Dividend Aristocrats Part 10 Of 54: Genuine Parts Company

In part 10 of the 54 Part Dividend Aristocrats In Focus series, we will look into automotive parts manufacturer Genuine Parts Company (GPC), better known to consumers as the owner of NAPA auto parts.

Business Overview

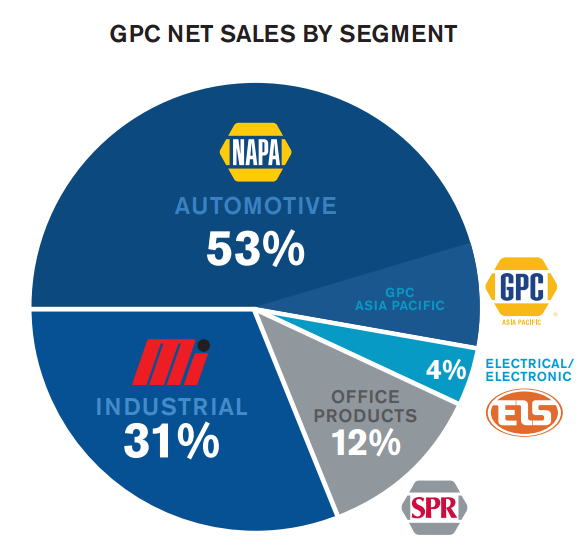

Genuine Parts Company’s operations are split into 4 business units. Each business unit is shown below, along with the percentage of revenue it generated for the company as a whole for the full fiscal year 2013.

- Automotive parts group: 53% of revenue

- Industrial parts group: 31% of revenue

- Office products group: 12% of revenue

- Electrical/Electronic materials group: 4% of revenue

Source: 2013 Annual Report

The automotive parts group is the company’s most important, generating over half of revenues. The group owns 1,100 NAPA auto parts stores in the U.S., and services about 4,900 additional franchised stores in the U.S. In addition, the automotive parts group owns over 200 locations in Canada and services 500 more. The group has a small presence in Mexico, and owns about 460 stores in Australia and New Zealand under the Repco Auto Parts name.

The industrial parts group sells industrial replacement parts to manufacturers and maintenance/repair businesses in North America. The industrial parts group operates under the Motion Industries name and website. Industries served include food and beverage, automotive, oil & gas, power generation, and railroads, among others.

Genuine Parts office products group wholesales office products to over 4,300 resellers through its network of 41 distribution centers in the U.S. and Canada. The company operates its office products group under the SP Richards name. The group makes up just 12% of the company’s overall revenue.

Finally, the electrical/electronic materials group distributes electronic parts and products throughout North America. The business unit operates under the EIS name. The electrical/electronic materials group accounts for just 4% of revenues overall.

Competitive Advantage

Genuine Parts Company’s competitive advantage rests with its extensive distribution network, convenient locations, and trusted brand names. The company has built an extensive supply chain throughout North America to distribute its automotive parts, industrial parts, office products, and electrical products. This efficient and extensive distribution system gives the company the ability to quickly supply retailers and small stores with the parts and supplies they need. To compete with Genuine Parts Company, a competitor would have to outlay a substantial amount of capital to build the infrastructure that Genuine Parts Company has built over the last 86 years.

One does not have to drive far to find a NAPA auto parts in most areas of the U.S. The company has over 6,000 locations in the U.S. The sheer number of NAPA auto parts locations gives the company an edge over smaller auto repair stores. The company’s franchise business model has allowed it to expand its territory across the U.S. In addition to its excellent distribution network and convenient locations, Genuine Parts Company’s NAPA brand helps its many locations stand out. The NAPA brand lets customers know they are going to an established business, not a fly-by-night operation for their auto repairs. The combination of convenience and trust has helped NAPA maintain its growth, earnings, and dividends.

Growth Prospects

Genuine Parts Company has been growing its earnings and revenues in recent years through acquisitions. Historically, the company has operated within North America. In 2013, Genuine Parts acquired Exego, gaining access to the Australian and New Zealand. Exego was the leader in automotive parts and accessories and had over 430 stores at the time of the acquisition. The deal marks the beginning of Genuine Parts Company’s expansion past North America. The company managed to export the same competitive advantages it enjoys in North America by purchasing the industry leader in Australia and New Zealand, giving the company a built in distribution network.

Going forward, Genuine Parts Company will likely experience low to medium single digit organic growth from its continuing operations. Additional growth will come from further acquisitions. An opportunity like the strategic acquisition in Australia and New Zealand will likely not occur for some time. The conservative management at place in Genuine Parts Company will likely look for smaller bolt-on acquisitions in North America to grow their revenue and earnings faster than organic growth alone.

Dividend Analysis

Genuine Parts Company currently has a dividend yield of 2.6%, well above the S&P500’s dividend yield of 1.9%. The company has a payout ratio of about 50%, which is average for a company no longer in its rapid growth phase. The company has increased its dividend payments for 58 consecutive years. Over the last decade, Genuine Parts Company’s dividend has increased at a CAGR of about 7%. The company’s earnings per share have grown at almost the exact same pace.

Going forward, I expect Genuine Parts Company to maintain a payout ratio of around 50% and a dividend per share growth rate of about 7%, in line with its historical averages. The company has managed to grow dividends faster than overall company revenue (which has a CAGR of about 5%) by repurchasing shares, which management has indicated they will continue to do.

Valuation

Genuine Parts Company currently has a P/E ratio of about 20. The company has historically traded for a P/E ratio of between 14 and 17 over most of the last 15 years. Genuine Parts Company has a durable competitive advantage as shown by its long history of increasing earnings and dividends. On the other hand, the company has managed to grow at about 7% a year, which is a little below the historical market average growth rate. I believe the company should trade at a slight premium to the market’s historical average P/E ratio of 15. A P/E ratio in the range of 16 to 17 is likely fair value for Genuine Parts Company. The stock is currently somewhat overvalued, as is the market as a whole. I believe that Genuine Parts Company is less overvalued than the overall stock market, however.

Final Thoughts

Genuine Parts Company is a high quality business that has a long history of growth and dividend increases. The company currently has a fairly high dividend yield for today’s low interest rate environment. Genuine Parts Company ranks in the Top 40 based on the 8 Rules of Dividend Investing, which analyze businesses with a long history of dividend increases over several quantitative metrics that have historically improved returns. The company ranks highly due to getting average to above average scores in volatility, yield, and payout ratio. In the final analysis, I believe Genuine Parts Company is a solid business with the ability to continue its current growth into the future. At current prices it is a hold, not a buy.

Disclosure: I am not long any of the stocks mentioned in this article