Yearly Cycle In Equities Running On Fumes

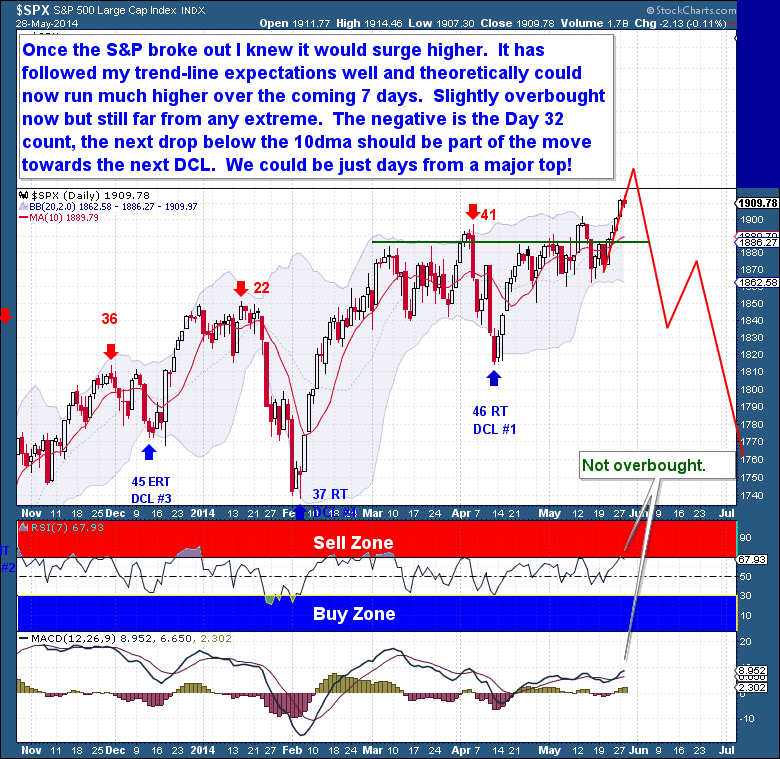

I covered this exact scenario within the weekend report. Now that the S&P has broken out of its long established trading range, there is just no telling how far, or for how long, this move will last. But we’re into a Yearly Cycle still running on fumes, it could not possibly have much "left in the tank". For now, the move is following my expected “breakout” pattern well, but from here on out, anything really is possible, from a sudden top or to all the way to a powerful 7 day move that tests 2,000!

The reality is that the S&P is only slightly overbought in the short term and nowhere near any of the extreme levels which would automatically topple a Cycle. And based on past Investor Cycles, this current rally has the pent up energy of a 10 week consolidation at its back. The only negative (obviously, besides the fundamentals) is the Daily Cycle is on day 32, comfortably into the timing band for a Cycle high.

But a trend is always the dominant force, until it breaks. So as long as this move continues to remain above the 10dma (on a closing basis), then the rally will have my respect. Once the S&P closes below the 10dma, then I will be fairly comfortable in stating that the Daily Cycle is heading towards a Cycle Low. For the many equity bears who read my reports, that coming Cycle high could well be the major Yearly Cycle top we’ve been waiting for.

None.