Forex Setup Week (August 10, 2014): Major Trends In Play

Currency markets have been providing some excitement during the past several weeks. Some will ascribe it to lower liquidity, but I think that explanation is too easy. Major adjustments are likely underway in sentiment and positioning, so traders will do well to review charts on at least a weekly basis to assess the bigger picture and storylines…especially when major, longer-term trends at the 200-day moving average (DMA) are involved.

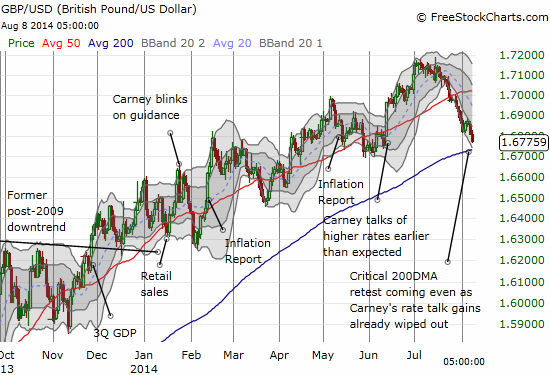

The British pound (FXB) is heading for a critical retest as GBP/USD careens toward its 200-day moving average (DMA).

The British pound continues to reverse against the U.S. dollar with a critical technical test around the corner

I thought the reversal of June's gains would mark the end of the reversal. Instead, the 200-day moving average (DMA) is looking like a more important marker than last week’s manufacturing PMI or interest rate decision from the Bank of England. The pound’s weakness is distributed across all the major currencies I follow. Typically I deal with this situation by reserving one of those currency pairs to make the reverse (hedging) bet against my core positioning. Admittedly, I got caught this time being extra bullish with my bets sprinkled across ALL the major currencies!

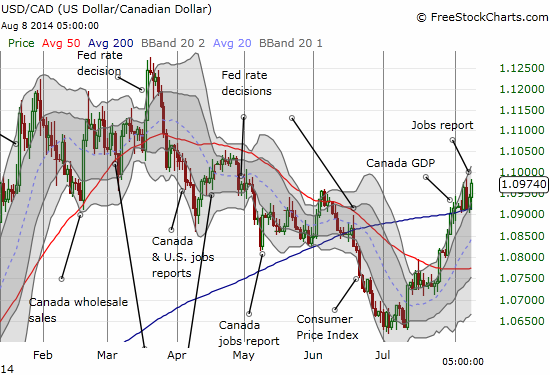

Patience has paid off against the Canadian dollar (FXC) as the U.S. dollar stages a major comeback. Resistance at the 200DMA is quickly melting away against USD/CAD.

The U.S. dollar is on the comeback against the Canadian dollar with a breakout above the 200DMA

I dare not anticipate that my 1.16 upside target will still get tapped by the beginning of 2015 but at least I have taken advantage of the earlier weakness in USD/CAD. I have accumulated a sizeable position that is now working quite well.

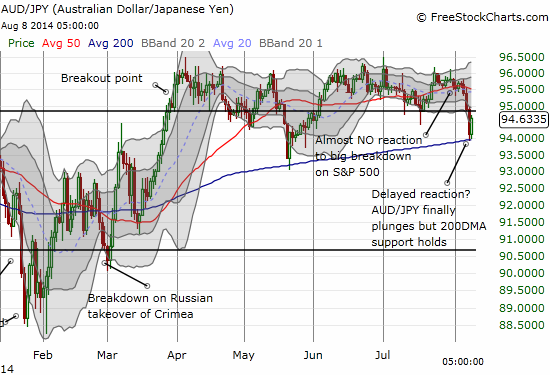

The Australian dollar (FXA) is under pressure again. However, it survived a major test by bouncing off 200DMA support on Friday, August 8th.

The Australian dollar is playing stubborn as it holds support against the Japanese yen

Source for charts: FreeStockCharts.com

I have used AUD/JPY as a pretty good gauge this year of underlying risk attitudes and sentiment. Friday’s bounce is a major confirmation of the bullish divergence that preceded the stock market’s continued bounce from oversold conditions. Until AUD/JPY breaks support here, I have to assume the general bias in the market has turned bullish again.

Be careful out there!

Full disclosure: long the British pound, long USD/CAD, net short the Australian dollar

© Copyright 2011 ONE-TWENTY TWO - All Rights Reserved