Chinn-Ito Financial Openness Index Updated To 2012

The Chinn-Ito index revised and updated to 2012 is now available here.

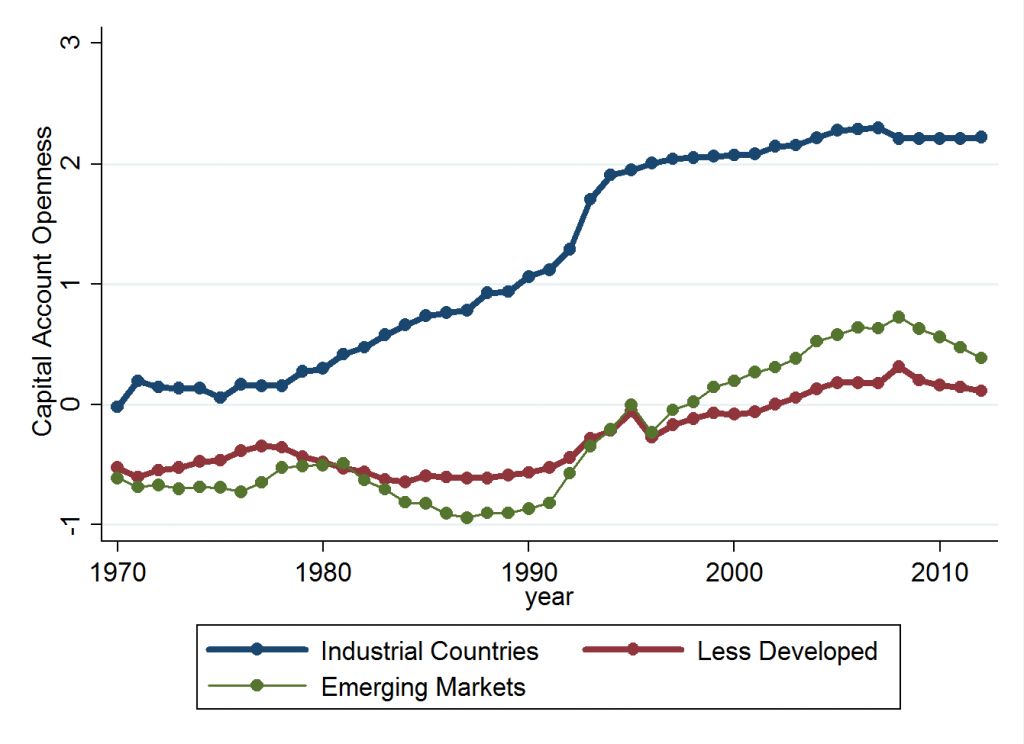

Figure 1 depicts the evolution of this measure of financial openness for three groups of countries:

Figure 1: Evolution of KAOPEN for Different Income Groups. Higher values indicate greater financial openness.

To recap:

The Chinn-Ito index (KAOPEN) is an index measuring a country’s degree of capital account openness. The index was initially introduced in Chinn and Ito (Journal of Development Economics, 2006). KAOPEN is based on the binary dummy variables that codify the tabulation of restrictions on cross-border financial transactions reported in the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER). This update is based on AREAER 2013, which contains the information on regulatory restrictions on cross-border financial transactions as of the end of 2012.

The CI index is a de jure measure, based on written (and self-reported) information (a characteristic it shares with most extant indicators). Moreover, it does not contain as much detailed information regarding the types of restrictions, nor does it differentiate between restrictions on inflows and outflows. On the other hand, it does cover a wider range of countries over a longer span than all others. (See Quinn, Schindler, and Toyoda (2011) for a discussion of the various measures.)

Capital openness measures are useful for assessing the international trilemma — the proposition that one cannot simultaneously pursue full financial openness, exchange rate stability, and monetary autonomy — as discussed here.

It’s of interest that financial openness has declined for emerging market economies (on the whole — this is a simple average); this result is not inconsistent with the increasing use of capital controls to stem capital inflows.[1]

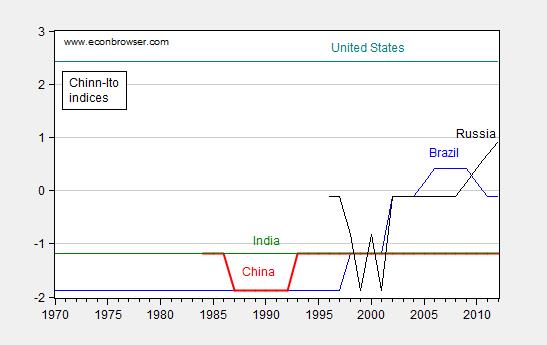

Financial openness is germane to the prospects for the rise of new international currencies (e.g., Eichengreen (2013), Chinn (2012), Ito and Chinn (2014), and Prasad (2014)). Most studies concur that one of the pre-requisites for international currency status (thus far) is financial openness, so it’s useful to inspect the evolution of openness in the BRICs (compared to the US).

Figure 2: Chinn-Ito KAOPEN series for Brazil (blue), Russia (black), India (green), China (India) and US (teal). Source: Chinn-Ito.

It’s interesting that China and India have made no progress toward liberalization in recent years on paper. Russia was liberalizing at least through 2012. What happened in 2013 is a question that will have to await the next AREAER.

The data files (in Stata, Excel), along with documentation, are available here. Previous posts on the Chinn-Ito index here and here.

Disclosure: None.