Dividend Aristocrats In Focus Part 14 Of 54: Clorox Company

In Part 14 of my 54 part series on Dividend Aristocrats I analyze the growth prospects, dividend, and competitive advantage of Clorox Company (CLX). Clorox sells branded consumer products including Clorox Bleach, Pine-Sol, Hidden Valley Ranch Dressing, Brita water filters, Burt’s Bees natural products, Glad trash bags, Kingsford charcoal, and Fresh Step cat litter, among others. The company has increased its dividend payments for 37 consecutive years and has a history of rewarding shareholders with share repurchases as well.

Business Overview

Clorox operations are divided broadly into 3 categories:

- U.S. Sales (75% of Revenue)

- International Sales (20% of Revenue)

- Professional Sales (5% of Revenue)

The company controls a large portfolio of well known brands. The image below gives a concise breakdown of Clorox’ brands

Competitive Advantage

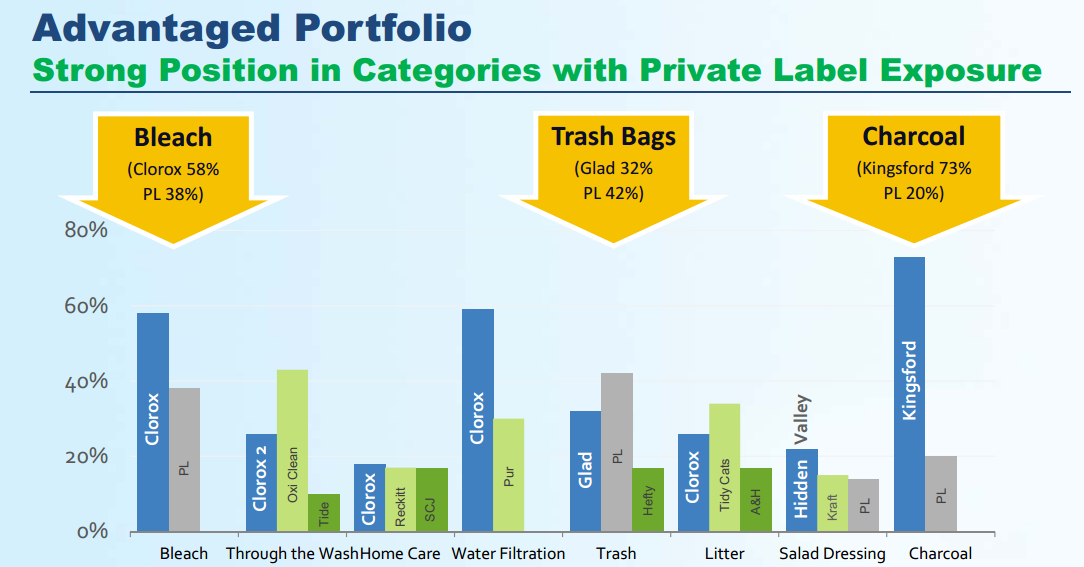

Clorox’ competitive advantage is derived from its strong brands. The company has a long history of building, strengthening, and acquiring consumer branded products. Clorox focuses on disposable products that customers must buy over and over driving repeat sales and brand loyalty. The company has a large portfolio of brands that are #1 or #2 in their respective categories. The image below shows Clorox #1 market position in bleach (58% market share), water filtration (through the Brita brand), trash bags (32% market share), and charcoal (73% market share).

In addition to its strong brands, Clorox has an advantage of scale over less diversified consumer brand companies. Since Clorox controls the #1 or #2 product by market share in several important retail strategies it can ‘bundle’ its product offerings to retailers letting Clorox sell a wider variety of products. A well diversified consumer brand portfolio provides Clorox downside protection if any one product in the portfolio falters. Because of Clorox’ stability, the company can focus on innovation and expanding the product offerings of its core brands.

Growth Prospects

Clorox has faced headwinds in recent years from private label products and fierce competition from other brands. As a result, the company’s revenue per share has grown at just 4.3% a year over the last decade. The company expects sales to grow between 3% and 5% for the long-run. Clorox expects long-term 2% to 3% annual sales growth in U.S. retail, 10% to 15% annual sales growth in its professional category, and 5% to 7% annual sales growth internationally.

I believe Clorox will fall somewhat short of 3% to 5% sales growth based on its historical numbers. Competition should increase, not decrease for the company as private label products and other brands continue to compete. Overall, I believe the company will hit 3% to 5% revenue per share sales growth, which takes into account the company’s strong share repurchases which reduce share count and boost per share numbers.

Clorox’ most exciting growth prospects are in healthcare. Examples of Clorox’ health care products include the following:

- Clorox Bleach Germicidal Wipes used to kill bacteria in hospitals

- Clorox Hydrogen Peroxide sprays used in hospitals for surface sanitation

The Clorox brand name is synonymous with disinfection and cleaning, making it a natural choice to use for expanding into health care. The company is positioning itself as a “healthcare acquired infections” preventer. Healthcare acquired infections are diseases patients pick up resulting from their stay in a hospital or medical facitlity. The company’s health care products are part of its rapidly growing professional category which is expected to grow by up to 15% per year through the year 2020. Healthcare sales are being propelled by several macro trends. The U.S. (and global) populations are aging due to the baby boomer population bulge. In addition, there has been increased focus and regulatory pressure on medical facilities to prevent healthcare acquired infections. Helping health care providers solve healthcare acquired infections will continue to propel Clorox’ health care sales.

Recession Performance

Clorox performed well through the recession of 2007 to 2009. The company managed to grow earnings per share each year of the Great Recession. Clorox’ earnings per share from 2007 to 2010 are listed below:

- EPS of $3.23 in 2007

- EPS of $3.24 in 2008

- EPS of $3.81 in 2009

- EPS of $4.24 in 2010

The company’s excellent performance through the recession shows that consumers continue to buy the company’s branded products in times of economic hardship despite buying slightly more expensive than private label brands. If the last recession is any indication, Clorox’ underlying business will perform well through the next recession (whenever that may be).

Valuation

Clorox currently trades at a P/E multiple of 23, which is near the top of the company’s range over the last decade. The stock has surged recently on speculation of a potential buyout of the company. There are no definite buyers yet, but Church and Dwight (CHD) is rumored to be interested. In addition, Clorox recently shed its loss producing Venezuelan operations which also boosted the company’s share price. Due to the recent positive events surrounding the company and the resulting run up in share price, now is not the time to start a position in Clorox. The company has traded around an average P/E multiple of 18 over the last decade. I believe the company’s full value is reflected at a P/E multiple of 18. My ‘back of the envelope’ calculation is shown below:

- Start with historical S&P500 average P/E of 15

- Add 2 additional points due to Clorox’ safety from high quality brands with low risk of obsolecense

- Add 1 additional point due to long history of rewarding shareholders with share repurchases and dividends

- Total comes to a P/E ratio of 18, in line with historical average

Dividend Analysis

Clorox has a current dividend yield of 3%, well above the S&P500’s dividend yield which is currently below 2%. Clorox has increased its dividend payments for 37 consecutive years. The company expects long term revenue per share growth in the 3% to 5% range. Clorox also has a fairly high payout ratio of about 67%. The company’s dividend will likely grow around 3% to 5%, on pace with overall company growth. Shareholders should not expect rapid dividend growth from Clorox due to the company’s fairly high payout ratio and low to mid single digit projected company growth. On the other hand, the company is very stable and has a long history of dividend increases. What Clorox lacks in growth potential, it makes up for in safety.

Final Thoughts

Clorox is a high quality business that appears to be somewhat overvalued. It is operating in an extremely competitive environment due to continued pressure from private label products and competitors. Despite this, Clorox operates in slow changing industries and as a result has little risk of business obsolescence. The company is ranked 46th out of 132 businesses based on the 8 Rules of Divdiend Investing. It does not rank higher due to its fairly high payout ratio and mediocre growth rate.

Disclosure: I am not long any of the stocks mentioned in this article