Energy: A Double-Edged Sword For Markets

Light Economic Calendar

With little in the way of market moving announcements Monday, traders tended to focus on changes in the energy markets. From The Wall Street Journal:

Oil futures shed 0.7% to $92.66 a barrel, their lowest price since January, amid concerns that demand isn’t keeping pace with booming supply. The pullback knocked shares of energy companies.

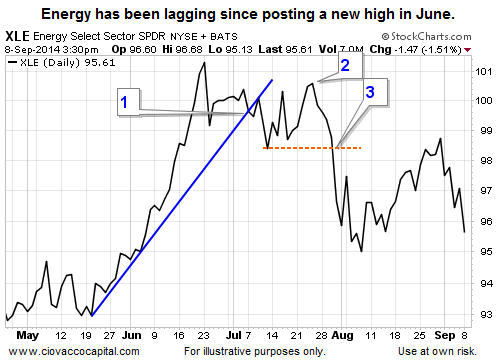

Late in Monday’s session, the Energy Select Sector SPDR ETF (XLE) was down 1.51%. Energy recently completed all three steps for a change in trend. A good baby step for XLE would be to retake $99.00.

Are Equity Red Flags Starting To Wave?

In order to gain a better understanding of the current investment landscape, this week’s video compares 2014 to 1987, 1998, 2002, 2003, 2008, and 2009.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Doubled-Edged Sword

Lower oil prices can be good news for consumers. However, if oil prices remain depressed it eventually starts to impact the earnings of energy companies. News out of China contributed to oil’s pullback Monday. From Reuters:

China’s import growth unexpectedly fell for the second consecutive month in August, posting its worst performance in over a year and stoking speculation about whether authorities should loosen policy further to revive domestic demand.

Investment Implications – The Weight Of The Evidence

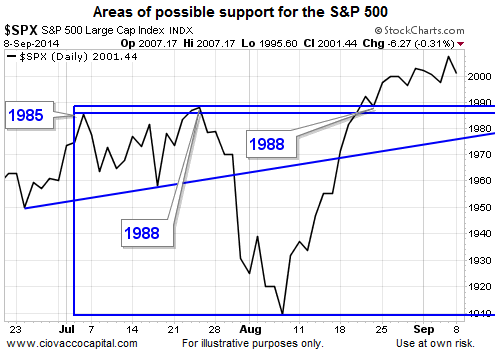

Monday’s session did little to impact the intermediate-term outlook for stocks. Therefore, we continue to hold an equity-heavy portfolio with U.S. stocks (SPY), leading sectors (XLK), along with a relatively small stake in U.S. Treasuries (TLT). Stock market bears would prefer to see a push below 1985 on the S&P 500.