Should Oracle Stock Be In Your Portfolio Now?

It is no secret that Larry Ellison’s Oracle (ORCL) is a freight train when it comes to facilitating the needs of many businesses around the globe, but is it a solid investment? Many are starting to have doubts and fears regarding how the company is faring from a financial viewpoint. We will see where the technology and software behemoth is heading, and we will see how it is running, growing, and also how it is transforming itself for future growth.

Company Information

Oracle is a provider of enterprise software and computer hardware products and services. The company provides cloud services, as well as software and hardware products to other cloud service providers, both public and private. The company’s software business consists of two segments: new software licenses and cloud software subscriptions and software license updates and product support.

The company’s hardware systems business consists of two operating segments: hardware systems products, and hardware systems support. ORCL’s services business consists of the remainder of its operating segments and offers consulting services, managed cloud services and education services.

Oracle’s Financials

ORCL’s financial results for 2014 were not up to par with estimates and expectations. We can see from this financial snapshot that the company has not been doing exceedingly well, and that total revenue for fiscal 2014 was up by only 3%.

However, the good news is that cloud software and platform services and products increased by 23%. Apparently this was not good enough for investors though, as in their eyes, sales of software licenses are the most important element for ongoing payments for updates and support, which is ORCL’s main locomotive for revenue and growth.

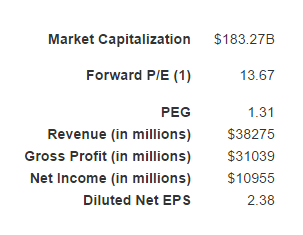

Without further ado, here is some of ORCL’s key financial data, bearing in mind that net income, gross profit, and diluted net EPS are FY ended on 5/31/2014:

ORCL does have a positive net income, but it may not be suitable for value investors when comparing the company’s forward P/E and PEG ratios with the industry’s forward P/E ratio and PEG ratio averages. ORCL’s forward P/E ratio, unfortunately, pales in comparison to the industry’s average. It is also noteworthy that ORCL’s stock has tumbled ever since its most recent earnings conference call.

ORCL currently maintains -1.67% Earnings ESP, an average EPS surprise rate of -0.01%, and a -4.35% EPS Surprise last quarter. Looking at the EPS Surprises chart, one can see that it has been relatively positive in the past, however the company has just not been pulling its weight as of recently.

Oracle’s Prospects

Cloud software and platform products and services were not enough to boost revenue, due to the fact that they only make up about one-sixth of traditional software sales, and they made the income statement look weak, partly because of how their revenue is realized in the long-term, rather than with license sales.

On Thursday, Oracle’s CEO, Larry Ellison, announced he was stepping down as CEO, and after missing analysts’ expectations of fiscal first quarter results by 2 cents a share (posting 62 cents/share, as opposed to 64 cents/share estimated), the stock is down about 2% in after-trading hours Thursday.

Investors’ worries are mounting, and they have been left with many questions. How will Larry Ellison’s replacements fare as Co-CEOs? Is Ellison giving up?

He has stated many times that profit margins are going to have to improve if ORCL is to reign supreme in the cloud computing infrastructure niche. We can see that from the financials how ORCL is nowhere near financial trouble, however it has not been outperforming analysts’ estimates.

The company is also struggling for control of a larger share of the market, and it is in direct competition with rivals Rackspace Hosting Inc. (RAX - Snapshot Report), Microsoft Corporation (MSFT - Analyst Report), and Amazon.com Inc. (AMZN - Analyst Report), who have all penetrated the cloud computing market, and are currently beating ORCL’s cloud infrastructure in sales.

ORCL will need to revolutionize itself and perhaps innovate, or capitalize on its user friendly cloud computing services. ORCL needs to focus on offering more attractive prices for clients, because RAX and AMZN are doing so at the moment. Software and platform as a service are faring better than ORCL’s cloud infrastructure business.

Conclusion

Perhaps it is not only ORCL that has been struggling with financials in the computer software industry, because Adobe Systems Inc. (ADBE - Analyst Report) recently reported its earnings results in a conference call, and they missed analysts’ expectations, which caused shares to slip by 5% in after-hours trading.

At this point in time, we would advise investors to exercise caution if they plan on investing with ORCL. By looking at the following comparative chart, ORCL has not been able to beat the S&P 500 index’s performance for about two years’ time on a consistent basis. We do not recommend investing in ORCL as it maintains a Zacks Rank #3 (Hold), and there are better options out there in the same industry.

Disclosure: None