Small Cap Best And Worst Report

The highest scoring names in small cap from 1 year ago (6/20/2013) returned 490 bps more than the Russell 2000. The best performers have been CRZO up 128%, QCOR up 99%, UHAL up 73%, MPWR up 73%, NTRI up 73%, SWHC up 68%, and CGNX up 65%.

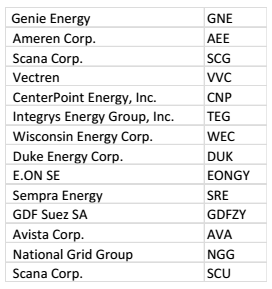

- The top small cap sector is utilities.

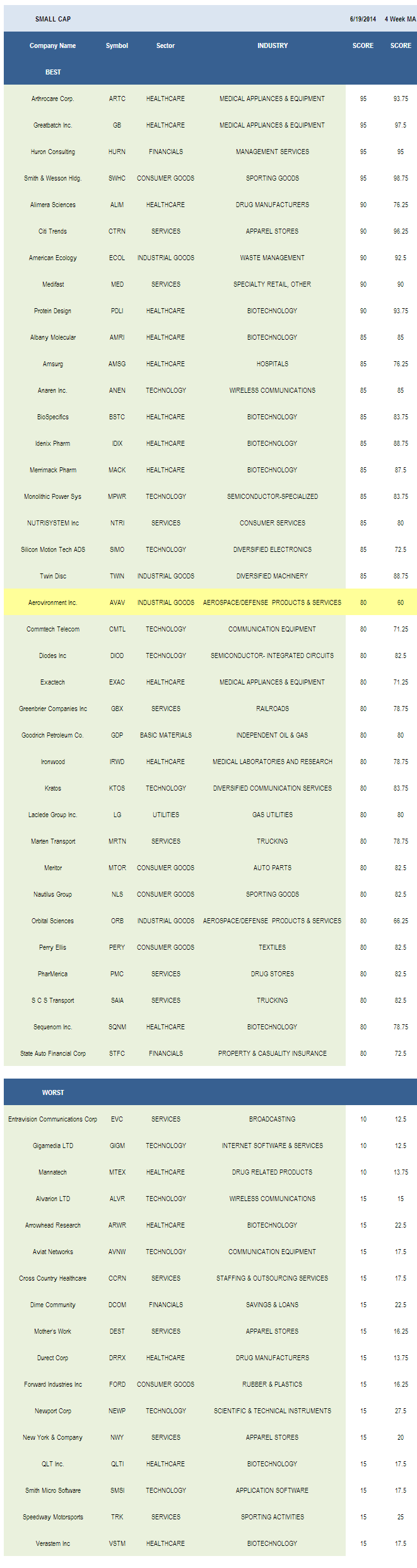

- The best small cap industry is trucking.

The average small cap score is 46.61, below the four week moving average score of 47.47. The average small cap stock is trading -24.78% below its 52 week high, -1.62% below its 200 dma, and has 8.42 days to cover held short.

Utilities score best across our small cap universe. Industrial goods and consumer goods also score above average. Basics, healthcare, services, and technology all score in line with the average small cap universe. Financials score below average.

.png)

Trucking (SAIA, MRTN) is best across small cap. P&C insurers (STFC, MIG) offer seasonal strength through storm season. Auto parts (MTOR, SMP) demand benefits from recovery in Europe. Restaurant (DAVE, BJRI) foot traffic and same store sales are climbing, supporting earnings. Semi ICs (DIOD, RFMD) are strong; however, book-to-bill typically peaks this quarter.

.png)

The best basics group is independent oil & gas (GDP, PVA, CRK). In consumer, buy auto parts and processed & packaged goods (BDBD). P&C insurers score above average in financials. Medical instruments (OSUR, LMNX, ATRI) score above average in healthcare. In industrials, buy aerospace/defense (ORB, AVAV) and general building materials (USLM). The best services groups are trucking, restaurants, and catalogs (GAIA). In technology, focus on semi ICs, semi equipment (ATMI), diversified electronics (SIMO), and business software (NTCT, MSTR).

None.