Bought BBBY, EQR And NTT

Earlier in the week, before the recent market correction, I made a few buys in the Barchart Van Meerten New High Portfolio. The additions were Equity Residential (NYSE:EQR), Bed Bath & Beyond (NASDAQ:BBBY) and Nippon Telegraph and Telephone (NYSE:NTT). They have moved a little since then but I think they are still sound.

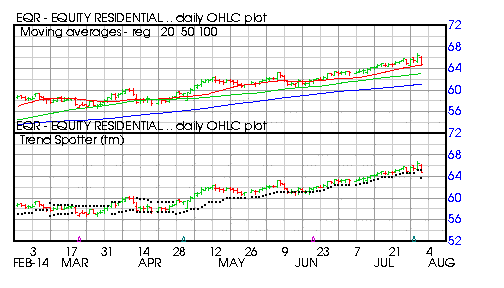

Equity Residential (EQR)

Barchart technical indicators:

- 72% Barchart technical buy signal

- Trend Spotter hold signal

- Above its 2, 50 and 100 day moving averages

- 15 new highs and up 2.84% in the last month

- Relative Strength Index 53.75%

- Barchart computes a technical support level at 64.40

- Recently traded at 64.80 with a 50 day moving average of 63.05

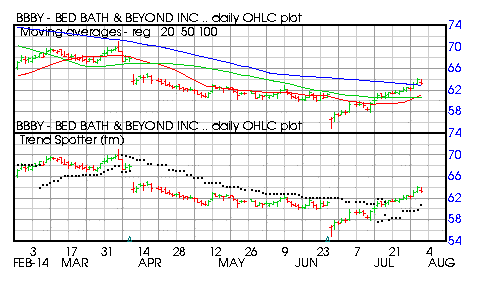

Bed Bath & Beyond (BBBY)

Barchart technical indicators:

- 64% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 100 day moving average

- 14 new highs and up 10.06% in the last month

- Relative Strength Index 62.98%

- Barchart computes a technical support level at 62.54

- Recently traded at 63.13 with a 50 day moving average of 60.67

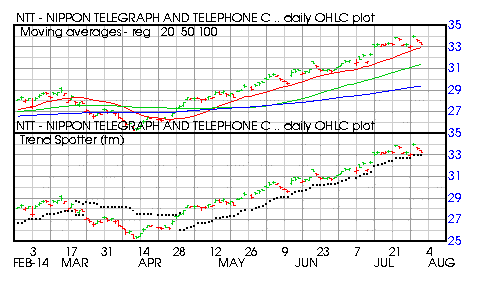

Nippon Telegraph and Telephone (NTT)

Barchart technical indicators:

- 72% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 6.54% in the last month

- Relative Strength Index 59.04%

- Barchart computes a technical support level at 33.39

- Recently traded at 33.28 with a 50 day moving average of 31.40

In the most recent Marketocracy rankings this portfolio beat 97.9% of the 100,000 portfolios they review and beat 90.4% for the 5 year period.

Disclosure: I bought EQR, BBBY, NTT

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!