Testing Images In Articles

The future’s unclear, especially when it comes to anticipating the trend for inflation. Or so it appears based on comparing the Treasury market’s implied forecast vs. recent estimates from several prominent investment and consultancy shops.

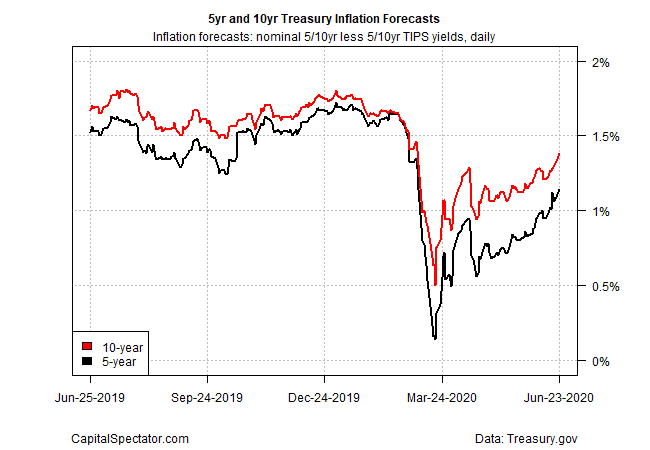

Let’s start with the Treasury market, which continues to price in a rebound in US inflation expectations. Consider the 5-year Note’s implied estimate, based on the yield spread for the nominal rate less its inflation-indexed counterpart. After diving in March, threatening to reach zero and perhaps go negative, the forecast has bounced sharply in recent weeks. At yesterday’s close, the 5-year spread ticked up to 1.14% (June 23)—the highest since March 6—the early days of the coronavirus crash in global markets.

One theory is that the rebound is simply rethinking the extreme estimate of disinflation/deflation risk. As economies have reopened after the shutdown, and economic activity has partially recovered, the crowd is revising inflation expectations to the formerly modest-but-still-positive outlook and that’s about as far as it will go, for now.

Disclosure: None.

Good read. You may like this @[Matthew Hoenig](user:12878).