Danger Zone: Hawaiian Electric Company (HE)

Hawaiian Electric Company (HE: ~$25/share) is in the Danger Zone this week. Utilities are typically thought of as safe investments, but across the board we see Utilities as overvalued currently, and HE is one of the worst. In addition to overvaluation, HE has misleading earnings due to questionable pension assumptions and significant threats to its long-term business model in the form of solar and other renewable energy sources.

Low Profitability

HE has grown after-tax profit (NOPAT) by less than 1% compounded annually over the past 11 years. Even for a Utility company, such a low growth rate is troubling. More troubling, however, is the fact that HE’sinvested capital has grown by 5% compounded annually over the same time.

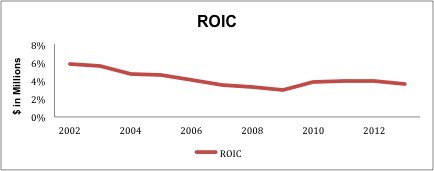

The steady growth in invested capital while NOPAT stagnates hurts HE on two important metrics: ROIC andfree cash flow. HE’s return on invested capital (ROIC) has declined from 6% in 2002 down below 4% in 2013. ROIC is the truest measure of a company’s profitability and the key variable in calculating economic earnings. Figure 1 shows the long-term declining trend in HE’s ROIC.

Figure 1: Long Term Profitability Decline

Sources: New Constructs, LLC and company filings.

HE’s free cash flowhas been negative in five out of the past seven years. In addition, HE pays out a 5% annual dividend (~$100 million), which puts an additional strain on its cash resources. With negative free cash flow and a large dividend to support, HE has had to raise money by increasing its debt and taking on more deposit liabilities in its bank segment. This strategy is clearly unsustainable.

Misleading Accounting Earnings

Companies have a surprising amount of discretion when it comes to certain accounting policies that can impact both the income statement and the balance sheet, and HE used that discretion to their advantage in 2013. Specifically, they made some generous assumptions about return on plan assets and projected benefit obligation discount rates for their pension plan.

The average expected return on plan assets for the roughly 1,000 companies we have pension data for is 6.6%. HE puts its expected return on assets at 7.75%, in the 86th percentile. HE’s projected benefit obligation discount rate was set at 5.09%, well above the 1,000-company average of 4.5%.

These inflated rates have two effects. For one, the overly high discount rate causes the company to understate its pension obligations. If HE used the average 4.5% discount rate, its pension would be underfunded by roughly $375 million (15% of market cap) rather than the reported $250 million.

In addition, the assumptions affect accounting earnings, as companies boost EPS with an expected rate of return on plan assets meaningfully higher than the actual returns. In this way, HE managed to ”earn” $10 million in hidden non-operating pension gains. This $10 million in hidden income, along with a $2 milliondecrease in reserves (another area with significant management discretion) and a $2 million gain on sale contributed $14 million to HE’s pre-tax earnings (9% of reported earnings).

HE’s reported earnings increased by 16% in 2013. However, when we remove the non-operating gains from 2013, as well as significant non-operating losses in 2012, we see that operating profit (NOPAT) actually declined by 9%.

Solar Poses a Big Threat

One of the biggest contributors to HE’s decline in 2013 was the increasingly popularity of solar power on the Hawaiian Islands. Solar’s detractors tend to scoff at the notion that it can compete with traditional utilities, but special circumstances make it cost competitive in Hawaii. The costs of importing petroleum and other fossil fuels make energy prices in Hawaii roughly three times the national average, and the state enjoys more consistent sun than most places.

Prior to the advent of solar, HE enjoyed a near monopoly in the state, which allowed it to succeed despite the high cost of production. Now, however, 10% of households in Hawaii utilize solar power, a number that is expected to keep growing. The company’s move to make it harder for rooftop solar systems to connect to the power grid suggest that it sees solar as a real threat.

Publicly, HE has spun solar and other renewables as a way to help cut its production costs, but the company’s past efforts don’t bode well for its future success. In its 2013 10-K, HE wrote, “In December 2002, Hawaiian Electric formed a subsidiary, Renewable Hawaii, Inc., to invest in renewable energy projects, but it has made no investments and currently is inactive. In September 2007, Hawaiian Electric formed another subsidiary, Uluwehiokama Biofuels Corp. (UBC), to invest in a biodiesel refining plant to be built on the island of Maui, which project has been terminated.” These events show HE’s inability to tap into the renewable energy business.

Over The Top Valuation

HE’s steadily maintained 5% dividend has kept the stock overvalued in the face of declining fundamentals as investors chase yield without paying close attention to significant earnings and balance sheet red flags.

HE’s current valuation of ~$25/share implies that the company will grow NOPAT by 6% compounded annually for 12 years. Remember, this is a company with less than 1% NOPAT growth in the last 11 years. Official estimates have the state’s GDP growing at less than 2% a year going forward, so 6% NOPAT growth seems unrealistic.

Even if HE can fight off competition from solar and grow along with the state, 2% NOPAT growth for the next 15 years only yields a fair value of ~$14/share.

As long as HE can support its 5% dividend, it will likely avoid a significant decline in its stock price, but that dividend could be in trouble before too long. With $2.5 billion in debt, underfund pensions, and deferred tax liabilities, HE can’t keep supporting its dividend through swelling debt, deposit liabilities and questionable pension accounting. Meanwhile, the company’s already negative free cash flow should decline even further as it has to weigh between an expensive investment in renewable energy or a potential hit to its revenues as solar provides an increasing share of Hawaii’s energy. Either way, profits and cash flows look to decline significantly.

Bottom Line

HE has enjoyed monopoly status in Hawaii for a long time, but solar power is disrupting its business model, and HE doesn’t appear to have a solid plan to adapt. Investors need to look past the yield and dig into the fundamentals, which clearly don’t support the current valuation. To paraphrase Benjamin Franklin, he who would give up due diligence for a high dividend deserves neither.

Disclosure: NewConstructs staff receive no compensation to write about any specific stock, sector, or theme.