Dividend Aristocrats In Focus Part 13 Of 54: Chubb Corporation

In lucky part 13 of the 54 part series on Dividend Aristocrats, I will analyze the competitive advantage and growth prospects of Chubb Corporation (CB). Chubb sells home, car, business, and supplemental health insurance policies through its network of independent agents and brokers located in North and South America, Australia, Europe and Asia. The company was established in 1882. Chubb’s conservative underwriting policies have allowed the company to grow its dividend for 32 consecutive years. In the first half of 2014, about 77% of Chubb's premium revenue came from the US with just 23% coming internationally.

Business Overview

Chubb is the 12th largest property and casualty insurer in the U.S. The company has a global network that boasts 120 offices in 26 countries staffed by over 10,200 employees. The company’s revenues are divided between personal insurance, commercial insurance, and specialty insurance. The types of insurance within each division are listed below:

- Personal Insurance: automobile, homeowner

- Commercial Insurance: multiple peril, casualty, workers compensation, property & marine

- Specialty Insurance: professional liability, surety

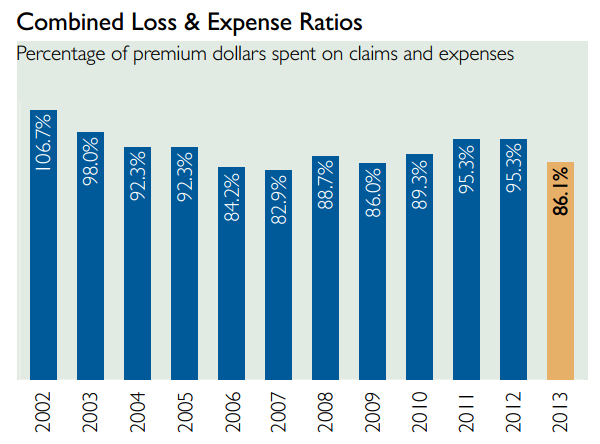

Chubb’s revenues are well diversified across its different insurance groups. For the first 6 months of 2014 the company generated 36% of revenue from its personal insurance division, 44% from commercial insurance division, and 20% from its specialty insurance divisions. Each of Chubb’s categories and sub categories had a combined ratio of less than 100% for the first six months of 2014. The combined ratio is calculated he sum of both business expenses and claims paid divided by premiums earned. A combined ratio of less than one shows that an insurance company is engaged in profitable underlying and all investment gains made from investing the float are additional profits on top of the profitable underwriting business. Chubb’s ability to keep all of its categories and sub categories’ combined ratio under one shows that the company is disciplined enough to only write profitable policies.

Competitive Advantage

Chubb’s competitive advantage rests with its conservative underwriting policies. insurance industry has hard and soft markets. When competition is high, many insurers will write unprofitable policies in hopes of making up the loss through investment income from investing the float. This tends to be a losing proposition and opens insurance companies up to the risk of bankruptcy. When enough firms collapse due to underbidding on their policies, more responsible firms (like Chubb) move in and gain market share, all while issuing profitable policies. The company has maintained a combined ratio under 100% since 2002, showing just how dedicated it is to profitable underwriting.

The second competitive advantage enjoyed by Chubb is its large network of independent agents. The company is well established (being in business since the 1800’s can have that effect). Recreating such a large network of sales representatiteves would take a new insurance business decades of time and millions or billions of dollars to replicate. Chubb’s well established network protects it from competition from much smaller businesses by giving the company relationships with and access to over 10,000 representatives and their clients and potential clients.

Growth Prospects

Chubb does not have exciting growth plans that involve risky new ventures like many businesses. Chubb’s growth plans center on organic growth and incremental improvement. The company has managed to grow revenue per share by about 6.5% a year over the last decade. Interestingly, nearly all of the company’s revenue per share growth has come from a reduction in share count rather than organic growth. Chubb uses its insurance profits to repurchase its shares at a fast rate. It has averaged about 6% a year compound reduction in share count over the last decade.

The company’s future growth prospects look marginally better than the past decade. Overall, I believe Chubb Corporation can grow revenues between 1% and 3% a year over the next decade through organic growth, leveraging its network of independent agents, and focusing on better underwriting and plan management through technological advances. The company will likely give shareholders earnings per share growth in the 7% to 11% a year range from share repurchases (6%), organic growth (1% to 3%), and efficiency gains (1% to 2%).

Dividend Analysis

Chubb Corporation currently has a dividend yield of about 2.15%, above the S&P500’s dividend yield. Further, the company has paid increasing dividends for 32 consecutive years. Chubb’s dividend is virtually guaranteed over the next several years due to the company’s low payout ratio of 22%. Chubb will likely keep its payout ratio low and continue to gobble up its shares through repurchases. Shareholders of Chubb can expect dividend payments to grow in line with overall earnings per share growth, which I expect to be between 7% and 11% a year (see growth prospects section above for how this number is derived).

Valuation

Chubb Corporation appears exceptionally cheap now compared to the overall market. The company currently trades for a P/E ratio of only 11.4, well below the S&P500’s P/E ratio which is above 19. The company is currently trading at a PE 10 ratio (which takes average of last 10 years earnings for the E in the P/E ratio) of 15.45, well below its pre-2009 market crash levels. Chubb’s valuation multiples have not fully recovered from the Great Recession of 2007 to 2009. Before the recession, the company traded at an average PE 10 ratio of around 20. Based on the company’s P/E multiple compared to the overall market, history of rewarding shareholders through dividends and share repurchases, and the company’s PE 10 multiple compared to its historical average, I believe Chubb Corporation is undervalued and has upside of about 33% from current prices.

Recession Performance

Chubb Corporation remained profitable throughout the recession of 2007 to 2009. The company had record earnings per share in 2007. In 2008, earnings per share dipped from $5.51 to $3.88. In 2009, the company reported earnings per share of $4.90. Overall, Chubb Corporations operations are not heavily correlated with market recessions (though its stock price is, make no mistake). Chubb manages to remain profitable through recessions by focusing on only writing profitable underwriting policies and not giving in to the temptation to write unprofitable policies and make up the losses in investment income.

Final Thoughts

Chubb Corporation operates in the slow changing insurance industry. The fundamental product insurance companies provide is unlikely to be changed by advancing technology. The big data revolution can increase the accuracy of underwriting policies, but technology as a whole will not affect the competitive advantage of insurance companies. The process of insuring against risk works through aggregation and reaching scale, something that technology cannot replace.

Chubb Corporation will likely continue rewarding shareholders with solid if unspectacular earnings per share growth coupled with increasing dividends per share. The company appears to be undervalued in this time, and I believe has 33% upside from its current level. Due to the company’s low payout ratio and above average revenue per share growth rate, the company ranks in the Top 20 based on the 8 Rules of Dividend Investing. Chubb makes an excellent addition to a dividend growth portfolio as part of the insurance section of a diversified portfolio.

Disclosure: I am not long any of the stocks mentioned in this article