Danger Zone: Value Investors

Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Value investors are in the Danger Zone this week, not because value investing is the wrong approach, but because executing this strategy is becoming increasingly difficult if not impossible for most investors.

To execute a value-based investment strategy, one must truly understand the profitability and valuation of a company. This task requires analyzing the company’s annual reports over the last five to ten years, at least. Even professional investors, who spend millions of dollars on and dedicate their professional lives to research, have trouble analyzing the increasingly long and complex annual reports, or Form 10-Ks, published by companies these days. Diligent research takes enormous time and expertise that most investors cannot afford.

More Needles In an Expanding Haystack

Just last week, Justin Lahart of the Wall Street Journal wrote how ridiculously long (152 pages on average) and complex filings have become. Lahart also reported that the stocks were more volatile and the earnings estimates were less accurate for companies with longer filings.

The main issue with today’s filings is how companies use them to hide items that distort their true earnings.

Note that the portion of the filings dedicated to financial statements has hardly changed. It is the footnotes, Management Discussion and Analysis (MD&A) and other complex disclosures that have exploded in length.

Take, for example, AT&T (T). T does not even number many of the pages in its 2013 10-K, but the filing runs into several hundred pages, above average, but not nearly the longest filing, which was Trinity Industries’ (TRN) epic 1,913 page filing. However, what T hid in its filing makes it truly dangerous.

Buried near the end of the filing, T disclosed that it recorded an actuarial gain of $7.8 billionon its pension and post-retirement benefit plans. This gain came almost entirely from the increase in the discount rate it uses for its projected benefit obligation in its pension plans, which are underfunded by about $33 billion.

If we remove this non-cash, non-operating gain, as well as a number of other non-operating items hid throughout its filing, we find that T’s true after-tax profit (NOPAT) was $16.4 billion, or $1.8 billion less than its reported earnings of $18.2 billion.

Given the length and complexity of its filing, it’s not surprising that investors and analysts often miss these unusual items. I recently found several bullish articles on T in the last month that refer to its unadjusted price to earnings ratio. Investors are looking for value, but without digging through hundreds of pages of financial disclosures, it’s easy to be misled.

Widespread Problem

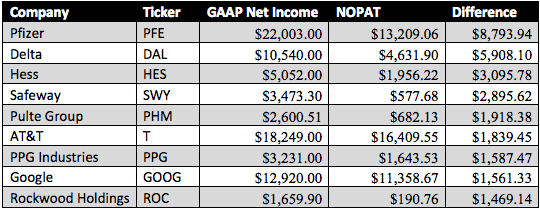

T is far from the only company that poses a challenge to investors. Figure 1 shows the ten companies with the largest difference between GAAP net income and NOPAT.

Figure 1: Companies with the Largest Difference Between GAAP Net Income and NOPAT (in $mm)

Sources: New Constructs, LLC and company filings

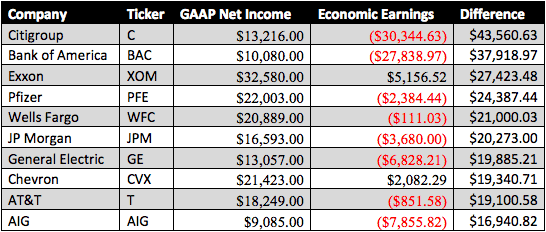

Figure 2 shows the 10 companies with the largest difference between GAAP net income andeconomic earnings.

Figure 2: Companies with the Largest Difference Between Net Income and Economic Earnings (in $mm)

Sources: New Constructs, LLC and company filings

These are only the ten companies with the largest adjustments. Thousands of other companies have smaller, but still significant adjustments. Since February 1, 2014, we’ve parsed 2,229 filings and made over 57,000 adjustments to reported incomes statements and balance sheets to ensure we provide clients with the most accurate calculations of NOPAT and invested capital, which are the key drivers of return on invested capital (ROIC) and economic earnings.

True Value Investing is Difficult

My definition of a value investor is the same as Ben Graham and John Maynard Keynes:

“If you are an investor, your decision to buy and sell is based on the underlying economics of the stock you own.”

– Ben Graham

“Investing is an activity of forecasting the yield on assets over the life of the asset…”

– John Maynard Keynes

The challenge today is that applying the true value investing principles as defined above requires analyzing financial reports that are several hundred pages long. Very few investors have the time or expertise to perform proper diligence.

The haystack is getting bigger and there are more needles. Making investment decisions without reading these reports is like driving a car at night without headlights. Due diligence simply must be done to make prudent investment decisions, and it must be done to fulfill fiduciary responsibilities if you provide advice.

There is no other way to get to the truth about a company’s profits. Without adjusting the accounting numbers to reflect the underlying economics of the business, you cannot assess the efficacy of management or corporate strategy, and if you cannot measure that, you cannot value the business with any precision or confidence.

In my nearly 15 years on Wall Street, I met very few professional managers who appreciate this fact. Lately, as I meet advisors, they appreciate the fact but recognize they do not have time to do it.

Diligent investing is hard work. If it were easy, everyone would be doing it, because diligence pays.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Feature Photo Credit: Jenni C (Flickr)

David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.