The Coming Week’s Top Market Movers

What to watch this week

Summary

–Technical Outlook: Medium Term Bullish, Short Term Bearish

–Fundamental Outlook 1: Three big likely market drivers this week the top calendar events to monitor

–Fundamental Outlook 2: Top calendar events to watch

Health issues keep this week’s post short.

Technical Picture: Medium Term Bullish, Short Term Bearish

We look at the technical picture first for a number of reasons, including:

Chart Don’t Lie: Dramatic headlines and dominant news themes don’t necessarily move markets. Price action is critical for understanding what events and developments are and are not actually driving markets. There’s nothing like flat or trendless price action to tell you to discount seemingly dramatic headlines – or to get you thinking about why a given risk is not being priced in.

Charts Also Move Markets: Support, resistance, and momentum indicators also move markets, especially in the absence of surprises from top tier news and economic reports. For example, the stronger a given support or resistance level, the more likely a trend is to pause at that point. Similarly, a confirmed break above key resistance makes traders much more receptive to positive news that provides an excuse to trade in that direction.

Indexes Are Good Overall Barometers. Their usual positive correlation with other risk assets, and negative correlation with safe haven assets, makes them good overall barometers of what different asset classes are doing.

Overall Risk Appetite Medium Term Per Weekly Charts Of Leading Global Stock Indexes

Weekly Charts Of Large Cap Global Indexes May 26 2013 – Present: With 10 Week/200 Day EMA In Red: LEFT COLUMN TOP TO BOTTOM: S&P 500, DJ 30, FTSE 100, MIDDLE: CAC 40, DJ EUR 50, DAX 30, RIGHT: HANG SENG, MSCI TAIWAN, NIKKEI 225

Key For S&P 500, DJ EUR 50, Nikkei 225 Weekly Chart: 10 Week EMA Dark Blue, 20 WEEK EMA Yellow, 50 WEEK EMA Red, 100 WEEK EMA Light Blue, 200 WEEK EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange.

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com

01 Sep. 14 10.45

Key Points

US Indexes: Last week’s minor pullback brings them to the lower end of their double Bollinger® band buy zones, meaning they’re at the brink of losing medium term upward momentum. Uptrends are obviously still quite solid, so at this point there’s nothing more than a normal correction within a longer term uptrend. Though as we note below with the daily charts, short term deterioration puts the odds in favor of further downside next week, from a purely technical perspective. That said, with so many top tier events that could move markets, the coming weeks’ direction for indexes in general is mostly dependent on the outcomes from these events.

European Indexes: Last week’s pullback put them back into their double Bollinger® band neutral zone, suggesting flat trading ranges in the weeks ahead. Otherwise, the same comments apply.

Asian Indexes: A mixed bag, mostly following the US and EU lower. There were a few exceptions based on local market conditions. Japan’s Nikkei was up on Yen weakness (due to USD strength) which is seen as supportive of this exporter-heavy index. So too was Shanghai, which rose as low inflation figures raised stimulus hopes.

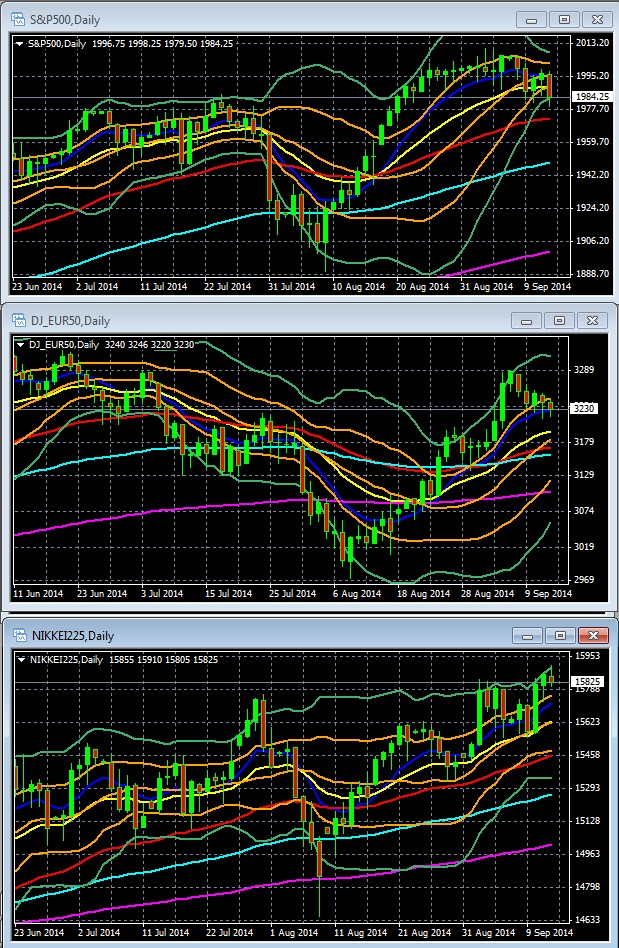

Overall Risk Appetite Short Term Per Daily Charts Of Leading Global Stock Indexes

Key For S&P 500, DJ EUR 50, Nikkei 225 Daily Chart: 10 Day EMA Dark Blue, 20 Day EMA Yellow, 50 Day EMA Red, 100 Day EMA Light Blue, 200 Day EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange.

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com

02 Sep. 14 11.10

Key Points From Daily Charts

US: The daily chart for the S&P 500 is revealing, so I’ll focus on that. The flattening of the S&P 500 since Mid-August meant that even a week’s pullback has brought the index into its double Bollinger band sell zone, suggesting that the odds favor greater downside this week. Note how the 10 day EMA is getting close to crossing below the 20 day EMA, which would support the downward momentum thesis. Mark Chandler notes here that the 5 day moving average is due to cross below the 20 day MA, and that has been a reliable signal of trend changes in recent months.

The next major support level is around the 50 day EMA at 1970, then at the 100 day EMA around 1950. A decisive break below that opens the way for a test all the way down to 1900.

Fundamental Outlook 1: Top Potential Market Movers To Monitor This Week

It’s the events with the most potential to move most asset markets are the Fed meeting, the ECB’s TLTRO launch, and the Scottish referendum, so we’ll focus on them.

Wednesday October 17th FOMC Rate Statement, Forecasts, Press Conference

The big question is obviously whether the combination of these events will change feed or dampen rising expectations for a hawkish shift in policy that brings rate hikes sooner. We see those expectations reflected in the recent jump in US Treasury yields. For example, the 10 year note dipped below 2.35% in late August, and was up to 2.60% at the close last week.

There are a few ways this could happen. For example:

- The Fed has long asserted that even after QE ends, it plans to hold rates steady for a “considerable time.” Dropping this phrasing, or replacing it with something implying a shorter period of steady rates would send a clear signal that the Fed is getting more hawkish.

- Yellen sounds more hawkish at the press conference. For example, she’s more upbeat on the US economy, particularly on employment. Alternatively, she could make an outright admission that rates could rise sooner than previously planned (of course with the normal qualification that US data keeps improving).

- Some other kind of clarification on when rates are due to rise that does not extend beyond the current consensus of mid-2015.

- As the last Fed meeting of the quarter, it includes updated forecasts on employment, interest rates, and inflation. These forecasts provide another way market sentiment could be moved, particularly if Yellen press conference comments on them have reflect growing optimism or her usual, opaque caution. A bullish upgrade to this forecasts would favor USD bullish sentiment, as long as Yellen doesn’t downplay them in the press conference.

Conversely, doing the opposite of any of the above three moves, or even simply ambiguous, noncommittal comments, should send the USD down and the EURUSD higher.

Given Yellen’s tendency to err on the dovish side, the odds favor this scenario and thus a EURUSD bounce in the wake of the Fed meeting. Reigning bond deity Jeff Gundlach said in his latest webcast that he’s almost certain Yellen wants to keep rates low for an extended period, because real wages for the bottom seven deciles of wage earners have fallen from 2007-14.

03 Sep. 14 12.33

See here for details.

Even if the Fed is feeling more hawkish, it will likely be extremely careful to avoid shocking markets into anything remotely resembling another selloff in risk assets and rate spike like we saw in last year’s “taper tantrums.” Therefore any hawkish changes should be subtle and accompanied by an emphasis that the actual timing of the first rate hike hasn’t changed, or is only minor, and at any rate is ultimately dependent on US economic data continuing to improve. The question is, will markets take that wording at face value?

Calculated Risk offers a sampling and summary of opinions here.

A hawkish result would pressure stocks and other risk assets and currencies lower, and would likely fuel the uptrend in the USD and at least US interest rates.

Thursday September 18th ECB TLTRO Operation

Meanwhile, as the Fed edges towards tightening, the ECB is starting to activate one of its big new easing moves, the Targeted Long Term Refinancing Operation (TLTRO). Like the earlier LTRO, the idea is to provide low cost loans to EU banks in the hope that they pass on the low rates to businesses and households and spur spending and a rise in inflation back towards normal rates, aiding growth and reducing the deflation threat. The difference with this newer version is that it comes with conditions to better insure that the funds are actually lent out into the real economy as was originally intended.

The whole point of ECB’s recent rate cut was to prepare the way for strong demand for its TLTRO program by making it clear to banks that rates are now as low as they’ll go, thus banks should not wait for lower rates, instead borrow heavily from the ECB now and relend that money quickly. The idea is to offer banks cheap loans on the condition that they use the funds for new loans and also pass on the low borrowing costs, fueling economic expansion and higher prices.

Thus the higher the demand, the better for the EU economy and the less likely it is that there will be further easing any time soon. Thus ironically, this seemingly EUR-dilutive program could actually boost the EUR as traders anticipate less future easing and perhaps a smaller ABS program.

Although there are other economic reports next week that could move the pair, the above two events are the big ones, as central bank policy remains the prime driver for asset markets worldwide

September 18th Scottish Independence Referendum

As long as polls stay close, markets in general, and particularly UK indexes and the GBP, will be under some pressure.

The economic damage would be high for both Scotland and what’s left of the UK, so most expect the referendum to fail, and see a bounce in UK stocks and especially in the GBP.

Although a yes vote would likely bring the opposite result, the vote is still too close to call, as matters of national independence and pride can override economic interests. Felix Salmon has a good post hereexplaining why Scots might well accept the economic harm and vote in favor of independence.

The threat of Scottish independence is somehow seen as raising the risk of other European succession movements like that of Catalonia in Spain, so markets in general, particularly in Europe, could also be expected to suffer.

We expect a no vote, and subsequent bounce in the GBP. The question is whether the EUR or USD suffers more from that sudden demand for the GBP.

We note we could see the most volatility this week in the forex markets, as all of the above events should directly influence at least one major currency. The Fed and ECB events obviously are huge for both the USD and EUR. Remember, a strengthening in one of these almost always brings a weakening in the other, so ECB and Fed policy changes are usually equally significant for both the EUR and USD, as if the two were mutually controlled by both central banks.

While there’s lots more to cover, I’m a bit under the weather, and so will cut this short here, concluding with a rundown of other events worth monitoring this week.

Fundamental Outlook 2: Top Calendar Events To Monitor This Week

Beyond those mentioned above, here are the most likely scheduled events that could move most asset markets

Monday

US: Empire state mfg index, capacity utilization rate, industrial production

Tuesday

EU: German ZEW sentiment report, EU ZEW report

US: PPI, TIC long term purchases

Wednesday

EU: Final CPI

US: CPI, FOMC Meeting, rate statement, forecasts, press conference

Thursday

EU: ECB TLTRO operation launch

US: Building permits, weekly new jobless claims, Fed Chair Yellen speech, Philly Fed mfg index

UK: Scottish independence vote

The above is for informational purposes only, responsibility for all trading or investing decisions lies solely with the reader.