Why Chanticleer Holdings Could Rise 150% Within Weeks

- Chanticleer is an exclusive owner of the very valuable Hooters brand and other high potential restaurant chains

- Chanticleer is growing >100% annually

- Chanticleer is dramatically undervalued compared to peers

- Small restaurant stocks have the potential to soar tremendously

- Multi-year low share price provides excellent entry point

I recently initiated a long position in Chanticleer Holdings (HOTR), an undiscovered holding company that is exclusively invested in fast-growing and high potential restaurant chains like the iconic Hooters brand.

Picture this: This NASDAQ stock is growing exponantially, will have an annual revenue of $36 million based on latest quarter, is on the verge of profitability, yet it's current valuation is just $15 million? Yes it is. Welcome to Wall Street. Even though the stock market is nowadays considered to be fully valued, there are always ridiculously mis-priced small cap stocks to be found providing you a great opportunity to make money.

About the company

Chanticleer Holdings was founded in 1999 and owns and operates Hooters franchises in the United States and internationally. It also holds exclusive franchise and development rights in various locations in South Africa, Brazil, Australia, and Europe. In addition, the company owns and operates American Roadside Burgers that focuses on American food menu offerings; Just Fresh, a casual dining concept; and Spoon Bar & Kitchen, a fine dining seafood restaurant in Dallas, Texas. Management is rolling out a rapid growth strategy of expanding these brands in US and emerging markets through franchising, partnerships and/or acquisitions of highly experienced operators with aligned interests. Based on this year quarter-to-quarter growth in revenue, Chanticleer appears to be exactly on the right track.

Chanticleer is growing massively

The financial statements clearly show how fast Chanticleer is already growing. Check out the most recent revenue numbers:

Q3 2013: $1.6 million

Q4 2013: $3.3 million

Q1 2014: $5.8 million

Q2 2014: $6.9 million

Q3 2014: $9.0 million

And the increase in restaurant holdings:

2011: 3

2012: 6

2013: 18

2014: 26

Chanticleer's major expansion strategy

Chanticleer has 4 different fast-growing chains/brands in its portfolio:

Number 1: Hooters

Hooters is a world famous brand, and has especially great potential in the emerging markets. What’s more, it’s still growing in mature markets, so you can imagine what the possibilities are in say South Africa, India, Brazil and other nations.

Chanticleer has an equity stake in the privately held group, Hooters of America. Let me reiterate the interesting part: Chanticleer owns the exclusive rights to commercialize Hooters in South Africa, Hungary, United Kingdom, and parts of Brazil. The company also has a majority stake in Hooters Australia. So besides a direct equity stake, Chanticleer is also a franchisee of domestic and international Hooters locations. Currently the company has opened locations in South Africa, Australia and Brazil. A Hooters joint draws in approximately $2 million in annual revenue, and management expects the territories to have a market opportunity of at least 75 restaurants, equating to $150 million in annual revenue potential (Chanticleer's total current trailing annual revenue is $17 million). The upside is very large.

Number 2: Just Fresh

Next to Hooters, Chanticleer also has a majority interest in Just Fresh, getting a piece of the pie of the health food trend. The restaurants are currently based in the US only, but Chanticleer has plans to introduce this brand abroad.

Number 3: American Roadside Burgers

One of Chanticleer’s largest investments is American Roadside Burgers, amounting to a $3.6 million equity stake.

If you think the burger market is saturated, you’re dead wrong. American Roadside Burgers operates in the so-called better burger trend, a fast-growing niche of the $80 billion burger market. It's a global trend. I live in Amsterdam, and new better burger bars are opening every month. I visited Barcelona and Brussels in the past 2 months, same thing happening in those places. The first wave of American cuisine going around the world were the mediocre McDonalds and Burger King joints, but this time, people are lining up for real good fast food.

Their CEO, Mike Pruitt, stated:

“….We believe that acquiring American Roadside at this stage of their development presents Chanticleer a strategic opportunity to participate in a high-growth space with an already established brand. We plan to continue to expand the American Roadside chain as future opportunities occur as well as continue on our development of Hooters restaurants internationally…”

Number 4: Spoon, Bar & Kitchen.

Chanticleer’s latest acquisition is the one-unit fine-dining Spoon Bar & Kitchen in Dallas. This is an upscale sea food restaurant, and management has plans to turn the brand into a fast casual concept and begin expansion soon. It already has been championed as the best new restaurant in Texas. So it holds a lot of promise, and 2015 should be the year for more openings.

In short, Chanticleer seems to be on the verge of major expansion. I believe it is probable that the number of restaurant units will about triple within a few years, both domestic and global, and I like the fact that Chanticleer is not betting on just 1 horse, but has multiple shots on goal.

Key financials

Due to the primary focus on rapidly expanding the business, Chanticleer is fully invested, but the company expects to be profitable by the end of this year. Thanks to a few recent non-dilutive cash injections, Chanticleer should be able to finance its operations until it fetches a net profit. The balance sheets shows the assets outweigh the liabilities by a factor 2. The CEO told me they do not plan to initiate a dilutive equity raise as long as the share price stays so low.

Chanticleer is dramatically undervalued compared to peers

Let’s look at the valuation side of the story. Chanticleer has a miniscule market cap of $15 million, and if you consider what they already own - which is expanding by the month - this valuation seems oddly low. But how does it stack up versus its peers?

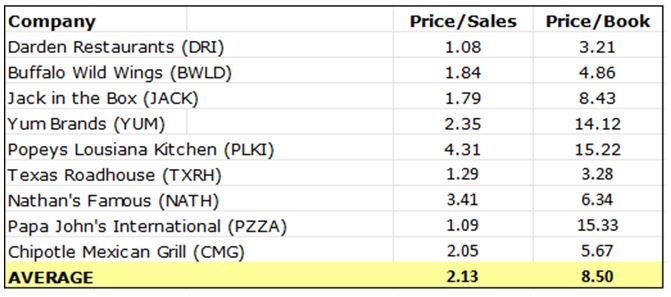

An overview of 9 peer companies:

Chanticleer price/sales ratio of 0.71 and price/book of 0.87 are significantly lower than the industry average, which should make clear how big the mis-pricing is, especially considering Chanticleer’s high revenue growth. If Chanticleer’s valuation would be on par with the rest, the share price should be $5 instead of today’s $2.

Enormous upside

Given how things are going, I project Chanticleer to continue to add restaurants to its portfolio. Let’s see how than translates to shareholder value. Bases on the most recent financial statements, I apply an average revenue per restaurant of $1.4 million, assume the outstanding shares total remains the same and assume the company will be profitable either this quarter or in Q1 2015. I apply 2 factors to determine the valuation: price/sales multiple and the number of restaurants.

Let’s do a scenario analysis:

Very conservative scenario: No growth in restaurant locations and a price/sales multiple of just 1, exactly as it is today. That makes a $36 million annual revenue (based on proved Q3 revenue numbers), and thus a $36 million market cap. That equates to a $5.40, or 150% higher share price.

Conservative scenario: Mild 20% growth in restaurant locations and a price/sales multiple of 1.5, still below industry average (the higher the growth, the higher the price/sales multiple should be). That makes a $44 million annual revenue, and thus a $66 million market cap. That equates to a $10.00, or 400% higher share price.

Neutral scenario: A projected 40% growth in restaurant locations and a price/sales multiple of 2, similar to the industry average (fair value). That makes a $50 million annual revenue, and thus a $100 million market cap. That equates to a $16.00, or 650% higher share price.

Optimistic scenario: A 50% growth in restaurant locations and a price/sales multiple of 3, higher than industry average because of this growth. That makes a $54 million annual revenue, and thus a $162 million market cap. That equates to a $27.00, or 1100% higher share price.

Very optimistic scenario: A strong 60% growth in restaurant locations and a price/sales multiple of 4, twice the industry average because of the strong growth. That makes a $58 million annual revenue, and thus a $232 million market cap. That equates to a $38.00, or 1500% higher share price.

Even in the most conservative scenario - no extra restaurant locations and a 50% discount in valuation to industry average - share price should be aboven $5 right now. This should make you wonder how undervalued Chanticleer is today, and how big the upside is from today’s $2 share price. Chanticleer’s share price has been trading at $5 for a long time, so I would not be surprised if that would be the first base to take. The most optimistic scenario foresees a 15X return. Weighing the odds, I expect the share price to rise 150% quickly, and subsequently a ten-bagger performance if management keeps executing. Either way, this basic valuation model demonstrates what a bargain this stock is.

Insiders haven’t sold shares for years, but did buy

According to the SEC form 4, the insiders have not sold a single share for years. This is a very important factor. You do not want insiders selling shares, when the company is embarking on a massive expansion. You do want them buying shares, and that is what they did do this year.

The CEO, Mike Pruitt, has personally invested $1.1 million, and 4 other major shareholders are in for the long-term.

Chanticleer could repeat other restaurants stock’s home-run performances

Not many investors know that small restaurant stocks have the potential to soar tremendously. For example, Alsea is just like Chanticleer a multi-brand holding company. It also started with just a few restaurants in its portfolio, and the share price was in 2010 priced at $3. Management executed, just like Chanticleer’s management is doing right now, a rapid growth strategy by bringing American cuisine abroad in any way possible (franchising, acquisition, etc). A couple years later, shares hit $47: a true home-run. Another example: Domino’s Pizza (DPZ). Similar formula, shares ballooned from $5 to $70. And what about Chipotle (CMG)? An astronomical 1000% rise in 4 years.

Could Chanticleer pull off a similar performance? That could be, but think about this: even if Chanticleer’s strategy would turn out to be a partial success story, shares could still easily triple. That’s what I like about this stock, the market cap is just so incredibly low, no success is priced in at all. The flimsiest positive news announcement alone, or this article, could boost the share price significantly higher.

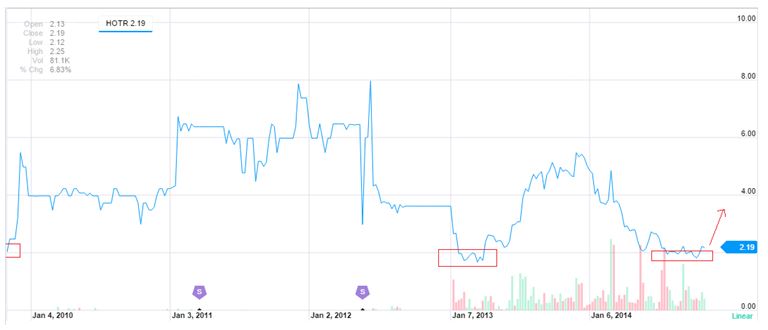

Chart confirms buying opportunity

This 5-year chart clearly shows that $2 is a tested technical bottom. It also shows the stock has been trading a substantially higher prices before for most of the time, when the outlook was less bright then today. If management executes well, shares could provide a multi-bagger return, while downside risk, from a technical perspective, appears to be minimal. Another strong indicator the stock has reached its bottom is that the global market rout a few weeks back did not push shares lower. Buying stocks at such strong technical bottoms often make up for a great trade.

Downside risk

Although the diversified portfolio of holdings, strong revenue growth and unfair low valuation reduce downside risk, there are a few company-specific risks you should be aware of.

The biggest challenge for management is keep the company in a rapid-growth state, with 4 different restaurant chains in its portfolio. Management has to deliver, now perhaps more than ever.

Also, Chanticleer has to do some debt repayments from time to time, like any other company has to do with debt on the balance sheet. From my understanding, they will account for this by initiating a non-dilutive refinancing of the debt or tapping into the line of credit they already have, like they have been doing successfully in the past. But then again, management expects a net profit this very quarter, so they can fully repay all debt next year.

Lastly, while management has no intentions of diluting shares at this low level, they could be tempted to do so if the stock price is considerably higher, but investors at today’s prices will have realized significant gains by that point.

You can study the most recent SEC filing here.

Summary

Chanticleer has all the features for a near-term multi-bagger run. The share price is at a strong multi-year low technical bottom, the valuation is drastically lower than the industry average, and the rapid growth strategy management has initiated last year provides a enormous upside case for shareholders. Today’s $15 million market cap is absurdly low by any means, and I expect shares to rise 150% quickly, and more in 2015.

Disclosure: The author is long HOTR.

The Q3 earnings reveals why the share price didnt jump on the volume spike. Apparently, warrants at high strike prices got re-priced at $2, and about 180k were converted. That explains.

Further, revenue was even higher than expected. Also, the debt repayments are postponed to 2015, that's positive. Key thing now is that they need to report a profit within 6 months.

I really enjoyed this article and did buy HOTR based on it. But the 150% increase failed to materialize... in fact the stock went down. So my question for Mr. Lahiri is, do you have an update to this article? Do you still feel the stock will increase, but needs more time?

Despite a 15X volume, share price stayed flat. Apparently, a big seller got out, but I don't know who that might be. I asked the CEO, he didn't know it either. So that delayed the increase, and yes I believe it just needs some more time. Earnings are on 14th, and I'm holding. Thank you for the feedback.

Thanks, would love to read a follow up by you some time soon. Though I'm disappointed, I think your initial analysis still holds true and I haven't given up hope that we'll see a marked increase soon.

After doing a bit more research, this sounds like a sweet investment idea! My thanks to the author. I'm following you know.

This is an intriguing investment idea, but I don't want to get caught up in the hype or tempted by something too good to be true. How can anyone ever claim a stock will likely increase by 150%. A bit sensationalist now? I'd like a bit more convincing. I'll keep an eye on the stock and if I'm wrong... well it's always better to be safe than sorry.

The question is, at the current price, can you risk not investing? There is always a chance the price will go down, but the stock is at a such a low price now... there is far more upside than down. You can certainly afford at least a minor investment. Diversification is key.

Yes there's some risk here, but the upside is huge. The stock did do over 100% between September and October of this year. And I think it will go even higher.

Mr. Lahiri, I appreciate your time in sharing your analysis. But I have serious concerns about this stock and would like better understand how you can make such a recommendation.

Do you think it makes sense to buy a company because it claims to be growing exponentially when:

1) it has essentially no cash and lots of the debt

2) no earnings, only losses

3) it does not have enough money to fund the next year, so will need more money

4) management has already been sued for failing to make SEC disclosure requirements and for stating that results were audited when they were not

So how does this sound like a good investment to you? Can you please address my concerns?

Thank you for reading my analysis. The growth in revenue stems for the SEC filings. They are executing an aggressive growth strategy, in which they can switch to profitability any time now. It's about the economies of scale in the restaurant business. They have a line of credit, and the CEO is heavily invested himself. The key is that they now need to make sure they keep growing while generating a net cash inflow. It will be a home-run if they do. It's all about the risk vs. reward at the end.

Thanks for taking the time to reply.

It looks like a penny stock to me. Management has been involved in a lawsuit for failure to disclose lack of auditing of it's financial results in S. Africa (yes, they settled, but that the fact that there even was a lawsuit is troubling).

Also the key stats look terrible: finance.yahoo.com/q/ks?s=HOTR+Key+Statistics. Why would I want to take this sort of a risk?

I think Mr. Lahiri has made an excellent case. I'm convinced. Plus I can't find any other analysts on the web saying anything contradictory here. I'm buying.

Isn't there a class action lawsuit against this company for unscrupulous business practices? Sounds like a risky investment.

Nah, that lawsuit is over.

While I'm certainly no fan of Hooters, you make a compelling case for this stock. I will add it to my portfolio.

Loading comments, please wait...