Are Commodities Waving Red Flags For Stocks?

Worries Not In Short Supply

Are there things to be concerned about? Yes. Europe is weak economically and flirting with deflation, the Fed is on the verge of shifting policy, and recent U.S. economic data has been weaker than expected. Should stockholders add divergences between stocks and commodities to their list?

Recent Example

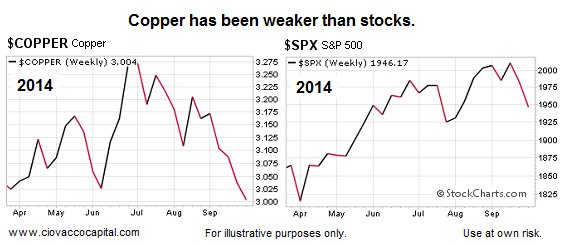

The 2014 charts below show that on a relative basis stocks have been stronger than copper. Many have cited weakness in commodities as a reason to run for the stock market emergency exits. Is it a real concern?

18-Year Divergence

In general terms, divergences between commodities and stocks are not reliable “run for the equity exit” signals. For example, the CRB Index, a diversified basket of commodities, was weak between 1982 and 2000 (top of chart below). Over the same period, stocks did quite well (bottom).

The economy was in decent shape between 1982 and 2000, meaning weak commodity prices can occur in periods of economic expansion.

Investment Implications - The Weight of The Evidence

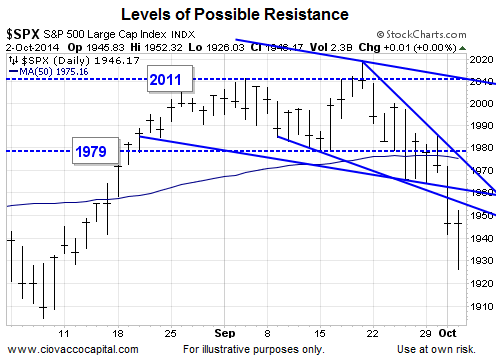

We outlined concerns about stock market vulnerabilities on September 26. Even with Thursday’s intraday rally, the S&P 500 is still down 1.85% this week. Friday brings Wall Street’s greatest over-hyped report; monthly non-farm payrolls. The market remains vulnerable and in “prove it to us” mode. It is not Friday’s employment figures that are important, but rather the market’s reaction to them. If a bullish reaction allows the S&P 500 to recapture 1979, it would be a noteworthy reversal. Below 1979, it is much easier to remain patient with our cash.

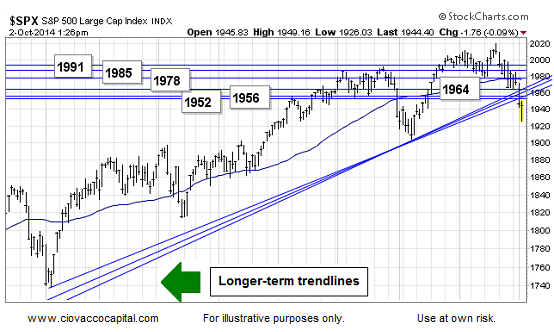

Longer-term forms of possible resistance on the S&P 500 come in between 1952 and 1991 (see chart below). We will enter Friday’s session with a flexible and open mind.

Disclosure: None.