Finally Stepping In To Start Buying IShares MSCI Brazil Capped ETF

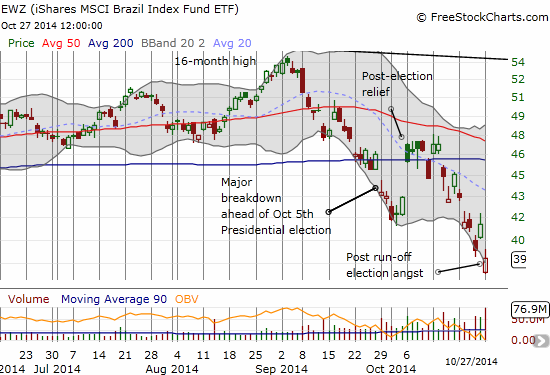

The iShares MSCI Brazil Capped ETF (EWZ) has fallen rapidly from a 16-month high to a retest of 2014 lows in just seven weeks. The 27% loss over this timespan represents a remarkable collapse in sentiment, but the move is quite consistent with EWZ’s downward trek since its post-recession peak in 2010/2011.

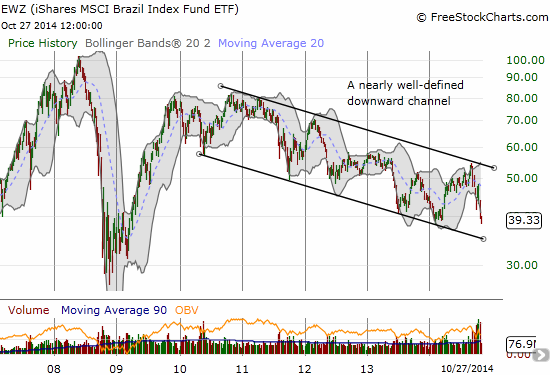

EWZ has been stuck in a downward channel for the majority of this post-recession period

Political drama from Brazil’s presidential election and subsequent run-off have generated extremes in volatility on the way to the plunge toward 2014’s low.

Election-related drama have created very volatile conditions for EWZ

Source for charts: FreeStockCharts.com

When I visited EWZ almost a month ago, EWZ had almost triggered my rule to start buying EWZ on a 20% drop from the most recent high. I argued for putting that rule on hold given the risk of steeper losses. Another 10% drop later with an open near the 2014 low, I decided it was finally time to start buying.

$EWZ challenging 2014 low which would now be around 5 1/2 year low. Time to be a buyer again as risks getting priced in.

— Dr. Duru (@DrDuru) October 27, 2014

There are all sorts of reasons to hate EWZ here.

The Brazilian real has plunged along with EWZ

Source: XE.com

What is there to like?

First of all, I like that the 2014 low actually held throughout the election drama and upon the victory of Rousseff. It is starting to look like a lot of post-election and future economic risks are getting priced into the market. I daresay (short-term?) pessimism has reached a near-climax.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 27, 2014. Click here to read the entire piece.)

Full disclosure: long EWZ