Final Testing Editor Bugs

The US oil industry is making a fairly quick return following last week’s hurricane activity. At its peak, almost 1.6MMbbls/d of US Gulf of Mexico (GOM) oil production was shut in, which is a little over 84% of total US GOM production. However, the latest data from the Bureau of Safety and Environmental Enforcement (BSEE), reported as of yesterday only 989Mbbls/d of oil production remained shut in. The impact from the shut-ins, along with lower utilisation rates at refiners in the region will be reflected in the EIA weekly numbers on Wednesday.

The spike in US bond yields continues, with the US 30-year Treasury #yield now above 1.55%, up more than 20 basis points in the last couple of trading days. pic.twitter.com/HBwxSjkUZl

— jeroen blokland (@jsblokland) August 28, 2020

Initial claims for #unemployment -98k to 1.006mn in w-e Aug15.

— Gregory Daco (@GregDaco) August 27, 2020

> 4wk avg: 1.07mn

> PUA claims (NSA): 608k (+82k)

> Total UI+PUA still 1.43mn (NSA)

> Continuing claims 14.5mn we Aug15

> Total claims 27mn

Improvements over recent weeks encouraging, but levels still concerning pic.twitter.com/actOhoL3S4

The latest monthly data from the EIA shows that US oil production rose 4.2% MoM in June to average 10.44MMbbls/d. This increase reflects producers bringing back production that they shut in over April and May due to the low price environment. However, total output was still down 13.7% YoY. We would have likely seen production continue to grow over July and August as more producers brought back shut-in production. Obviously given the collapse in rig activity in the US, we are not going back to pre-Covid-19 production levels anytime soon. AAPL

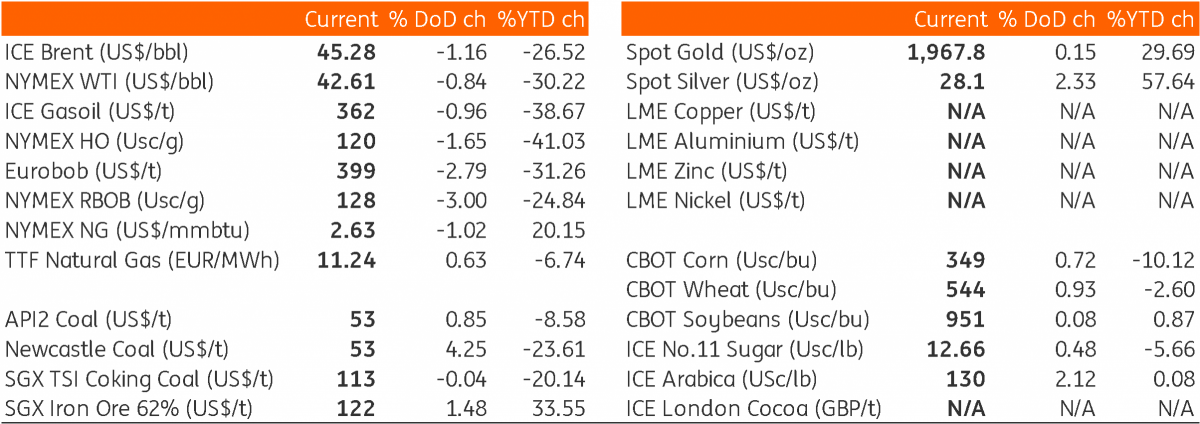

(Click on image to enlarge)

Bureau of Statistics shows that China’s manufacturing PMI expanded for a sixth straight month and stood at 51 in August, not far off market expectations of 51.2. Meanwhile, the latest data from the Shanghai Metals Market shows that treatment charges for imported copper concentrate in China extended their declines, falling to US$50/t on Friday, compared to YTD highs of US$69/t in March.

Disclosure: Copyright ©2009-2014 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more

Hello, it;s me.

No it is you.