Coach: From Current Value Trap To Ultimate Bargain Someday, Maybe?

Coach (COH) is having a rough couple of days, falling -13.16% in the last two trading sessions, as today the company warned that reduced promotions and store closures would pressure its revenue in the new fiscal year, pushing the upscale handbag and accessories retailer's stock down sharply. The company projected a low-double-digit revenue decline in its new fiscal year. So obviously Coach has turned into a serious Value Trap for those analysts /investors that only use Quantitative analysis in their research and ignored the technical analysis.

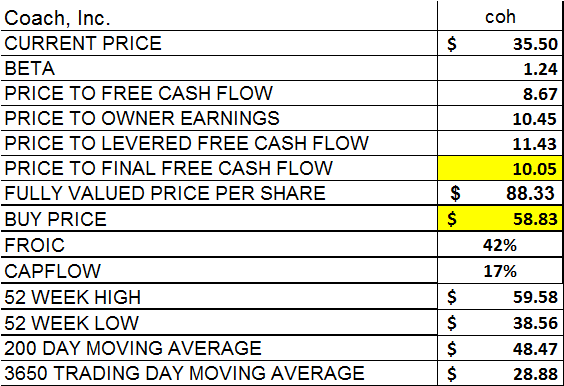

From a quantitative point of view Coach was a serious bargain as my research below shows.

Obviously with the company dramatically reducing its revenue projections, quantitative analysis becomes useless in this situation as we don't know if that negative revenue growth will also crush the company's free cash flow numbers as well.

Therefore since the quantitative analysis is useless to us, we must then rely solely on our long term technical analysis to guide us.

As you can see from the chart above, that this sort of similar pattern happened to Coach before in 2008-2009, when its stock dropped -78.18%. Currently the stock is down -52.76% from its high of $74.14 and would need to go to down another -50% or so before it hits the equivalent of its 2008-2009 or would need to hit $16.50 a share. I doubt that it will ever hit that point, but after witnessing the massacre that Aeropostale (ARO) has taken over the last few years, I am very comfortable sitting on the sidelines waiting to buy Coach after it has some better news and after I see a V shaped reversal similar to what it had in 2009, where it then proceeded to go up +598% in just a short period of time.

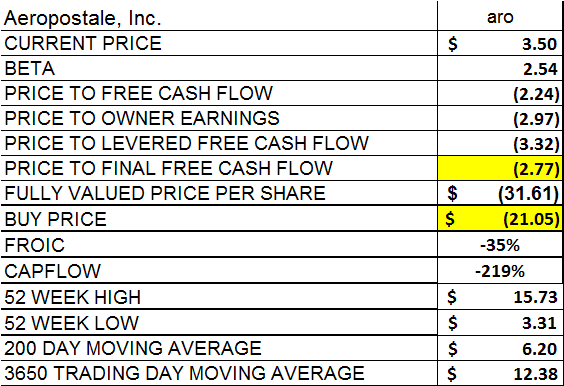

For those interested here is the chart for Aeropostale.

As you can see I have patiently been waiting for the V reversal in Aeropostale, but it has never shown up, so I never bought it as I will not buy Coach until I see a V reversal.

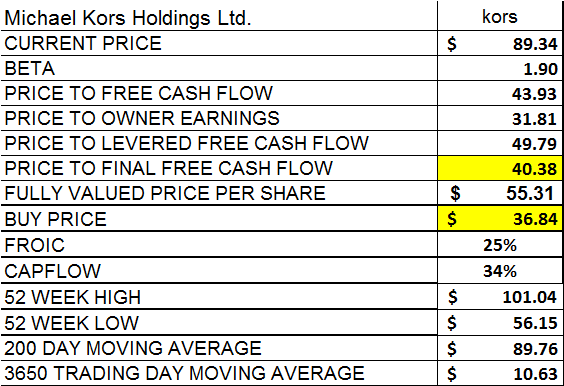

This should also be a warning to all those Michael Kors (KORS) bulls out there. Both Coach and Aeropostale were high flying stocks like KORS is now, but look at them now! Investing in this industry can make you a ton of money, but at the same time can crucify you if you get it wrong. KORS is trading at its 200 day moving average and if it drops a few percent below that number, then I would watch out below as the quantitative analysis has it as being very overbought.

Michael Kors maybe a Genius, but so is the Chairman of Coach Lew Frankfort. Here are the numbers for Aeropostale, which if it falls much further in price it should be taken private. I hope it will, because it's too painful to watch it trade, even though I don't own it.

When it comes to Coach, I am going to sit on the sidelines and watch and wait for a sharp V reversal. Retail investing is a dangerous domain and you better get the quantitative, qualitative and technical picture right before you buy any retailer as what has happened to Coach and Aeropostale, can easily happen to any apparel retailer, as a lot of the apparel business has to do with trends and fashion. While the ride up can be huge if you get both right, always remember that the fall can be just as crippling if you get it wrong. Coach obviously is witnessing a change in both fashion and trend and Michael Kors has been enjoying it. No one knows what will happen next, so the smart move it to move to the sidelines and wait.

Always remember that these are the results of our research based on the methodology that I have outlined above and in other articles previously published. This research is provided as an ...

more