Investing In Shipping Earnings Growth

I’m a big fan anything that could be viewed as a “Leading indicator.” Something that can give me an inside edge that the rest of the market doesn’t have. I know this goes against that whole efficient market thesis but I never liked that thing anyway. Here at Zacks our entire life centers around a ranking system we see as a leading indicator. And rightfully so I believe. 26% average annual return for our Zacks Rank #1 (Strong Buy) stocks versus the market’s average just under 10%. The proof is in the pudding.

Now when I get to combine that edge with another leading indicator like the Baltic Dry Index and then put technical analysis on top of that, I feel like I’m fishing with dynamite. The Baltic Dry Index calculates the cost to ship raw materials in bulk around the world. Basically it’s a daily pulse of the market for shipping and shows us how much dry bulk shippers are getting paid to do business. As a result, it is a leading indicator for the industry.

Quick scrub on our website and you’ll find a host of Zacks Rank #1 (Strong Buy) stocks in the dry bulk shipping industry. Today I picked Paragon Shipping (PRGN) as our Bull of the Day. Look at how the Baltic Dry Index has increased since the beginning of 2013. From a low near 700 the index tripled before coming down early this year. PRGN stock has moved in a similar direction, gaining momentum as price rose from $3 to over $7.

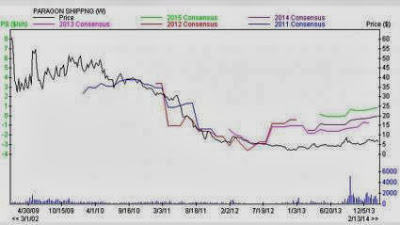

Given the cyclical nature of the BDI, I think we will see another big spike once the weather warms up and shipping kicks up again. This should prove bullish for the stock. Also, take a look at the price and consensus chart. Earnings revisions to the upside recently have helped add momentum. If revisions are right, 2014 could be a banner year for Paragon.

If you look at the technical chart of Paragon Shipping (PRGN) you see there was a big drop recently. Was there horrible news? A CEO scandal? Earnings miss? Nope. They priced a previously announced stock offering down at $6.25 when the stock was trading above $7. This is the greatest thing that could happen to someone bullish on the stock looking for a chance to get it. If you like it above $7, you have to love it down here.

This $6.50-ish price we are at here provides a good entry point given where buying has occurred in the past. This level has been good support several times since it broke below it in September 2013. Usually I would not recommend buying this stock given the technicals. The drop in price due to the announcement serves as a Roger Mathis-sized asterix. Here it throws the chart off a bit. Pulled the stock well below the 25x5 SMA and forced the stochastics into oversold territory. But you should never look a gift horse in the mouth. The story is there, the fundamentals are solid, and the price is right.

I'm not long or short any stocks listed in this article.