Are We Back To Bad News Is Good News?

Market Has Numerous Crosscurrents

A retail sales report released Wednesday was the weakest since January, when bad weather was cited as the reason for anything that was disappointing on Wall Street. The Street cannot use the meteorological excuse this time. Then why did stocks rally after a weak retail report? While there is never a single reason for any move in the broad U.S. stock market, we can throw out two possibilities:

- The softness in retail may allow the Fed to stay ultra easy short-term.

- The market reacted to the perception of reduced risk in Ukraine and Iraq.

Bonds gave some credibility to the Fed theory above; long-term treasuries (TLT) rallied 0.65% Wednesday.

How Meaningful Is The Current Rally?

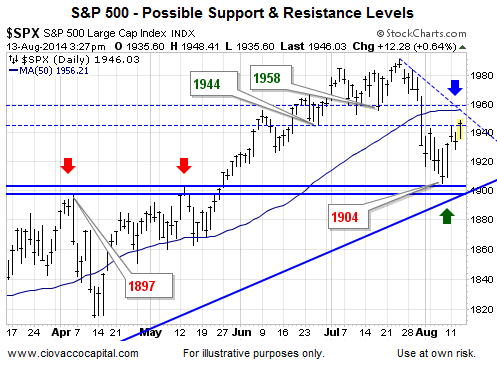

Wednesday’s close above 1944 gave the rally a bit more credibility since it represents a higher high on a short-term basis. From an investor’s perspective, the current rally would start to become much more meaningful if the S&P 500 can break above 1958, and remain above 1958. Wednesday’s close was 1946.

Geopolitical Risks

The level of distrust between Russia and Ukraine has spilled over into humanitarian aid. A convoy of trucks was in the news Wednesday. From The Guardian:

There is no reason not to believe that there are blankets and sleeping bags and canned food and wound dressings and drugs on board, although there may be other things as well. But it turns out that neither the Red Cross nor the OSCE have actually endorsed the convoy, although they have been informed, in what seems a deliberately sketchy way. Similarly, Kiev, while not objecting in principle, has not agreed to anything, and it is now saying it will not allow the convoy to enter, unless a number of conditions are observed. The only problem with that position is that Ukraine does not control long stretches of its frontier with Russia.

Use of “ground troops” by a White House official would typically spook the markets, but in the context of Iraq it was digested more easily. From The New York Times:

A senior White House official said on Wednesday that the United States would consider using American ground troops to assist Iraqis in rescuing Yazidi refugees if recommended by military advisers assessing the situation…But he drew a distinction between the use of American forces to help a humanitarian mission and the use of troops in the battle against militants from the Islamic State in Iraq and Syria, something he said the president had rejected before and continued to oppose.

Investment Implications – The Weight Of The Evidence

Fortunately, the support levels we showed on August 7 helped us maintain a reasonable exposure to equities. Our allocation to stocks heading into this week remained in line with the market’s profile as of late Wednesday afternoon, meaning we have made no changes this week.

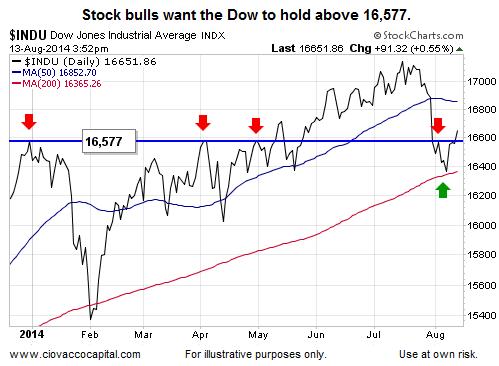

The S&P 500 (SPY) levels we outlined Tuesday remain relevant heading into Thursday’s trading day. During Wednesday’s session, the Dow cleared the area of resistance shown below and described on August 8.

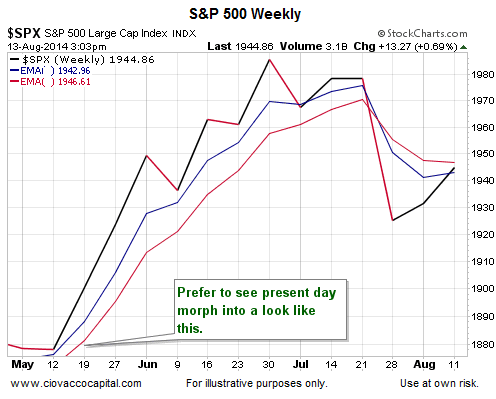

If Thursday’s report on jobless claims and Friday’s reading on producer prices can help the weekly chart of the S&P 500 morph into the “look” shown in the lower left corner below, we would likely add to our equity (VTI) exposure.