Silver Wheaton Reports Third Quarter Results For 2014

TSX: SLW

NYSE: SLW

VANCOUVER, Nov. 12, 2014 /PRNewswire/ - Silver Wheaton Corp. ("Silver Wheaton" or the "Company") (TSX:SLW) (NYSE:SLW) is pleased to announce its unaudited results for the third quarter ended September 30, 2014. All figures are presented in United States dollars unless otherwise noted.

THIRD QUARTER HIGHLIGHTS

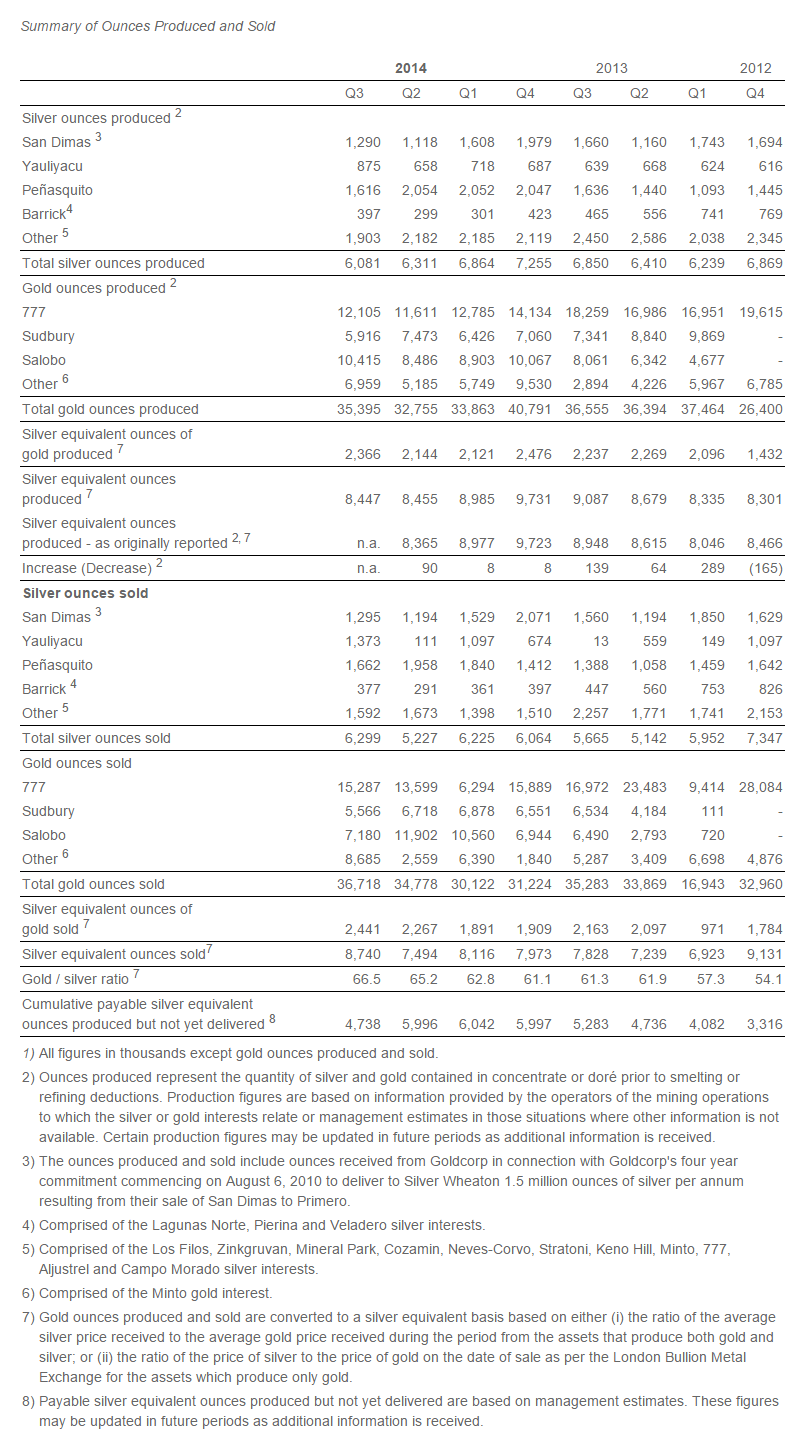

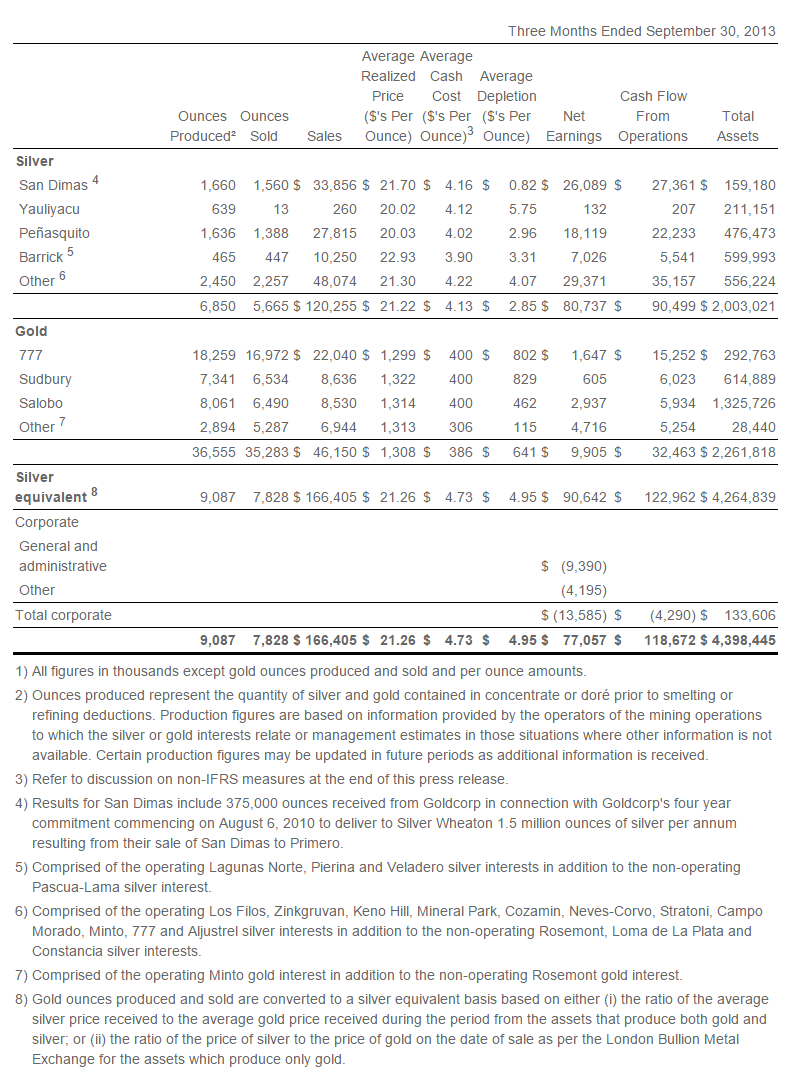

- Attributable silver equivalent production in Q3 2014 of 8.4 million ounces (6.1 million ounces of silver and 35,400 ounces of gold), compared to 9.1 million ounces in Q3 2013, representing a decrease of 7%.

- Attributable silver equivalent sales volume in Q3 2014 of 8.7 million ounces (6.3 million ounces of silver and 36,700 ounces of gold), compared to 7.8 million ounces in Q3 2013, representing an increase of 12%.

- Revenues of $165.9 million in Q3 2014, consistent with the $166.4 million in Q3 2013.

- Average realized sale price per silver equivalent ounce sold in Q3 2014 of $18.98 ($18.98 per ounce of silver and$1,261 per ounce of gold), representing a decrease of 11% as compared to Q3 2013.

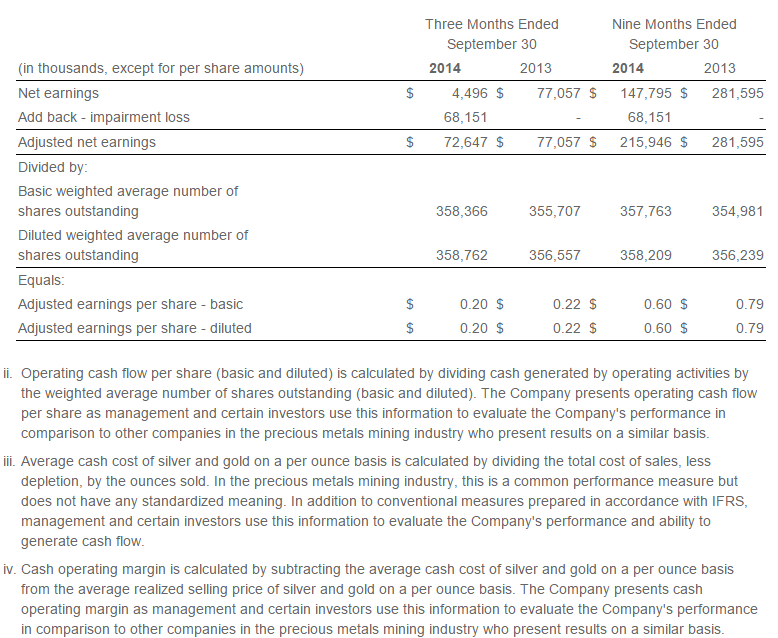

- Adjusted net earnings¹ of $72.6 million ($0.20 per share) in Q3 2014 compared with $77.1 million ($0.22 per share) in Q3 2013, representing a decrease of 6%.

- During the three months ended September 30, 2014, the Company recognized an impairment charge of $68.2 million related to its Mineral Park and Campo Morado silver interests.

- After including the impact of the impairment charge, net earnings was $4.5 million ($0.01 per share) in Q3 2014 compared with $77.1 million ($0.22 per share) in Q3 2013, representing a decrease of 94%.

- Operating cash flows of $120.4 million ($0.34 per share¹) in Q3 2014 compared with $118.7 million ($0.33 per share¹) in Q3 2013, representing an increase of 1%.

- Cash operating margin¹ in Q3 2014 of $14.39 per silver equivalent ounce compared with $16.53 in Q3 2013.

- Average cash costs¹ in Q3 2014 were $4.16 and $378 per ounce of silver and gold, respectively. On a silver equivalent basis, average cash costs¹ decreased to $4.59 compared with $4.73 in Q3 2013.

- Declared quarterly dividend of $0.06 per common share.

- On September 26, 2014 the Company paid $135 million to Hudbay Minerals Inc. ("Hudbay") in satisfaction of the upfront payment relative to the gold stream on the Constancia project through the issuance of 6,112,282 common shares, at an average issuance price of $22.09 per share.

- Asset Highlights:

- Hudbay announced that the Constancia project was approximately 94% complete as of the end of Q3 and remains on track for first concentrate production in Q4.

- Vale S.A.'s ("Vale") Salobo II expansion continued to ramp-up in Q3 resulting in record gold production of 10,415 ounces net to Silver Wheaton.

- As a result of a correction by Goldcorp Inc. ("Goldcorp"), resource estimates at the Peñasquito Mine as ofDecember 31, 2013, increased such that Measured and Indicated Resources increased by 45.26 million ounces to 113.37 million silver ounces and Inferred Resources increased by 4.74 million ounces to 15.04 million silver ounces2.

_____________________________

1 Please refer to non-IFRS measures at the end of this press release.

2 Silver Wheaton's most current attributable reserves and resources, as of December 31, 2013, can be found on the Company's website at www.silverwheaton.com. See "Reserves and Resources".

"The strength of Silver Wheaton's streaming model was once again highlighted in what can only be described as a challenging third quarter for precious metals," said Randy Smallwood , President and Chief Executive Officer of Silver Wheaton. "Despite silver and gold prices falling 19% and 9%, respectively in the quarter, Silver Wheaton continued to generate cash operating margins of over 70% while maintaining one of the highest production levels in the silver industry. Additionally, we saw excellent progress at our key growth assets with record production from Vale's Salobo mine as its expansion continued to ramp up, along with Hudbay's Constancia mine which remains on track for first production in the fourth quarter of 2014."

"While our business model was created to minimize the traditional risks associated with mining, Silver Wheaton is not fully immune to the impact of lower commodity prices. The lower pricing environment recently forced the operators of one of our smaller streams, Mineral Park, to face liquidity issues and subsequent bankruptcy. This event resulted inSilver Wheaton executing a comprehensive review of our entire asset base. As a result, we recognized an impairment charge of $68.2 million relating to the Mineral Park and Campo Morado assets. While this is certainly disappointing, it's important to recognize that these were the only two assets we found to be impaired, both are relatively small contributors to our portfolio, and both assets have generated cash flows well in excess of the original upfront payments."

"On a more upbeat note, Silver Wheaton recently celebrated the ten-year anniversary of streaming, a model we created when we signed the first streaming agreement on the San Dimas Mine in October of 2004. Over its first ten years, the company has grown to have over 20 assets in the portfolio, including cornerstones such as Peñasquito, Salobo, and San Dimas. Furthermore, our streaming model has been adopted across the industry and is now recognized as a valuable way for traditional mining companies to raise funds and crystalize the value of their non-core precious metal production. As far as performance, in its first ten years, Silver Wheaton's share price has climbed over 500%, while silver has risen just under 140%. We are proud of the value we have created over our first ten years, and look forward to further opportunities over the next ten!"

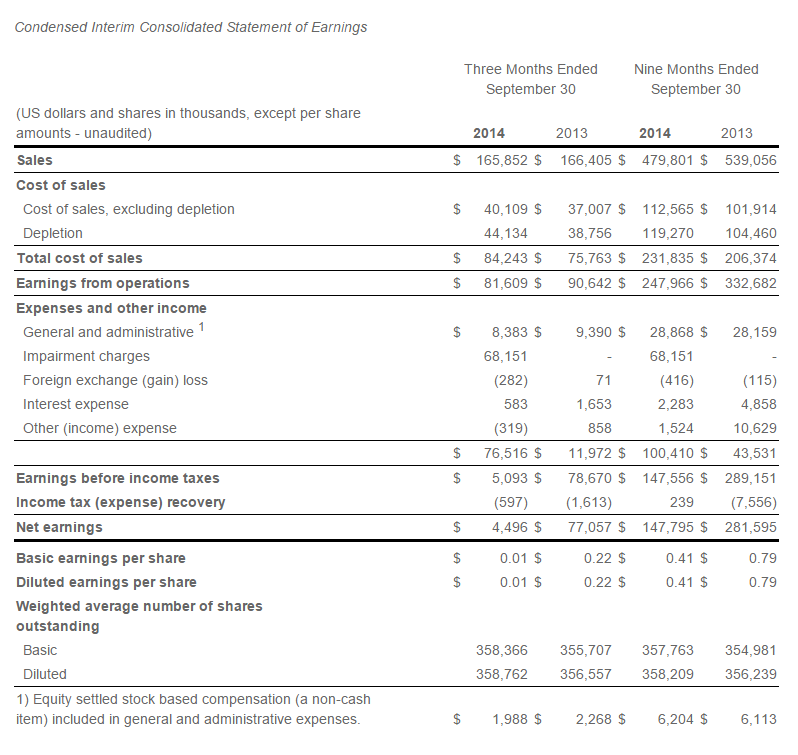

Financial Review

Revenues

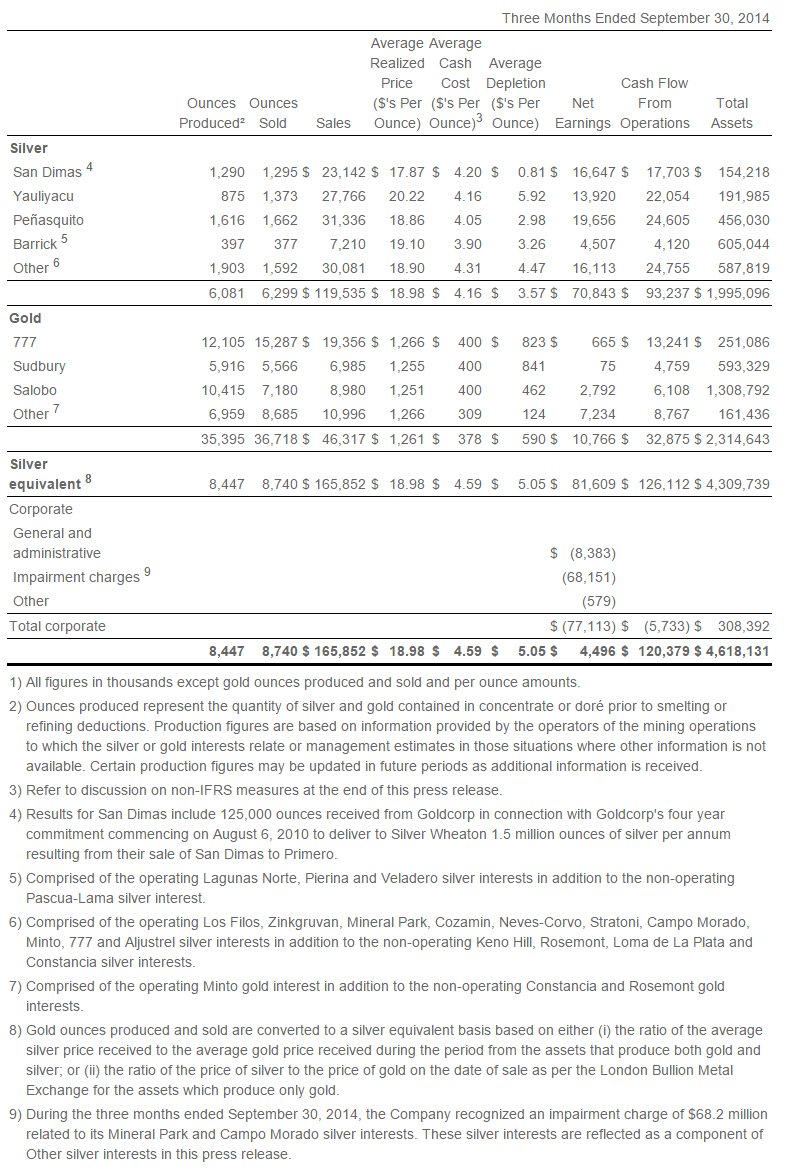

Revenue was $165.9 million in the third quarter of 2014, on silver equivalent sales of 8.7 million ounces (6.3 million ounces of silver and 36,700 ounces of gold), virtually unchanged from the $166.4 million of revenue generated in the third quarter of 2013, with an 11% decrease in the average realized silver equivalent price ($18.98 in Q3 2014 compared to $21.26 in Q3 2013), being offset by a 12% increase in the number of silver equivalent ounces sold.

Costs and Expenses

Average cash costs¹ in the third quarter of 2014 were $4.59 per silver equivalent ounce as compared to $4.73 during the comparable period of 2013. This resulted in a cash operating margin¹ of $14.39 per silver equivalent ounce, a reduction of 13% as compared to Q3 2013. The decrease in the cash operating margin was primarily due to an 11% decrease in the average silver equivalent price realized in Q3 2014 compared to Q3 2013.

Earnings and Operating Cash Flows

Adjusted net earnings¹ and cash flow from operations in the third quarter of 2014 were $72.6 million ($0.20 per share) and $120.4 million ($0.34 per share¹), compared with $77.1 million ($0.22 per share) and $118.7 million ($0.33 per share¹) for the same period in 2013, a decrease of 6% and an increase of 1%, respectively. Earnings and cash flow continued to be impacted by lower gold and silver prices.

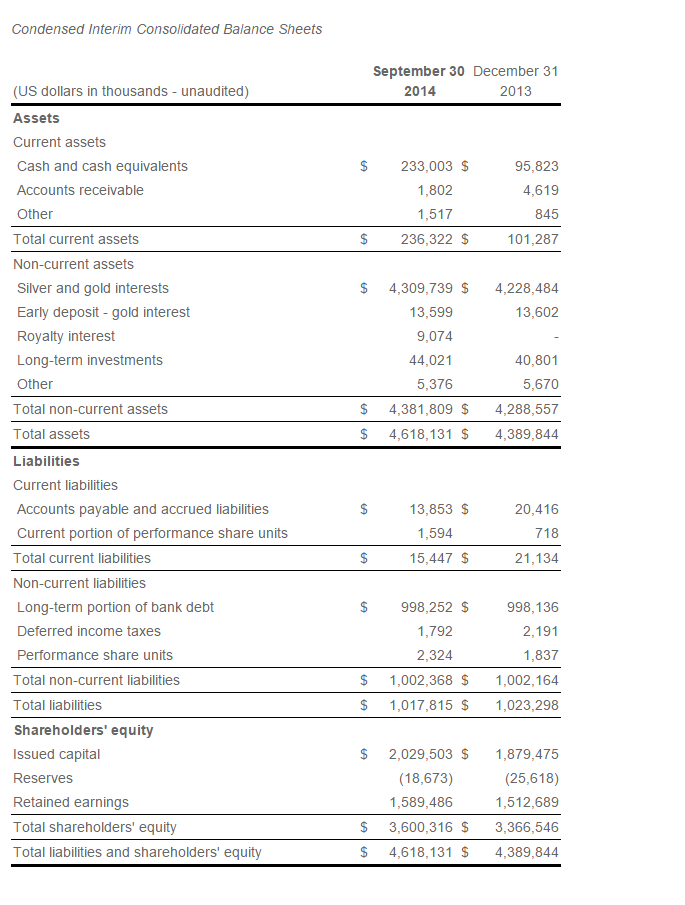

Balance Sheet

At September 30, 2014, the Company had approximately $233.0 million of cash on hand. The combination of cash and ongoing operating cash flows, combined with the credit available under the Company's $1 billion Revolving Facility, positions the Company well to fund all outstanding commitments as well as providing flexibility to acquire additional accretive precious metal stream interests.

___________________________

1 Please refer to non-IFRS measures at the end of this press release.

Asset Impairment

Mineral Park

On August 26, 2014, Mercator Minerals Ltd. ("Mercator") disclosed that they had filed a Notice of Intention under the Canadian Bankruptcy and Insolvency Act ("BIA").Mercator was subsequently deemed to have filed an assignment in bankruptcy under the BIA. In addition, four of Mercator's subsidiaries (including Mineral Park Inc., the owner of the Mineral Park mine) filed Chapter 11 bankruptcy petitions in the United States. As a result, management has concluded that the value of the Mineral Park silver interest is nominal, and as such has reported an impairment charge of $37.1 million during the current period, representing the carrying value of the Mineral Park silver interest atSeptember 30, 2014.

On November 4, 2014, the United States Bankruptcy Court for the District of Delaware approved a settlement agreement among Silver Wheaton, the four Mercator United States subsidiaries in bankruptcy and their secured lenders. Under the settlement agreement, a portion of the sale proceeds from the sale of the Mineral Park mine and assets is to be paid to Silver Wheaton and Silver Wheaton retains the right to proceed against Mercator, the Canadian parent company, as guarantor under the stream. In return for these agreements, the settlement provides for the termination of any claim Silver Wheaton may have against the Mineral Park mine. If Silver Wheaton recovers proceeds under the settlement agreement, Silver Wheaton will recognize such proceeds in the period in which they are received. The amount of any recoveries by Silver Wheaton under the settlement agreement and the ultimate outcome and recoveries from the Canadian bankruptcy proceedings are uncertain.

As at September 30, 2014, the Company has received approximately 2.1 million ounces of silver related to the Mineral Park mine under the agreement, generating cumulative operating cash flows of approximately $51.1 million, as compared to an original upfront cash payment of $42.0 million.

Campo Morado

As the G9 orebody at the Campo Morado mine nears exhaustion, there has been a continuing deterioration of ore grades at the mine. As per Nyrstar NV's ("Nyrstar") third quarter 2014 MD&A, Nyrstar is undertaking major metallurgical test programs to determine if the complex mineralogy of the additional satellite deposits at the mine site can be processed economically (albeit with some modifications of the flow sheet). As a result, the estimate of future production from Campo Morado has been reduced during the quarter. The reduction in estimates of future production is an indicator of impairment related to the Campo Morado silver interest. Management estimates that the recoverable amount under the Campo Morado silver interest is $25 million, resulting in an impairment charge of $31.1 million during the current period.

As at September 30, 2014, the Company has received approximately 4.4 million ounces of silver related to theCampo Morado mine under the agreement, generating cumulative operating cash flows of approximately $94.1 million, as compared to an original upfront cash payment of $79.3 million.

Operational and Development Highlights

During the third quarter of 2014, attributable silver equivalent production was 8.4 million ounces (6.1 million ounces of silver and 35,400 ounces of gold), representing a decrease of 7% compared to the third quarter of 2013.

Operational highlights for the quarter ended September 30, 2014, are as follows:

Constancia

As per Hudbay's third quarter 2014 MD&A, the Constancia project in Peru is approximately 94% complete and remains on track for initial production in the fourth quarter of 2014 and commercial production in the second quarter of 2015. Key milestones have been achieved with the commissioning of the power transmission line from Tintaya toConstancia, plant commissioning well under way, pre-stripping significantly advanced with sufficient broken ore available for the ramp-up schedule, and all major reagents and consumables are now under contract. As per the agreement with Hudbay, a final payment of $135 million relative to the gold stream on Constancia was paid to Hudbay as total capital expenditures reached $1.35 billion on the project. At Silver Wheaton's election, the payment was made through the issuance of 6,112,282 common shares, at an average issuance price of $22.09 per share.

Salobo

As per Vale's third quarter 2014 MD&A, the Salobo II expansion, which increased mill throughput capacity at the Salobo mine to 24 million tonnes per annum ("Mtpa") from 12 Mtpa, continued to ramp-up in Q3 after achieving first production in June 2014. As a result, attributable gold production from Salobo reached a record 10,415 ounces during Q3.

Peñasquito

As per Goldcorp's third quarter 2014 MD&A, Goldcorp has corrected the Mineral Resource estimate for the Peñasquito Mine contained in the Technical Report entitled "Peñasquito Polymetalic Operation, Zacatecas State Mexico, NI 43-101 Technical Report" dated January 8, 2014 because it did not include an updated increase in Mineral Resources. As a result of this correction, Silver Wheaton has increased its silver resources at the Peñasquito Mine as of December 31, 2013 proportional to our 25% stream such that Measured and Indicated Resources increased by 45.26 million ounces to 113.37 million ounces and Inferred Resources increased by 4.74 million ounces to 15.04 million ounces1.

____________________________

1 Silver Wheaton's most current attributable reserves and resources, as of December 31, 2013, can be found on the Company's website at www.silverwheaton.com. See "Reserves and Resources".

Yauliyacu

In the third quarter of 2014, silver production at the Yauliyacu mine rose to a six year high of 875,000 ounces as higher-grade material was processed in the quarter. This represented an increase of 37% and 33% over the third quarter of 2013 and the second quarter of 2014, respectively. In addition, sales at Yauliyacu were 1.373 million ounces in the quarter, resulting in a decrease of 0.6 million produced but not yet delivered payable ounces in the quarter.

Sudbury

As per Vale's third quarter 2014 MD&A, the Sudbury operations ("Sudbury") completed the planned maintenance shutdown in some of the mines and all of the surface facilities in the second quarter of 2014. Sudbury returned to normal operations in the third quarter, processing much of the inventory of feed stock piled in the second quarter. While nickel and copper production from Sudbury were up sequentially 146.5% and 62.2%, respectively, in the third quarter of 2014, attributable gold production to Silver Wheaton was reported to be 5,916 ounces, representing a 20.8% decrease quarter over quarter. The drop in gold production was due primarily to lower estimated grades in the processed material. Given the length of the process associated with producing the final product, reported production for the most recent quarter represents an estimate of actual production and will be adjusted once actual production information is available. In this regard, actual gold production for the second quarter of 2014 was 1,387 ounces higher than had been estimated in Silver Wheaton's second quarter 2014 MD&A.

San Dimas

On August 6, 2010, Goldcorp completed the sale of the San Dimas mine to Primero Mining Corp. ("Primero"). In conjunction with the sale, Silver Wheaton amended its silver purchase agreement relating to the mine. The term of the agreement, as it relates to San Dimas, was extended to the life of mine. During the first four years following the closing of the transaction, Primero delivered to Silver Wheaton a per annum amount equal to the first 3.5 million ounces of payable silver produced at San Dimas and 50% of any excess, plus Silver Wheaton received an additional 1.5 million ounces of silver per annum which was delivered by Goldcorp. Beginning on August 6, 2014, which was the fourth anniversary of the closing, Primero will deliver a per annum amount to Silver Wheaton equal to the first 6 million ounces of payable silver produced at San Dimas and 50% of any excess, and Goldcorp's obligation to deliver supplemental silver ceases.

Produced But Not Yet Delivered 1

Payable silver equivalent ounces produced but not yet delivered to Silver Wheaton by its partners decreased by 1.3 million ounces to approximately 4.7 million silver equivalent payable ounces at September 30, 2014, due primarily to decreases in produced but not yet delivered ounces at the Yauliyacu and Peñasquito mines.

Detailed mine by mine production and sales figures can be found in the Appendix to this press release and in Silver Wheaton's MD&A in the 'Results of Operations and Operational Review' section.

_____________________________

1 Payable silver equivalent ounces produced but not yet delivered are based on management estimates, and may be updated in future periods as additional information is received.

Webcast and Conference Call Details

A conference call will be held Wednesday, November 12, starting at 11:00 am (Eastern Time) to discuss these results. To participate in the live call, please use one of the following methods:

| Dial toll free from Canada or the US: | |

| Dial from outside Canada or the US: | |

| Pass code: | 24119433 |

| Live audio webcast: | www.silverwheaton.com |

Participants should dial in five to ten minutes before the call.

The conference call will be recorded and available until November 19, 2014 at 11:59 pm ET. The webcast will be available for one year. You can listen to an archive of the call by one of the following methods:

| Dial toll free from Canada or the US: | |

| Dial from outside Canada or the US: | |

| Pass code: | 24119433 |

| Archived audio webcast: | www.silverwheaton.com |

About Silver Wheaton

Silver Wheaton is the largest pure precious metals streaming company in the world. Based upon its current agreements, forecast 2014 annual attributable production is approximately 36 million silver equivalent ounces1, including 155,000 ounces of gold. By 2018, annual attributable production is anticipated to increase significantly to approximately 48 million silver equivalent ounces1, including 250,000 ounces of gold. This growth is driven by the Company's portfolio of low-cost and long-life assets, including precious metal and gold streams on Hudbay'sConstancia project and Vale's Salobo and Sudbury mines.

This earnings release should be read in conjunction with Silver Wheaton's MD&A and unaudited Financial Statements, which are available on the Company's website at www.silverwheaton.com and have been posted on SEDAR at www.sedar.com.

Mr. Neil Burns , Vice President of Technical Services for Silver Wheaton, is a "qualified person" as such term is defined under National Instrument 43-101, and has reviewed and approved the information on mineral reserves and mineral resources disclosed in this news release.

CAUTIONARY NOTE REGARDING FORWARD LOOKING-STATEMENTS

The information contained herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements with respect to the future price of silver or gold, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production (including 2014 and 2018 attributable annual production), costs of production, reserve determination, reserve conversion rates, statements as to any future dividends, the ability to fund outstanding commitments and continue to acquire accretive precious metal stream interests and assessments of the impact and resolution of various legal and tax matters. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, operations, level of activity, performance or achievements of Silver Wheatonto be materially different from those expressed or implied by such forward-looking statements, including but not limited to: fluctuations in the price of silver or gold; the absence of control over mining operations from which Silver Wheaton purchases silver or gold and risks related to these mining operations including risks related to fluctuations in the price of the primary commodities mined at such operations, actual results of mining and exploration activities, environmental, economic and political risks of the jurisdictions in which the mining operations are located and changes in project parameters as plans continue to be refined; differences in the interpretation or application of tax laws and regulations; and the Company's interpretation of, or compliance with, tax laws, is found to be incorrect; as well as those factors discussed in the section entitled "Description of the Business - Risk Factors" in Silver Wheaton's Annual Information Form available on SEDAR at www.sedar.com and in Silver Wheaton's Form 40-F on file with theU.S. Securities and Exchange Commission in Washington, D.C. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the mining operations from which Silver Wheaton purchases silver and gold, no material adverse change in the market price of commodities, that the mining operations will operate and the mining projects will be completed in accordance with their public statements and achieve their stated production outcomes, the continuing ability to fund or obtain funding for outstanding commitments, the ability to source and obtain accretive precious metal stream interests, expectations regarding the resolution of legal and tax matters, that Silver Wheaton will be successful in challenging any reassessment by the Canada Revenue Agency and such other assumptions and factors as set out herein. Although Silver Wheaton has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate. Accordingly, readers should not place undue reliance on forward-looking statements and are cautioned that actual outcomes may vary. Silver Wheaton does not undertake to update any forward-looking statements that are included or incorporated by reference herein, except in accordance with applicable securities laws.

CAUTIONARY LANGUAGE REGARDING RESERVES AND RESOURCES

For further information on Mineral Reserves and Mineral Resources and on Silver Wheaton more generally, readers should refer to Silver Wheaton's Annual Information Form for the year ended December 31, 2013, and other continuous disclosure documents filed by Silver Wheaton since January 1, 2014, available on SEDAR at www.sedar.com. Silver Wheaton's Mineral Reserves and Mineral Resources are subject to the qualifications and notes set forth therein. Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources: The information contained herein uses the terms "Measured", "Indicated" and "Inferred" Mineral Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them and expressly prohibits U.S. registered companies from including such terms in their filings with the SEC. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. United Statesinvestors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves or that any exploration potential will ever be converted to any category of Mineral Reserves or Mineral Resources. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable. United States investors are urged to consider closely the disclosure in Silver Wheaton's Form 40-F, a copy of which may be obtained from Silver Wheaton or from http://www.sec.gov/edgar.shtml.

_______________________________

1 Silver equivalent production forecast assumes a gold/silver ratio of 60:1.

Results of Operations (unaudited)

The Company currently has nine reportable operating segments: the silver produced by the San Dimas, Yauliyacu, Peñasquito and Barrick mines, the gold produced by the 777, Sudbury and Salobo mines, the silver and gold produced by the Other mines and corporate operations.

Non-IFRS Measures

Silver Wheaton has included, throughout this document, certain non-IFRS performance measures, including (i) adjusted net earnings and adjusted net earnings per share; (ii) operating cash flow per share (basic and diluted); (iii) average cash costs of silver and gold on a per ounce basis; and (iv) cash operating margin.

| i. | Adjusted net earnings and adjusted net earnings per share is calculated by removing the effects of the non-cash impairment charges. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, the Company and certain investors use this information to evaluate the Company's performance. |

| The following table provides a reconciliation of adjusted net earnings and adjusted net earnings per share (basic and diluted). |

These non-IFRS measures do not have any standardized meaning prescribed by IFRS, and other companies may calculate these measures differently.The presentation of these non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. For more detailed information, please refer to Silver Wheaton's Management Discussion and Analysis available on the Company's website at www.silverwheaton.com and posted on SEDAR at www.sedar.com.

Silver Wheaton Corp. official press releases

Disclosure: None.