Ruble Floats, And Sinks

From Reuters yesterday:

The rouble tumbled on Wednesday after Russia’s central bank effectively abandoned the trading corridor for the currency, halting the multi-billion dollar daily interventions that had propped it up through sanctions and plunging oil revenues.

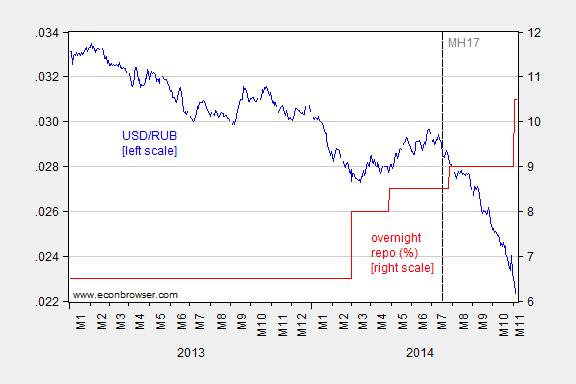

Figure 1 shows the collapse in the ruble, even as the central bank’s overnight repo rate has been raised. The drop occurs as forex intervention is capped at $350 million/day.

Figure 1: USD/RUB exchange rate (blue, left scale), and overnight repo rate, % (red, right scale). Source: Pacific Exchange Service, Central Bank of Russia.

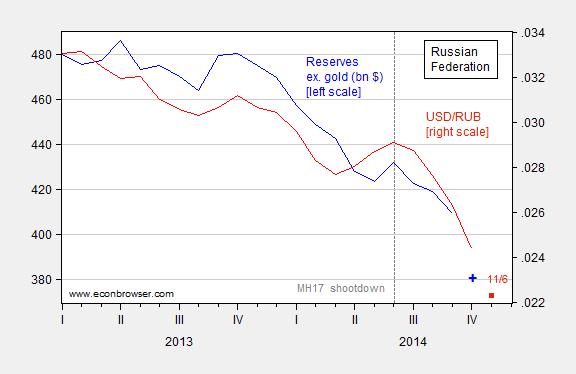

Figure 2 depicts the decline in foreign exchange reserves, as capital outflows have increased and the current account balance has deteriorated. October figures are not out yet. However, press reports indicate $29 billion was spent in forex intervention in October. If the private balance of payments was zero, then reserves ex.-gold would be about 280 billion (indicated by the +).

Figure 2: Russian reserves ex.-gold, in billions, end-of-month (blue, left scale), and USD/RUB exchange rate, monthly averages of daily data (red, right scale). Reserves observation for October 2014 is calculated assuming $29 billion forex intervention in October [1], and private balance of payments equal zero. Exchange rate observation for November is 11/6. Source: Pacific Exchange Service, Central Bank of Russia.

The depreciation of the ruble has already had an effect (along with Russian counter-sanctions). Inflation in the year ending in October was 8.3%, while food price inflation was 11.5% through September.

For more on sanctions and the Russian economy, see this post.

Disclosure: None.