Gold Or Stocks?

We All Have Limited Capital

Since all investment decisions involve opportunity costs, comparing alternatives head-to-head can help with the development of a short list of buy candidates.

Gold vs. S&P 500

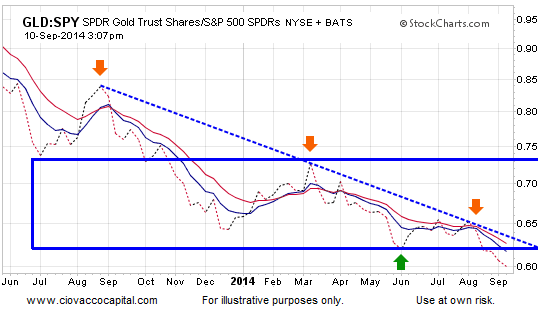

The chart below shows the performance of gold (GLD) relative to the S&P 500 (SPY). When the ratio is falling, as it is now, it tells us gold is underperforming stocks. The ratio continues to make a series of lower highs and lower lows, meaning from an “odds perspective” we prefer to own stocks rather than gold.

Fed And The Yellow Metal

As we noted on September 9, many assets are impacted by the actions of the Fed and movements in the currency markets; gold is no exception. If the Fed raises rates, it tends to be U.S. dollar-friendly. If the dollar is strengthening, then the desire to own currency hedges, such as gold, starts to drop. From Forbes:

Tepid short covering is seen in Comex gold futures after the market hit a three-month low Tuesday. The market place is calmer so far this week, due in part to no major world economic data having been released. Traders and investors are already looking ahead to next week’s U.S. FOMC monetary policy meeting. Things are also quieter on the geopolitical front this week. The Russia-Ukraine cease-fire is holding up.

Investment Implications – The Weight Of The Evidence

Following the September 9 close, we penned the following:

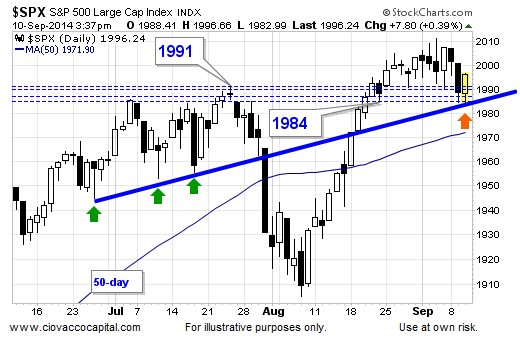

On Tuesday, the S&P 500 closed inside the support band shown in the chart below (1984 to 1991). Therefore, it is too early to get overly concerned about recent weakness in equities. The blue trendline in the chart below has acted as support on numerous occasions (see green arrows). The S&P 500 bounced near the blue trendline Tuesday (see orange arrow), meaning buyers stepped in at a logical level.

Below is an updated version of the chart shown on September 9. During Wednesday’s session, the S&P 500 once again bounced off the blue trendline, telling us to exercise some patience with our positions in U.S. stocks (SPY) and leading sectors, such as technology (XLK). With two trading days left in the weekly bull/bear battle, we will enter Thursday’s session with a flexible and open mind.

Gold coin image from Evan Bench via Flickr creative commons.

Disclosure: None.