2014: Should Be A Strengthening Economy

Economic predictions are not to be taken that seriously as they are an extrapolation of today’s knowledge – and introduce significant opinion to reach a particular conclusion.

Economic predictions are not to be taken that seriously as they are an extrapolation of today’s knowledge – and introduce significant opinion to reach a particular conclusion.

Our projections this year have more certainty than our previous projections (which may not be a very high bar to exceed) – except for the impact of Obamacare which continues to provide economic uncertainty for 2014.

2013 Prediction |

2014 Prediction |

|

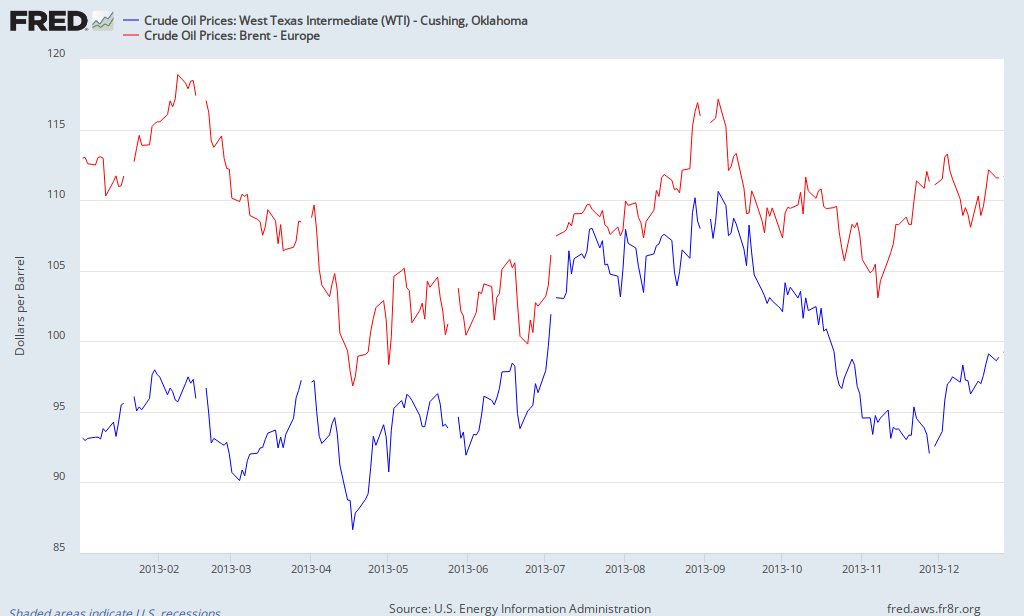

| Oil | As we pen this, oil prices for WTI remain slightly above $90. There is no dynamic currently in play which should push prices over $100 or under $85 barring a war or massive economic contraction. The only real risk here is conflict in the Middle East. | Our 2013 prediction for WTI appeared mixed but ended as predicted. Note the rising trend of WTI as we are leaving 2013. But still, current dynamics continue to suggest oil will remain in the $100 range for 2014. |

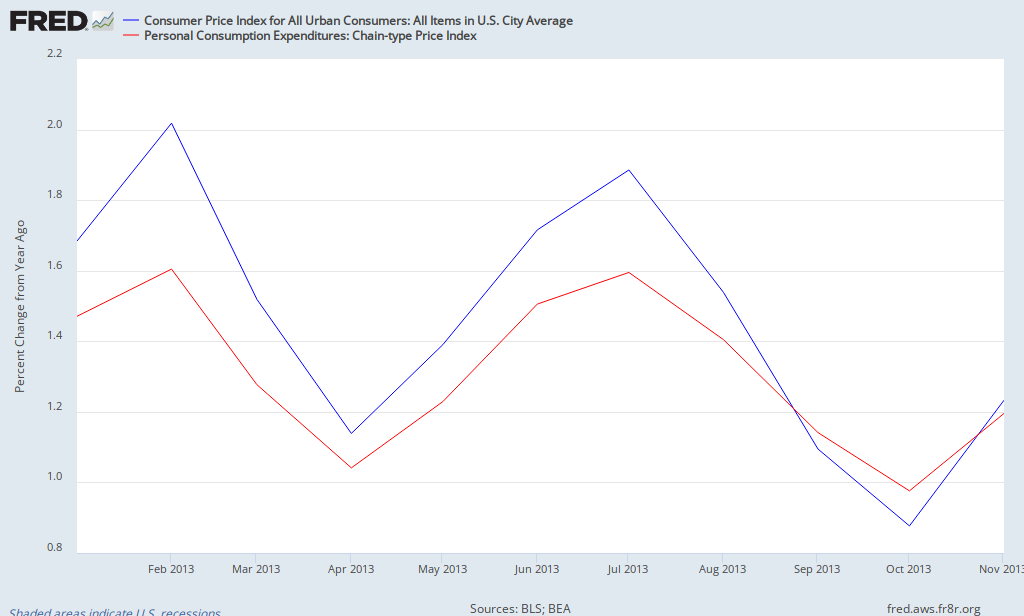

| Inflation | There just is no global dynamic in play currently which will budge inflation. Inflation will remain extremely modest. | There just is no global dynamic in play currently which will budge inflation in 2014. Inflation will remain extremely modest as inflation continued to moderate for most of 2013. |

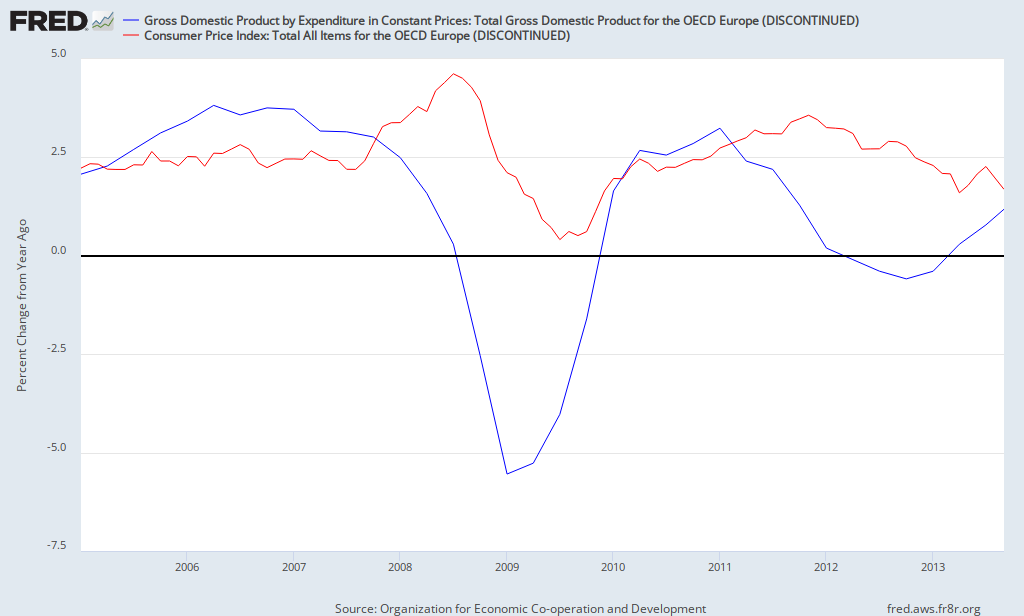

| Europe | Europe as a whole likely will improve as 2013 progresses. Very few of the real issues were resolved in 2012, and yet the Eurozone weathered the storm – and we suggest this should be considered the big win. 2013 should offer more “can kicking” – and doing just enough to keep the ship afloat while economies strengthen. As long as there are no economic jolts, the Eurozone will be in better shape at the end of 2013 than the beginning. | Europe did not improve as 2013 progressed – but their data reporting systems lag the USA by several months. Still Europe does not seem to be solving its economic imbalance between the countries. Whilst we see little that would trigger a train wreck, on the other hand it seems like Europe is going through a death by a thousand cuts. |

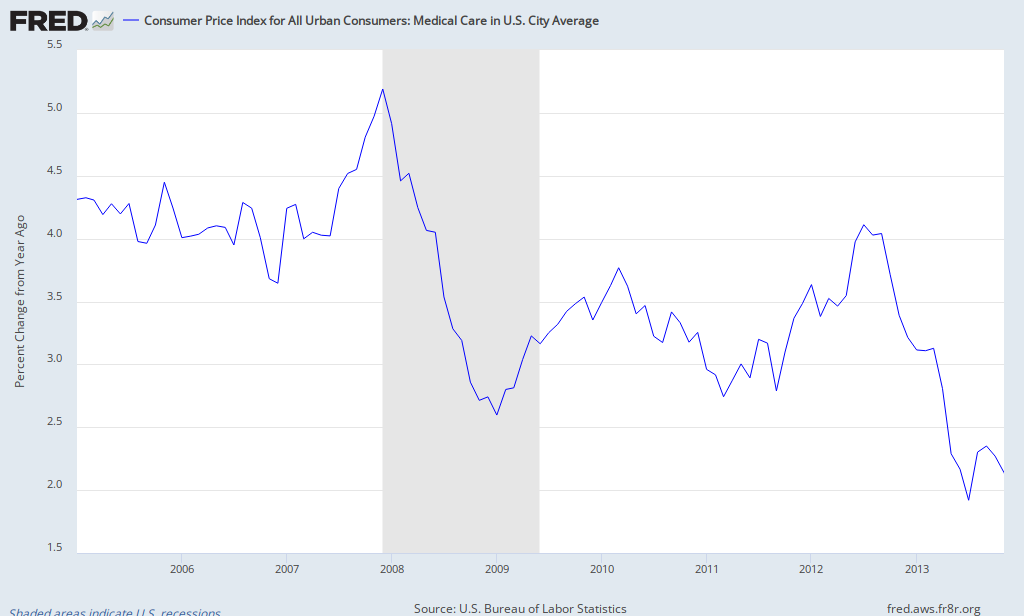

| USA | Of out 2012 predictions, the USA turned out to be our “miss” – as we believed a recession was in the cards at the end of 2012. The USA is being held from real expansion by inept political leadership – but even with the fiscal cliff looming (higher taxes, lower government expenditures), the underlying dynamics should overcome. 2013 will continue the “muddle” along economy – with hopefully strength popping up in 4Q2013. | Still our long range economic guess for 2013 was not precise enough – even though the economy has appeared to have strengthened in the later half of 2013. If it was not for Obamacare, Econintersect would have simply projected 2014 with a continuing economic strengthening. But we have no confidence in projecting Obamacare’s economic effect either way. So label 2014 as uncertain – but if Obamacare did not exist our projection would be GDP growth in 2014 in the 2.5% to 3.0% range. The big question is whether the long-term low in healthcare expense growth can be maintained in 2014. |

| Asia | 2013 should offer more of the same. Asia will continue to regear which will produce growth well under 10%. | At this point, China is driving Asia’s growth. According to the official Xinhua News Agency, China estimates that growth slowed to 7.6% in 2013. Considering the continuing overcapacity, growth may drop as low as 6% (possibly even lower) in 2014. |

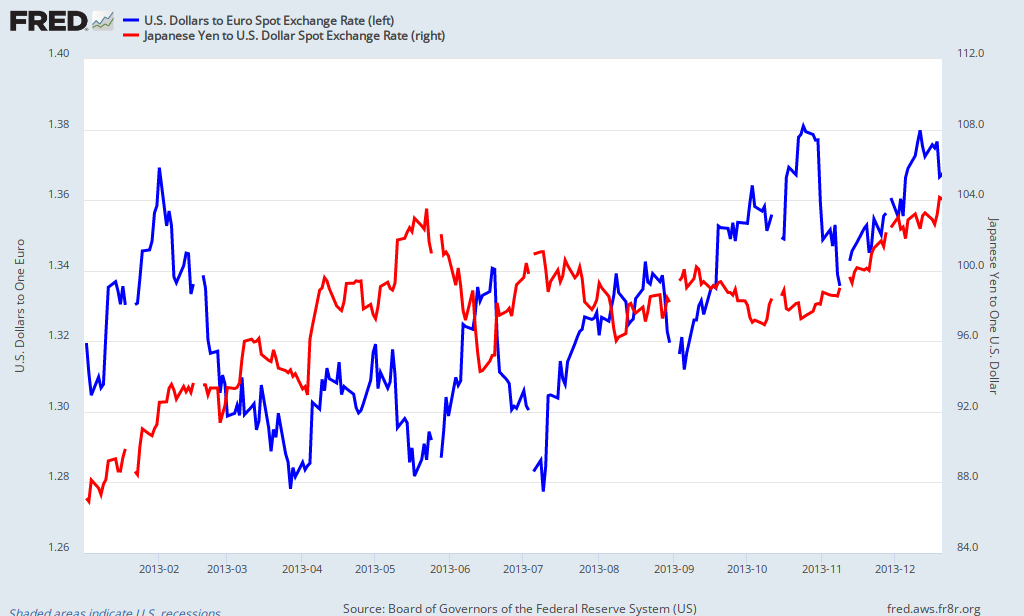

| Currency | We still think that parity of the Euro to the dollar should have occurred, but it did not. It will be interesting in 2013 to watch the Yen to see if the government / JCB is capable of devaluing the yen. Other than the Yen, most currency pairs should be stable in 2013. | The dollar was stable against the breadbasket of currencies in 2013 – but lost ground against a strengthening Euro, and gained ground against a devaluing Yen. We project 2014 continuing dollar stability against the breadbasket of currencies even with the tapering of quantitative easing. |

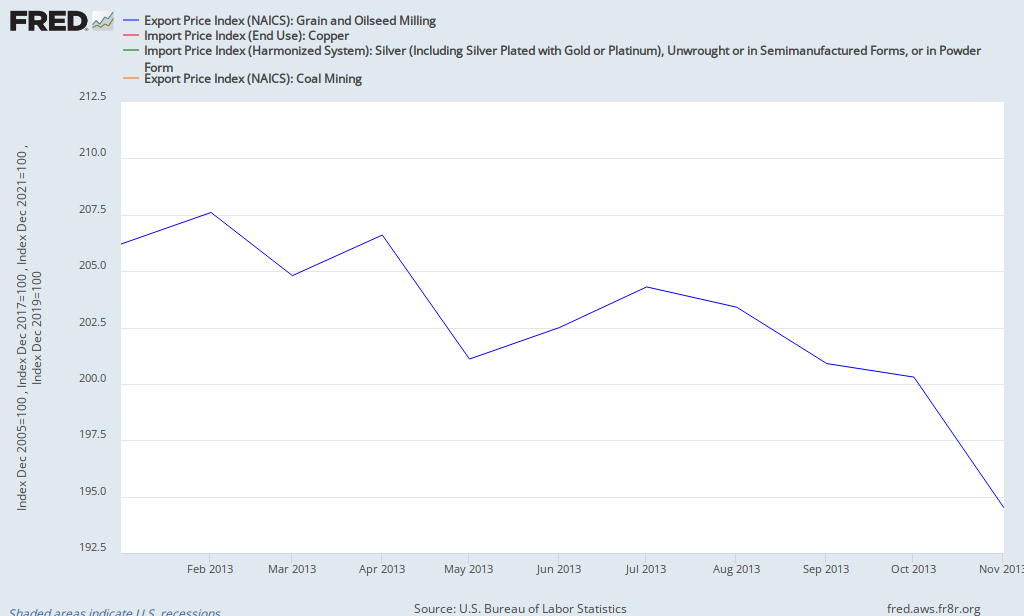

| Commodities | Our commodity prediction was a bust. QE is no longer what it is cracked up to be. There are no long term dynamics in play to move prices much in any direction baring a real nasty recession. The commodities markets are gamed, with the players having too much to lose by wild movements. Therefore our 2013 prediction is static commodity prices. | Commodity prices in general drifted lower in 2013 – likely caused by weaker growth in the global economy. We see no reason for this trend to change in 2014. |

Previous Predictions: 2011 , 2012 , 2013

Other Economic News this Week:

The Econintersect economic forecast for January 2013 predicted a slowing economic growth after several months of increasing growth. What this forecast cannot see is the effect of Obamacare – but slowing of growth in this forecast was primarily the result of the business sector.

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

/images/z weekly_indexes.PNG

Initial unemployment claims went from 338,000 (reported last week) to 339,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate. The real gauge – the 4 week moving average – degraded from 348,000 (reported last week) to 357,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

None