Large Cap Best & Worst Report

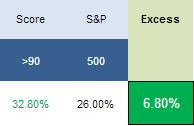

Our top scoring large cap stocks from 1 year ago produced an average 680 bps of excess return to the S&P 500 over the past year. The best performers from our list one year ago are WFT up 71%, GILD up 63%, MGA up 61%, LO up 57%, and NOC up 56%.

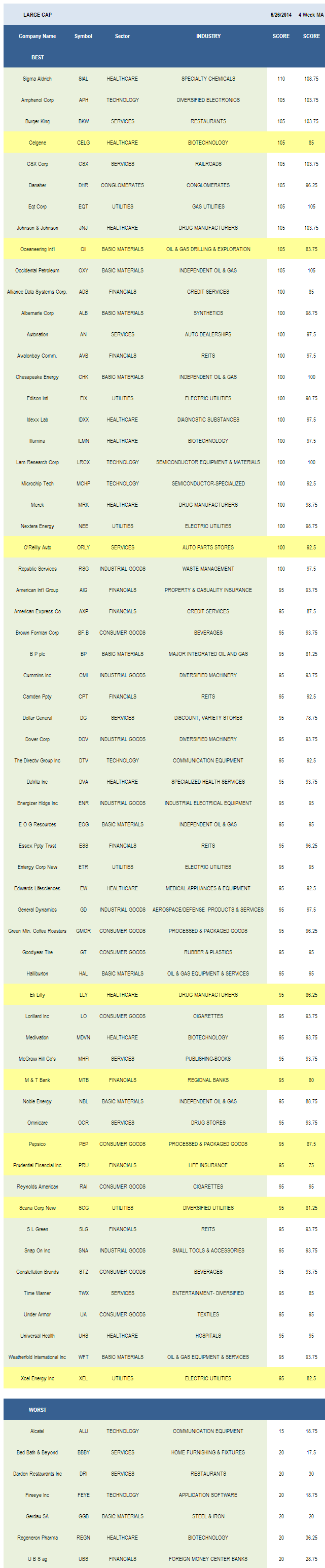

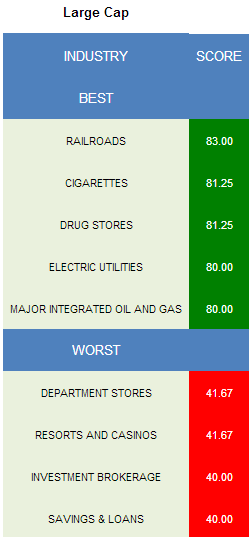

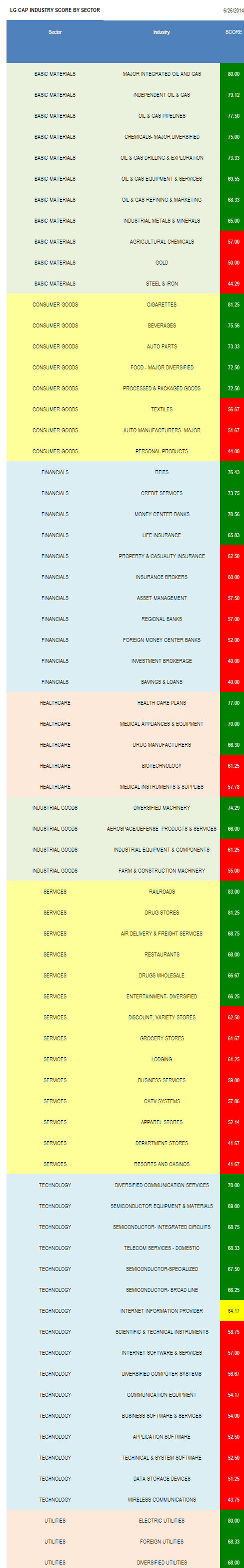

- The top scoring large cap sector is utilities.

- The best scoring large cap industry is railroads.

The average large cap score this week is 63.77, above the four week moving average score of 61.65. The average large cap stock is trading -7.83% below its 52 week high, 5.32% above its 200 dma, has 4.48 days to cover held short, and is expected to post EPS growth of 13.42% next year.

The best large cap sector remains utilities, followed by basic materials and healthcare. Industrial goods, financials, and consumer goods score in line. Technology and services score below average.

The best scoring industry is railroads (CSX, NSC, UNP, KSU). Total rail carload volume is 4.4% higher year-over-year through the first 24 weeks of 2014. Cigarettes (RAI, LO, MO) are high scoring and typically offer solid seasonality in summer as managers de-risk and embrace dividend stability. An improving patent calendar and rising Rx volume tied to healthcare reform support drug stores (OCR, CVS, RAD, WAG). Last week, Rite Aid reported script volume improved 2.3% in the three months ending May versus a year ago, in part due to Medicaid expansion. Today, Walgreen announced that its script volume grew 4.1% year-over-year last quarter.

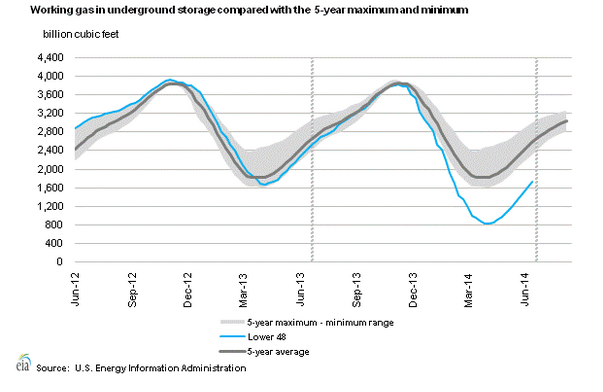

Electricity consumption was 5% higher in Q1 than last year. The EIA forecasts that the average U.S. residential electricity customer will spend 4.9% more this summer (through August) than last year year as consumption grows 1.2% and prices climb 3.7%. Overall, the EIA expects that U.S. electricity prices for residential consumers will average 12.5 cents per kilowatt hour this year, up 3.4% from 2013 (NEE, EIX, XEL, ETR, PPL, NRG). Major oil and integrated gas (BP, XOM, COP) benefit from seasonal tailwinds tied to typical summer global supply instability, growing demand tied to summer driving season, and inventory drawdown of natural gas heading into summer cooling season. Natural gas in storage is currently 33% below the five year average for this time of year.

The top industries across large cap basic materials include major oil & gas, independent oil & gas (OXY, CHK, NBL, EOG, ECA), and pipelines (SE, WMB). In consumer goods, cigarettes, beverages (STZ, BF.B, DPS), and auto parts (TRW, ALV, MGA) score above average. The best financials groups are REITs (AVB, SLG, ESS, CPT, VNO), credit services (ADS, AXP, MCO, DFS, COF), and money center banks (WFC, STI, PNC). Consumer loan and credit card standards continue to ease, supporting loan growth.

In healthcare, buy healthcare plans (WLP, HUM, CI) and medical appliances (EW, MDT, STJ, RMD). Diversified machinery (DOV, CMI, IR) and aerospace/defense (GD, SPR, BEAV) are best in industrials. In services, buy rails, drug stores, and air delivery & freight (CHRW, FDX, EXPD). In technology, focus on diversified communication (AMT), semi equipment (LRCX, AMAT), and semi ICs (TSM, SWKS).

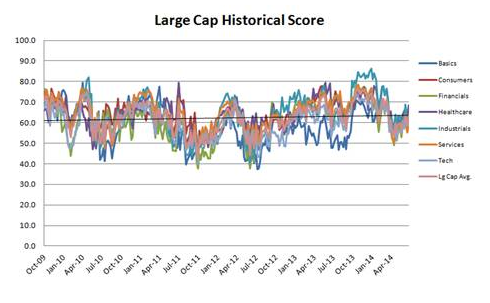

The following chart displays historical large cap scores by sector.

None.