Monday Madness – Anarchy In The Ukraine

Picture source: Dirty Cars and a Million Cows

How long has it been since we worried about that one? For people in the Ukraine, the answer is "when did they leave?" as Russia has always had a major naval base in the Crimean Peninsula and they are securing their "vital interests" which, of course, makes everyone else nervous.

NATO (remember those guys?) is talking sanctions and that sent the Russian Market (RSX) down 11% this morning and the Russian Central Bank had to step in and boost rates from 5.5% to 7% to stem the outflow of money. Russia's economy ($2Tn GDP) is 50% oil and nat gas exports and tensions are a double boost for Putin, who drives up the prices (oil is $104.50, Natural Gas is $4.70 – up $2,000 per contract from Thursday Morning's Pick in the main post). Since oil is priced in Dollars, he gets even more Rubles to play with. Where is his incentive to end the conflict?

Our Futures (7:15) are down about 1% across the board but the Russell is down 1.5%, at 1,164, which is fantastic for us as TZA (ultra-short Russell ETF) is our primary hedge and Friday morning we added this one in our Member Chat Room:

TZA – Well, I'd adjust that now to April $14/17 bull call spread at $1.05, selling $14 puts at .50 for net .55 on the $3 spread. That's nice weekend protection.

As I mentioned in Friday's post, we were worried about the market topping out and we were worried that the "rally" was nothing but weakly supported window dressing into the end of the month and I called for cashing out our bullish short-term positions into the move back to the market tops. Now we'll see if I was right. If it wasn't the Ukraine, it probably would have been something else taking down the markets – it was simply time.

Dave Fry's RSX chart (above) does not include today's 11% drop, that's 2.5x more than Friday's drop – back below that $22 line that held up last May and the October before that. Our markets quickly shrugged off that dip and we're likely to do the same with this one so we're not expecting a huge move down – just a little correction – as long as no one does anything really stupid to escalate things.

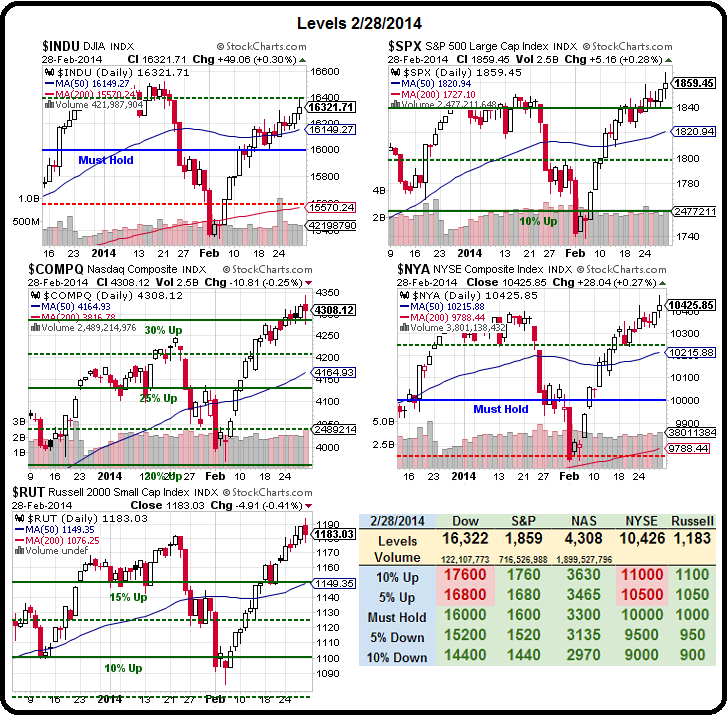

Meanwhile, it's almost time to redraw the lines on our Big Chart — ALMOST:

The problem is, we usually need to see all but two of those red boxes disappear and, stubbornly. The NYSE and the Dow keep refusing to cooperate. It's a very strange situation with the Nasdaq 30% over the Must Hold line and the Russell almost 20% over while our broadest index can't hold a 10% run – but that's how we made money shorting the Nasdaq intraday Friday and the Russell over the weekend – they are the most stretched – so we short them.

Europe has gotten worse as the day has gone on, with France, Italy and Spain dropping 2.5% for the day and Germany and the UK not far behind, with 2% drops of their own. It's 9am now and our Futures are "only" down 1% and, while it's not the end of the world - it's also not likely we can simply shrug off Europe's concerns so easily so we'll be looking for a bit more downside – especially if the Dollar comes off the floor, at 79.88.

It's going to be an interesting week – let's be careful out there.

Click here to try Phil's Stock World FREE!

The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Philstockworld, LLC (PSW) nor ...

more