Are U.S. Stocks More Attractive Than Emerging Markets?

Strong Dollar Could Alter Capital Flows

Once you invest outside the United States, the impact of currency fluctuations becomes more pronounced. All things being equal, emerging market economies would prefer to see a weak U.S. Dollar. From Reuters:

Rising rates in the United States could prompt heavy flows of investment out of emerging markets where investors flocked in search of higher returns. A stronger dollar also erodes the appeal of holding emerging market currencies. Minutes from the Fed’s last meeting fueled speculation that interest rates could soon start rising and news also emerged that two Bank of England policymakers had voted for higher interest rates earlier this month.

Why Be Different When Different Is Worse?

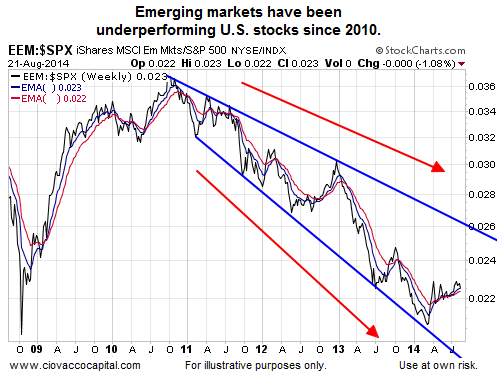

The facts are since the second half of 2010, emerging markets (EEM) have significantly underperformed the S&P 500 (SPY). At some point, the odds and correlations tell us the trend will reverse in favor of emerging markets. However, trying to guess, forecast, or anticipate a reversal has been a painful process in recent years.

Some Progress, But Hurdles Remain

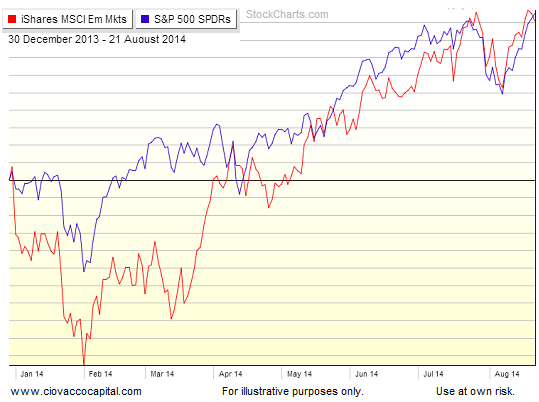

According to the graph from stockcharts.com below, emerging markets and the S&P 500 have performed in a very similar manner YTD.

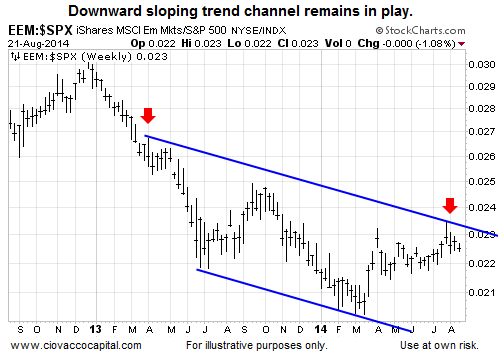

Before we are willing to look at emerging markets more seriously from a longer-term investment perspective, we prefer to see the ratio of EEM to the S&P 500 break above the longer-term bearish trend channel shown in blue below.

Pulling Back On The Reins

At some point, professional investors begin to question, “Am I being compensated for investing in emerging markets relative to developed markets?” One of the biggest players on the investment stage seems to be having some doubts. From Bloomberg:

Norway’s $880 billion sovereign wealth fund, the world’s largest, is slowing its expansion into emerging markets as it scales back a two-year mission to tap into the fastest growing markets. “We are gradually picking up some new markets but at a less rapid pace than we did at the beginning of the year,” Yngve Slyngstad, the fund’s chief executive officer, said yesterday in an interview after a press conference in Oslo.

Guideposts To Monitor Progress

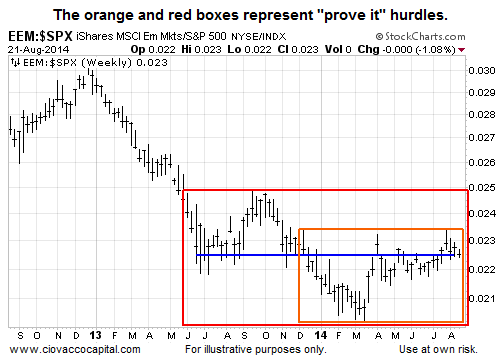

The blue horizontal line in the chart below tells us there has been no advantage to owning emerging markets relative to the S&P 500 over the last year or so. We prefer to see evidence of an advantage before considering shifting capital out of the United States. If the EEM/SPY ratio can break above the orange box below that would be a good first step in a “prove it to me” campaign. Better yet, a break above the red box would represent a significant higher high.

Investment Implications - The Weight Of The Evidence

With the most important event of the week, Jackson Hole, still on tap, equities have a big hurdle to cross Friday. Our allocations of stocks (VTI) and leading sectors, such as technology (XLK), remain in line with the evidence we had in hand as of Thursday’s close. A positive reaction to Janet Yellen’s remarks could prompt another reduction in our cash holdings.