TGIF - Stop The Rally, We Want To Get Off!

Enough already!

Enough already!

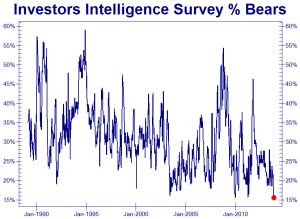

Look at that chart (to the right, Zero Hedge). There are only 15% of us (bears) left but still the media attacks us - why? What are they afraid of? Why do Central Banksters Bernanke, Draghi and Kuroda all feel the need to say "What bubble?" in the same week? As a parent, I know when my kids deny something too much it's a lot more likely that they KNOW they did a bad, bad thing...

Anyway, I am not a bear, I am a Fundamental Investor who doesn't see anything worth buying BECAUSE IT'S TOO FRIGGIN' EXPENSIVE! Is that bearish?

Once upon a time looking at valuations used to be called rational. And it's not like there's nothing to buy. Yesterday, in our fabulous Webinar, we found bullish plays we liked for ABX, FTR and DBA.

So, gold, communications and food are out of favor enough to be relative bargains in this runaway market. They have real earnings that are hard to extrapolate to infinity.

Infinity and beyond is where this market is projected to go as the Yellen Fed promises to be even more dovish than the Bernanke Fed. The chart by STAWealth (below) predicts S&P 2,200 in 2015 at a cost of "only" $2Tn more Dollars on the Fed's balance sheet. Lance Roberts of STA Wealth Management writes, "While this chart is likely to excite the 'bulls,' it also brings two very fundamental issues into question. The first is valuations... Barring any exogenous shock, and assuming that current reported earnings estimates actually occur, the S&P 500 will be sporting a P/E ratio of 21.17x in 2015."

As to the $2Tn more Dollars on the Fed's balance sheet, thank goodness we never have to pay that back and... what? Oh, we do?

Well, at least we have a robust US economy that's creating millions of jobs that will drive our GDP higher faster than the Fed and the Government drive our debt to infinity.... what? We don't? Son of a bitch!

(Next two charts by Lance Roberts of STA Wealth Management)

Well, jobs aren't everything, are they? They're highly overrated economic indicators of a bygone era where people mattered. Fortunately, our economy is in a new paradigm that can motor on without any actual workers doing work or earning incomes... what? No new paradigm?

Well, at least we know housing is turning around... what? Oh come on! (Chart below by Zero Hedge.)

And only 15% of you (and falling) believe this data may indicate an underlying problem? Really?

Well, just like you don't want to be 100% bullish on the way up, you don't want to be 100% bearish and that's why in weekend Chat, I suggested the DDM (ultra-long Dow) Dec $102/110 bull call spread at $4.50 with $3.50 of potential upside (78%) if the Dow "even twitches higher." Twitch it did and DDM is now $107.33 with the Dow at 16,009 and the $102 calls are $7 and the $110 calls are $.85 for net $6.15 on the spread already - up 36% in 4 days!

See, you don't have to be mindlessly bullish to make money in this market, even the mindfully bearish can take a few bullish pokes. Face it, we're in a market that is so fake that even Charles Schwab himself is telling people it's manipulated (4:30).

Still, as Schwab notes, it's the only game in town so we continue to play it with caution. I like cash going into the pre-holiday weekend and I'd rather enjoy next week with my family, watching from the sidelines, than sweat over this crazy market on what's likely to be a very low-volume affair. It's not likely we head lower next week. It's the first week of December I'm really concerned about but then it's Santa Rally time so why not keep ourselves flexible when we can always bet the Dow goes higher - especially if it has that 16,000 line to hold the downside.

If that line does fail - well, then we'll be glad we cashed out, right?

Have a great weekend,

- Phil

The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Philstockworld, LLC (PSW) nor ...

more