Downgraded: The Macro Outlook In Wisconsin

The Department of Revenue’s Wisconsin Economic Outlook, released last week, details a noticeable deterioration in forecast performance, in just the eight months.

Figure 1: Real personal income (bn Ch.09$, SAAR) (thick blue, thick red), and forecast from March 2014 (Winter 2014 issue) (light blue), and November 2014 (Fall 2014 issue) (light red). Source: Wisconsin Economic Outlook, Winter 2014 and Fall 2014 issues.

2014Q1 personal income was 1% less (in log terms) than the March 2014 forecast. The forecast for 2014Q2 was revised downward by 1.1%.

The mark down in prospects makes sense once one sees the trajectory of Wisconsin economic activity, as measured by the Philadelphia Fed’s coincident indices (October figures released today):

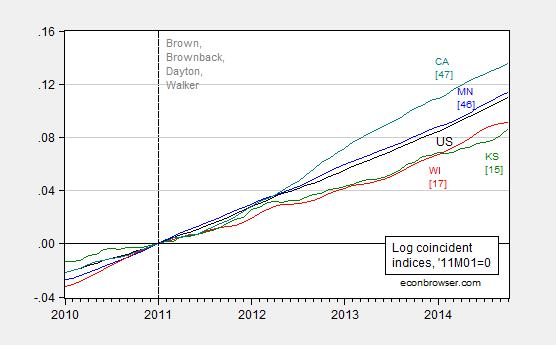

Figure 2: Log coincident indices for Minnesota (blue), Wisconsin (red), Kansas (green), California (teal), and United States (black), all normalized to 2011M01=0. Vertical dashed line at beginning of Brown, Brownback, Dayton and Walker administrations. Source: Philadelphia Fed, and author’s calculations.

According to this measure, the cumulative growth gap between Wisconsin and the US (and Minnesota) is again widening.

The ramifications of the downgrade in economic outlook are clear. From Wisconsin Budget Blog:

State officials confirmed today what we have feared for many months – that Wisconsin’s spending needs in the next biennium far exceed the projected revenue, and the state must also close a very substantial budget hole in the current fiscal year. As a result, lawmakers are likely to make cuts that have harmful consequences for Wisconsin children and families and for the investments needed to keep Wisconsin economically competitive.

Despite the assurances of Walker administration officials over the last couple of months that the state is in strong fiscal shape, the figures contained in a report released by the Department of Administration (DOA) today confirm that balancing the state budget in 2015-17 will require very deep spending cuts or significant tax increases. Specifically, the DOA document reveals the following:

- Tax revenue for the current fiscal year is now expected to be $82 million below the amount estimated in May (on top of a $281 million tax shortfall in the first half of the biennium), and net appropriations are estimated to be $43 million less.

- The state is on track to have a “net balance” of -$197 million at the end of this biennium, which means that significant cuts or transfers will have to be made to get the budget back into balance by June 2015 (and to preserve a required $65 million budget balance).

- The agency budget requests, which generally followed the Governor’s instructions for just maintaining existing programs, exceed the anticipated General Purpose Revenue (GPR) by $2.2 billion during the 2015-15 biennium (assuming the state does carry over a $65 million balance).

- The total gap between requested GPR spending and anticipated revenue is about $2.4 billion between now and June 2017, and that doesn’t account for various spending needs that are calculated later in the process (e.g., increases for debt service, state employee compensation and benefits, UW faculty pay adjustments, and a potential gap in funding for the Earned Income Tax Credit).

It is interesting to observe the sources of this shortfall. Most of it was not a failure in forecasting; rather it’s mostly due to the decision to cut taxes, and the refusal to take Federal funds associated with Medicare expansion.

Disclosure: None.