Dividend Aristocrats In Focus Part 5 Of 54: Pentair

Part 5 of the Dividend Aristocrats In Focus series covers industrial goods manufacturer Pentair (PNR). Pentair has evolved since its formation in 1966. Throughout the 1960’s and 1970’s, Pentair was involved primarily in the paper industry. The company became involved in tools in the 1980’s through the acquisition of Porter-Cable. The company began expanding into international markets in the 1990’s. In 2004, the company entered into the water industry through the acquisition of Wicor Industries. The company has a long history of investing cash flows into the industries it believes deliver the best value proposition for shareholders. Pentair has been extremely successful over the last 4 plus decades. The company has increased its dividend payments for 37 consecutive years, and grown to generating over $7 billion a year in sales.

Source: Pentair Investor Relations

Business Overview

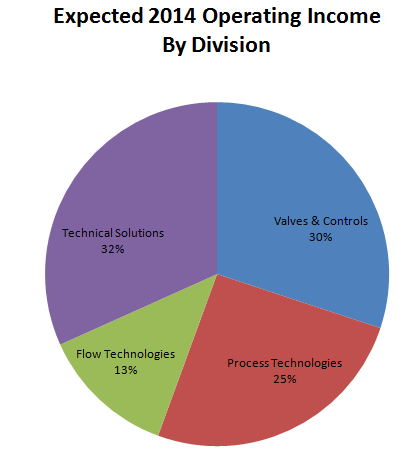

Pentair’s operations are split into four divisions: Valves & Controls, Process Technologies, Flow Technologies, and Technical Solutions. The company’s largest division based on expected 2014 operating income is Technical Solutions. The chart below compares each of the company’s four divisions based on expected operating income for 2014.

Source: data from Second Quarter Earnings Presentation

Competitive Advantages & Capital Allocation

Pentair’s competitive advantage comes from its lean manufacturing processes and ability to redeploy capital form lower margin businesses into higher margin businesses. The company has a 14 year legacy of using its Pentair Integrated Management System (PIMS). PIMS focuses on lean manufacturing practices and constant improvement. In addition, PIMS fosters accountability down to the individual operator level so people can be held responsible for the quality and amount of work they accomplish.

The PIMS system is the backbone of Pentair and the source of its competitive advantage today. The company has expanded its gross and operating margins through efficiency gains, as operating income per share and earnings per share are growing at a substantially faster rate than overall company revenue. The PIMS system allows Pentair to acquire smaller businesses and more efficiently integrate their operations into the company.

Pentair’s disciplined capital allocation shows where the company’s priorities are. Pentair has increased its dividend for 37 consecutive years. The company will continue to raise its dividend each year as long as overall company growth is anticipated. Despite the long streak of increases, the company has a payout ratio of about 33%, leavening significant amounts of cash available for reinvestment into the business.

In Pentair’s 2014 Electrical Products Group Conference Presentation, the company stated that its highest ROIC projects come from organic growth opportunities. This means Pentair first looks toward internal projects in which to invest cash. An example is investing in automation and robotics in the company’s manufacturing facilities. Pentair CFO John Stauch recently discussed current capital improvement and said:

The IRRs are just unbelievable returns. We are investing in a lot of robotics. We are investing in a lot of automation

In addition to investments in the company, Pentair is also looking to both repurchase shares and acquire other businesses. The company’s management has committed to repurchase shares even if the company is trading at higher valuations, which is an inefficient use of cash. If a company is overvalued, repurchasing shares destroys value because you are paying more for the company that it is worth.

Over the last year, Pentair management has rethought its capital allocation procedures for investing into any divisions. Within each division, there are several subdivisions. In all, there are about 20 subdivisions within Pentair. In the past, funds were allocated to all subdivisions. Now, the company requires each subdivision to ‘prove its worth; funds for growth are not equally, and must be earned.

Future Growth Prospects

Pentair expects future organic revenue growth of about 5% a year past 2015. The company expects about 3% revenue growth in 2014, and 6% in 2015. These single digit growth rates do not tell the whole story of Pentair. The company grew operating income 19% in 2013, and is expecting 15% growth in 2014, and 23% operating income growth in 2015. The company’s earnings per share growth is even more impressive. Earnings per share grew 26% in 2013, and are expected to grow over 20% in both 2014 and 2015. Pentair management has made it a goal to reach $5.00 earnings per share for the full year of 2015. This represents a significant jump over full year 2013 earnings per share of $3.21.

The company expects to accomplish its strong growth by continuing to realize synergies within its business units and better integrating the Tyco flow control business into the company’s structure. The company will also see gains from reorganizing itself in Ireland to avoid onerous U.S. tax laws. The company expects a tax rate of under 20% for the full year fiscal 2014.

Pentair’s short-term growth prospects are very promising due to a focus on increasing efficiency in capital structure, by reducing taxes, integrating newer businesses, and streamlining established units. The company’s long-term prospects are bright as well, although less spectacular than the double digit growth the company is expecting in the next two years.

Valuation

Pentair currently trades at a P/E ratio of about 22. If the company hits its 2015 EPS target of $5.00 per share, it is trading at a multiple of only 13.3x future earnings. Of course, it will take about 18 months to realize this growth. The company’s largest competitor in the industrial equipment and components industry is Parker-Hannifin PH. Parker-Hannifin trades at a P/E ratio of about 17. As a thought experiment, what would happen if Pentair hits its 2015 $5.00 EPS target, while its P/E ratio falls to 17 (where Parker-Hannifin’s is now) to make up for lower expected future growth(Pentair’s EPS won’t growth at 20%+ forever)? The company would be worth $85 a share, an annualized return of about 17% not including dividends. If Pentair can hit its short-term growth targets, shareholders of the company will likely do well. Based on the company’s short and long term future growth prospects, Pentair appears to be fairly valued at this time.

Final Thoughts

Pentair is a high quality business with a long history of rewarding shareholders through increasing dividends. The company has implemented systems that will spur growth for the next several years. Pentair is a Top 40 stock based on the 8 Rules of Dividend Investing due to its high growth rate and fairly low payout ratio (under 33%). Investors seeking capital gains over the next few years and long-term dividend growth will find Pentair a strong candidate for the industrial section of their portfolio.

Disclosure: I am not long any stocks mentioned in this article