Understanding Long End Inversion

I have seen a certain amount of chatter about inversions of the long end (or ultra-long end) of the Treasury curve. I do not have enough information to offer definitive conclusions on recent market action, but in the article I explain why I view a 20-/30-year inversion as not comparable to a 2-/10-year inversion.

Image Source: Pixabay

Terminology Clarification

The first thing to note is that I use the terms “term premium” and “technical factors” in a fashion that is consistent with market practitioners, and not academics in finance and economics.

Using my terminology, we can decompose an observed bond yield as:

Bond yield = expected path of overnight funding cost + term premium + technical factors.

Academics decompose into two terms.

Bond yield = expected path of overnight funding cost + term premium.

The problem with the academics’ version is that it lumps in all deviations from the expected path into the “term premium” — including other factors that are quantifiable.

For example, imagine that some tax change caused bond yields at the 20+ maturity range to rise by 20 basis points. Under the academics’ definition, the “term premium” rose by 20 basis points. From my perspective, that was a new technical factor, and is independent of the premium demanded for taking duration risk — which is the usual interpretation of “term premium.” Academics might argue that such directly quantifiable factors should be first removed from pricing before extracting curves, but what about factors that have a “fuzzier” effect on yields?

Since this article discussed “technical factors” that affect observed yields, this difference in point of view needs to be kept in mind.

Another terminology point: when I write “duration,” I mean the modified duration (or adjusted duration), and not the Macaulay duration (which is the weighted average maturity of a bond’s cash flows).

Why Would the 30-Year Yield Be Lower than the 20-Year Yield?

If we ignored technical factors, it seems unusual that the 30-year yield (TYX) would be lower than the 20-year (TLT): why would the market discount rate cuts starting 20-years in the future? Even though I am rate expectations zealot, I do not think that is the correct interpretation. Instead, we need to look at what I term “technical factors.”

I will divide this analysis into five main areas: term premium, issuance strategy, liquidity, “duration demand,” and convexity. The convexity factor is one that is the least obvious to people who are unfamiliar with bond markets, but I will deal with the more familiar ones first.

Term Premium

If we use my definition of the term premium as being solely the extra premium demanded to take duration risk, it is not entirely clear what the shape of the ultra-long premium should be. Once you are out at the 20 year maturity, why is going to 30 years riskier? This is quite different than looking at overnight duration versus six months, etc.

If we wanted to come up with a different price of risk for the 20-year versus the 30-year, we run into the factors that come up in later sections of the article.

Issuance

The reason why we expect rate expectations to hold is not solely because of the leveraged arbitrageurs that infest the fantasy world of academic finance, it is also because real money investors can slide allocations between instruments (using the fair values that a leveraged investor would use).

This relies on the instruments being in some sense fungible. For something like a 5-year government bond, it is easy to source a similar duration package using corporate, mortgage, or sub-sovereign paper. This is not true for a 30-year central government bond: there are no reliable private sector borrowers with non-callable debt, and things like regulated utilities and sub-sovereigns disappear into “buy and hold” portfolios and so we cannot hope to trade out of them without a severe transaction cost.

This means that for nominal bonds, the longer you go from a 10-year maturity, the more the “monopoly” on “duration supply” grows. (The central government is the de facto monopoly supplier of inflation protection if you want to extend to linker markets.) This means that issuance strategy can create a downward sloping term premium — or upward sloping if they exceed segmented demand for such paper.

Liquidity

Liquidity is a term that means different things to different people. Is the amount of trading? Is it the ability to transact in size without moving prices? As the various flash crashes associated with high frequency trading show, there can be lots of trading but no ability to absorb large net flows.

In this case, I lump a number of effects under “liquidity.”

- Funding costs. If we look at the arbitrage relationships that are behind rate expectations, it is not the policy rate that matters — it is the funding cost for an instrument. For Treasury securities, that is the repo rate. One can either fund at the general collateral rate, or at a “special” rate, either overnight or for a longer term. If a bond is trading “special” in repo, its fair value is lower. The change is the lifetime “special repo return value” of a bond divided by the duration of the bond. For long duration instruments, this is normally not too valuable.

- Bid/offer spreads. If one bond has a wider bid/offer spread than another, that gap should show up in the yield as compensation. You cannot expect to hold instruments to maturity. How an investor values this will vary, but one would expect that the “average” value of this should show up in observed bond yields.

- Market impact. Much harder to observe than bid/offer spreads, but can be viewed as the effective bid-offer spread for large size trade. Since entities with large balance sheets dominate fixed income trading, bonds should be priced to match their needs.

- Futures cheapest-to-deliver. Being the cheapest-to-deliver in a futures basket makes a bond more attractive.

Historically, the 30-year was more “liquid” under these measures than the 20-year for most markets, and so this can give the 30-year a premium.

Duration Demand

Real money portfolios are dominated by entities that need to match actuarial liabilities (pensions, insurance). Government bonds are universally hated by asset allocators, but they need to match their liabilities. The longer the maturity of bond you buy, the greater the dollar value of a basis point (DV01) of the portfolio. So unless you are bearish on risk assets, the tendency is to lengthen the maturity of instruments so that you can reduce your government bond allocation and buy serious stuff like SPACs or crypto.

Convexity

The previous points were an intuitive but not exhaustive list of what I see as “technical factors” that affect ultra-long yields. However, there is another effect that matters: convexity.

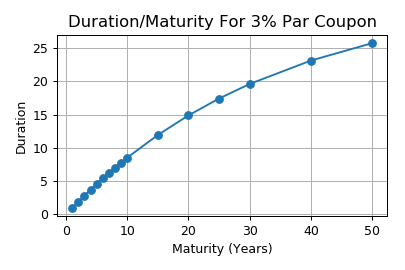

The chart above shows the duration for par coupon bonds with a coupon/yield of 3%. As can be seen, duration increases as a function of maturity. However, it does not increase linearly with maturity.

A bond’s duration is the (negative of the) sensitivity of its price to yields. For example, if a bond a duration of 10, and the yield rises by 1 basis point, a holder of the bond has an immediate capital loss of 10 basis points. However, that is only the sensitivity at the current level of yields: as yields change, the sensitivity also changes.

This second order sensitivity (derivative) of price to yield is known as “convexity” (although convexity has morphed into a catch-all word). The problem I have with convexity is that its units are not intuitive. So I illustrate it with the following figure.

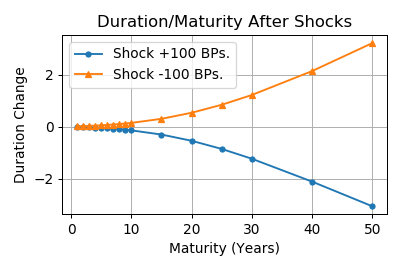

The chart shows the effect of taking our 3% bonds of differing maturities and shocking the yield up and down by 100 basis points (or a yield of 4% or 2%). What is shown is the change in the bonds’ durations from its 3% level (the previous chart).

What we see is that durations fall if yields rose, and durations rise if yields fall, with the change of duration increasing with maturity (in a non-linear fashion). For a bond holder, these changes are a good thing.

- If your duration lengthens as yields fall, you get greater capital gains per basis point of yield reduction.

- If your duration falls as yields rise, your losses per basis point are reduced.

This means that a bond would outperform an (unusual) derivatives contract that has a linear pay off as a function of duration as yields change. Since you are making money off large movements in either direction, one sees that this is behaving similarly to being long a straddle (a put option plus a call option with the same strike).

In other words, if you have two portfolios with the same duration, but one is more convex than the other, the more convex one can be thought of as having an embedded straddle — which is worth something. The analogy between the convexity of the bond and being long options has meant that “convexity” has morphed into a term including the payoff of non-linear instruments like options.

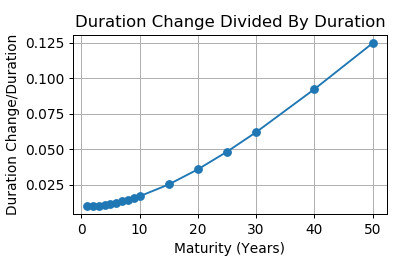

The chart above shows the change in duration (my stand in for convexity) divided by the initial duration of the bond. That is, what is the “convexity per unit of duration” of each maturity? We see that this measure increases a lot as we move past the 10-year maturity.

Although the exact numbers will depend upon the details of the yield curve, the rule of thumb is that the convexity advantages of a long-dated paper kick in as you move past the 20-year. As such, having a hump in the yield curve around the 20-year point is not an accident — you need a very steep curve to iron out the hump that should be there out.

Concluding Remarks

We cannot treat the 20-/30-year slope as being interchangeable with the 2-/10-year slope, unlike other slopes at the front of the curve (e.g., 2-/5-year, etc.).

Disclaimer: Riki nema disclaimer.

Comments

No Thumbs up yet!

No Thumbs up yet!