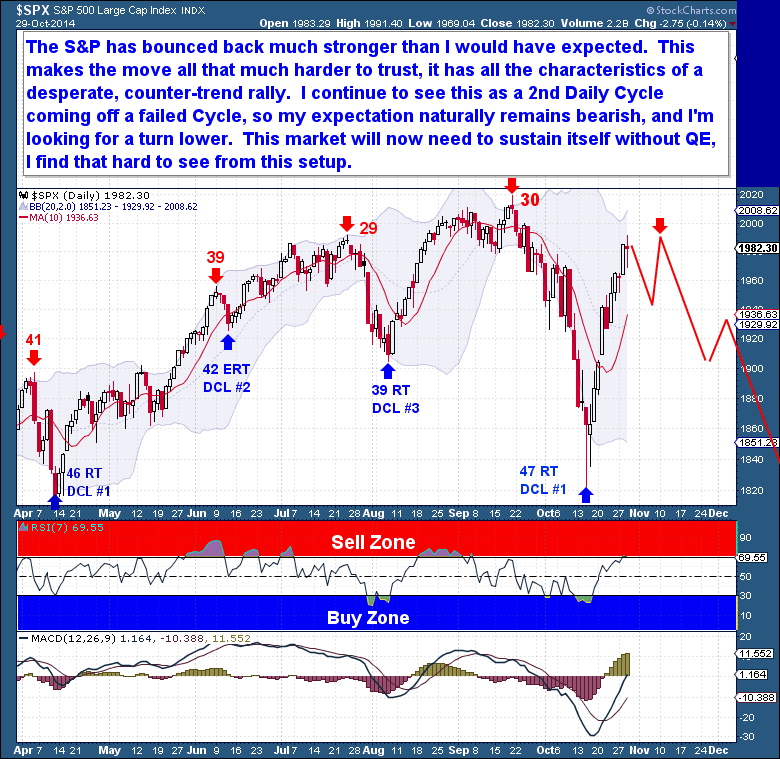

The S&P (SPX) continues to bounce back much stronger than I would have expected. And this makes the move all that much harder to trust. To me, the action has all the characteristics of a desperate, counter-trend rally. This is how (bull) trapping markets form and I continue to see this as a 2nd Daily Cycle coming off a failed Cycle. In that case, my only expectation is to naturally remain bearish, while looking for a turn lower to begin at any moment.

I’m curious now to see what role the ending of QE will play in this scenario. In my opinion, like we witnessed in past culminations of QE programs, this environment does fit the profile of a failed Investor Cycle well. This market will now need to sustain itself without QE and from a lofty (and failed Cycle) position. I find that difficult to see.