3 Auto Stocks To Buy For Surging Growth In 2015

The majority of U.S. equities have outperformed auto stocks during this most recent bull market. However, economic conditions are picking up for this industry. 2015 looks to book solid growth in both domestic and foreign car sales which will lead the charge in gains for these three stocks Bret Jensen loves to own.

Global auto production and sales in 2014 has been a mixed bag. Domestic sales racked up another good year and are close to being back to the robust levels before the financial crisis. This strength should continue in 2015 with the average age of a U.S. vehicle being over a decade, low financing rates, and the best spurt of job growth in a decade.

Europe continues to struggle with new car registrations near two decade lows. In addition, sanctions on Russia have cratered sales from Europe to Russia. However, auto registrations in the Eurozone have started to creep up in recent months.

South America is suffering through slowing growth and plunging currencies have negatively impacted American operations there. Finally, Chinese auto sales continued to grow at a solid clip. This is a critical market and likely to be the largest auto market for decades to come. Importantly, U.S. automakers are gaining share mostly against the Japanese makers in the Middle Kingdom. Ford (NYSE: F) has doubled its market share over the past two years.

South America is suffering through slowing growth and plunging currencies have negatively impacted American operations there. Finally, Chinese auto sales continued to grow at a solid clip. This is a critical market and likely to be the largest auto market for decades to come. Importantly, U.S. automakers are gaining share mostly against the Japanese makers in the Middle Kingdom. Ford (NYSE: F) has doubled its market share over the past two years.

Overall I am positive on the global auto market in 2015. Domestic sales should show a gain in the low single digits next year, China should again post impressive growth and it is hard to see Europe getting any worse. South America should remain problematic but is a much less important market for automakers’ operations than the other three.

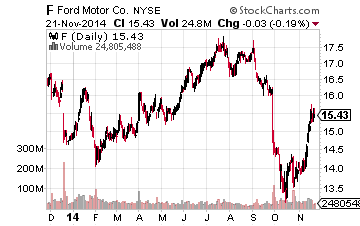

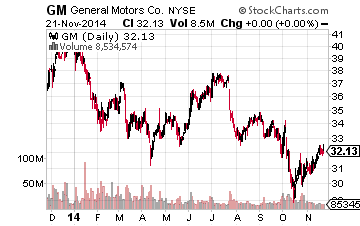

I have been accumulating shares in Ford as well as General Motors (NYSE: GM) in recent weeks. Both look set to outperform the market in 2015 after being laggards in 2014. Both American manufacturing icons are cheap compared to the overall market. Ford goes for less than 10 times next year’s earnings and GM sells for just over seven times next year’s projected earnings. These values are hard to come by in a market that goes for just under 16 times forward earnings currently.

I have been accumulating shares in Ford as well as General Motors (NYSE: GM) in recent weeks. Both look set to outperform the market in 2015 after being laggards in 2014. Both American manufacturing icons are cheap compared to the overall market. Ford goes for less than 10 times next year’s earnings and GM sells for just over seven times next year’s projected earnings. These values are hard to come by in a market that goes for just under 16 times forward earnings currently.

In addition, both pay generous dividend yields north of three percent. Finally, these automakers are becoming major players in China through joint ventures. General Motors is producing nearly 300,000 vehicles a month in the Middle Kingdom, included some 100,000 Buicks monthly. Ford is almost up to 100,000 vehicles a month and both American manufacturers are gaining share and benefiting from the historical enmity that exists between China and Japan.

Although both automakers had challenging years in 2014, brighter skies appear ahead over the next 12 months. Ford’s profit declined from 2013 levels this year due to its massive new model rollout schedule over the next year. Upfront marketing and retooling costs hobbled earnings this year. However, the company will benefit as these costs plunge in the New Year as its most ambitious roll out calendar in the company’s over 100 year history. Earnings should go from approximately $1.10 a share this year to $1.60 a share in 2015 and $2.00 a share in 2016.

General Motors was undermined by a huge recall debacle for ignition parts dating back more than a decade in 2014. The costs of the recall and litigation pushed down earnings substantially this year. However, the company should reach a settlement with the Federal Government over the next six months. The fine involved should range from $1 billion to $3 billion according to most estimates. Although a large number, it is entirely manageable for a company the size of GM. I also expect all victims of the defective parts to be compensated in the near future even though this liability was legally discharged by the company’s bankruptcy during the financial crisis. The actual number of deaths alleged to have happened because of these defective parts was extremely minor given that the company produced over 100 million vehicles in the affected time frame. Most of the victims were also either not wearing seat belts and/or under the influence. These two settlements will also remove a huge overhang on the stock when they occur sometime in 2015.

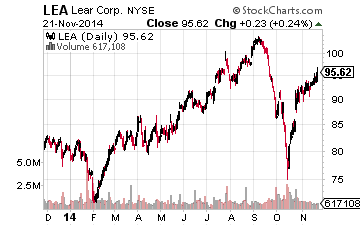

A solid global auto market should also bolster the profits and prospects for the auto parts sector as well. Lear (NYSE: LEA) is one of my favorite plays in this space. The company primarily manufactures seating components and electrical distribution systems. The manufacturer is slowly gaining a greater share of the actual manufacturing portion of the components that go into a vehicle.

A solid global auto market should also bolster the profits and prospects for the auto parts sector as well. Lear (NYSE: LEA) is one of my favorite plays in this space. The company primarily manufactures seating components and electrical distribution systems. The manufacturer is slowly gaining a greater share of the actual manufacturing portion of the components that go into a vehicle.

Earnings are tracking to better than a 30% year-over-year gain in 2014 and the consensus has another 15% increase in store in 2015. The company has a solid balance sheet, the stock has a five year projected PEG of less than 1 (.58) and the shares go for just 10.5 times next year’s earnings.

The global auto market seems poised for a solid year overall in 2015. The plays profiled above all should benefit from healthy production worldwide. Better yet, they are all priced at significantly lower valuations than the overall market and should outperform the indexes in the New Year and could be solid picks to rev up one’s portfolio over the coming 12 months.

Ford, GM, and Lear are the types of companies that have overcome tremendous headwinds and now provide investors with opportunities for solid, stable gains in their portfolios. The companies are also the kind that will play an integral part in the portfolio of my upcoming new investing newsletter, Blue Chip Gems, launching in early 2015. We’re currently accepting new advance registrations for Blue Chip Gems (it’s free, but limited). Find out more today. CLICK HERE.

Disclosure: L more

This was spot on! Thanks.