Enabled By ZIRP And QE Banksters Continue Looting Instead Of Building Capital

Courtesy of Lee Adler of the Wall Street Examiner

One of the purposes of ZIRP (zero interest rate policy) was to allow banks to rebuild their balance sheets through suppressed funding costs and thereby earn a wider spread and greater profits. Theoretically ZIRP would add to their capital.

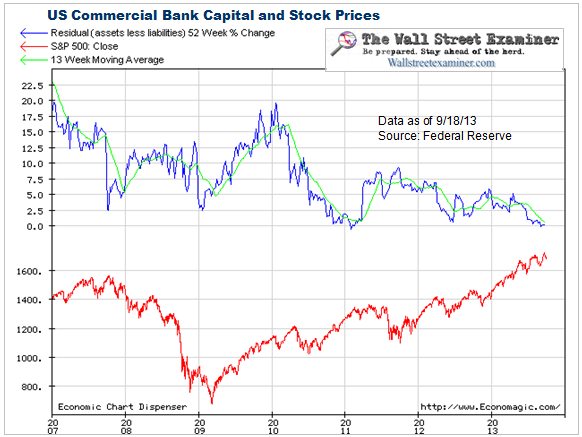

But in the chart below, we see that over the past month, the growth rate of bank capital has fallen to zero. Either banks aren’t really making the profits they are reporting or they are paying out 100% of them in dividends and share buybacks from executives who had received the shares in stock option grants. This is looting, pure and simple. Because no bank executives have been held responsible for the control fraud that caused the crash, the looting of the system just goes on and on. Worse, the bankers can continue rating the savers who should be earning the income from ZIRP.

According to the Fed's weekly statements, the growth rate of bank capital has been trending down since 2007 even though the banks get money from the Fed for almost nothing.

Bank Capital- Click to enlarge

While the Fed has been cashing out the banks week after week, month after month; while the banks have access to limitless amounts of free cash; and while their balance sheets continue to expand exponentially, the US commercial banksters have not added one red cent to bank equity over the past year. The banks continue to bleed the system while the Fed and the US Government stand idly by.

Your grandmother’s life savings have been wiped out by the same ZIRP that supports the banksters. She has had to spend down her principle because she is not getting the interest she should be earning.

This is why I call ZIRP “Bernankecide.” It is the mass financial murder of America’s elderly population, people who had saved all their lives only to find their savings supporting the criminal masterminds who run the world banking system. What's more, their only relief will come from the already-burdened taxpayers.

This crime will only end when interest rates are allowed to rise to levels that provide a reasonable return for low-risk savings accounts and when the bankers who caused the crash are ultimately forced to bear responsibility for it. A rise in interest rates would allow a return to rational investment decisions, instead of mindless speculation on the direction of Fed money-printing. Investors could make decisions based on real risk and real return.

I have no faith that those steps will be taken in time to make a difference. Instead the system will hurtle towards another massive collapse. There's no happy ending.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved.