Dividend Smackdown: Microsoft Vs. ExxonMobil

Big-tech behemoth Microsoft Corporation (MSFT) leapfrogged ExxonMobil Corporation (XOM) last week to become the second-largest company in the world by market cap. MSFT stock weighs in at a valuation of $405 billion compared to $402 billion for XOM stock.

Both still have a long way to go before catching up with Apple Inc.’s (AAPL) world-leading $671 billion market cap, but the reversal is telling. Just a year ago, Exxon was considered the bluest of blue chips, and Microsoft was a tech dinosaur that had been left in the dust by Apple, Google (GOOG) and others. But today, with crude oil prices in freefall and with Microsoft resurgent under CEO Satya Nadella, MSFT stock has the momentum.

I’m actually bullish on both stocks. I’ve been long Microsoft for years, and I have indirect exposure to ExxonMobil via a position in the Energy Select SPDR ETF (XLE). Both stocks are monster dividend payers with long histories of rewarding their shareholders. Today, we’re going to put Microsoft and ExxonMobil in the ring for a dividend smackdown. May the best dividend payer win!

Exxon Mobil Corporation

We’ll start with ExxonMobil. XOM stock currently yields 2.8%. This isn’t a monster payout by any stretch, but it is competitive in a world in which the 10-year Treasury yields a pitiful 2.3%.

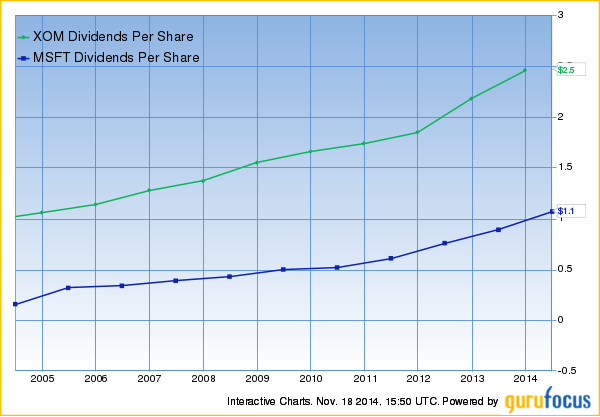

ExxonMobil pays out only 33% of its earnings as dividends. So, come what may with the price of crude oil, there is still plenty of room for dividend growth in the years ahead. And indeed, ExxonMobil has been a serial dividend raiser over time, boosting its payout every year for the past 32 years. Over the past five years, it has raised its dividend at a 10.7% clip. Over the past ten years—a period that included the 2008 meltdown—it has raised its dividend at a 9.4% clip. That’s not too shabby!

Let’s take a look at one of my favorite metrics: Yield on cost. Yield on cost is the current annual dividend divided by your original purchase price. This is the cash return that you’d enjoy for buying and holding a dividend stock, and it’s an important consideration for a stock like XOM with a modest current yield but a long history of dividend raising.

If you had bought ExxonMobil five years ago and held it until today, you’d be enjoying a yield on cost of 4.8%. Had you bought it ten years ago, you’d be enjoying a yield on cost of 6.9%. You’d have a hard time buying junk bonds offering a yield that high today. But such is the compounding power of dividend growth.

Microsoft Corporation

Microsoft sports a slightly lower yield than ExxonMobil at 2.3%. It also has a slightly higher dividend payout rate at 44%. But the dividend payout rate is still low enough to suggest that years of healthy dividend boosts are doable for Microsoft.

Microsoft’s dividend growth rate blows ExxonMobil’s out of the water. Over the past five years, Microsoft has boosted its dividend at a 20.0% annual rate. And over the past 10 years, it’s grown it at a very impressive 14.3% annual rate.

Part of this is due to Microsoft being newer to the world of dividend paying. Microsoft declared its first dividend just 11 years ago, and its initial quarterly payout was modest. But it’s fair to say that Microsoft is making up for lost time with its aggressive dividend hiking.

Can it continue? Well, let me put it this way: It’s showing no signs of slowing down. Microsoft grew its dividend at a 21.7% clip over the past year.

Looking at yield on cost, had you bought Microsoft stock five years ago, you’d be enjoying a 5.7% yield today. Had you bought Microsoft stock ten years ago, you’d be enjoying an 8.6% yield today. These are the kinds of yields you normally only find in speculative mortgage REITs and business development companies.

So…who wins the dividend smackdown?

I’m giving this round to Microsoft based on its higher dividend growth rates. But Exxon Mobil is a worthy competitor, and I would recommend both for a diversified income portfolio.

Disclosures: Long MSFT, AAPL

more

Comments

No Thumbs up yet!

No Thumbs up yet!